Finance:Naked put

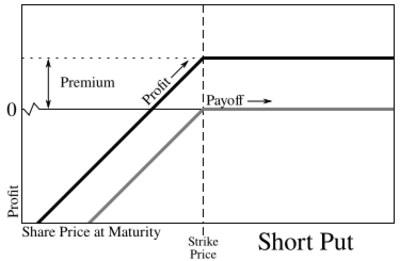

A naked put (also called an uncovered put) is a put option contract where the option writer (i.e., the seller) does not hold the underlying position, in this case a short equity position, to cover the contract in case of assignment. The seller receives the premium cost of the put price, and hopes that the underlying equity or stock price stays the same or rises modestly, in which case the seller retains the premium. A put option buyer is hoping for a decrease in the price of the underlying equity, and upon exercise or expiration will collect cash representing the difference between the strike price of the option and the price of the underlying equity.

If the seller has sufficient cash to purchase the equity position, the risk of selling a naked put is somewhat less than the risk of holding the underlying stock or equity (considering the premium gained and the loss from a decrease in the underlying stock price), while the benefit of the naked put sale is limited to the amount of premium gained. Persons considering purchasing a stock for a short term may instead sell a put on the stock because of reduced commission costs and the benefit of the premium received.

If the seller does not have sufficient cash to purchase the underlying equity, selling a naked put becomes a riskier proposition. In the event of a decrease in the price of the underlying equity, the seller will be obligated to provide cash that could in theory equal the entire strike price of the derivative. Other stocks held by the seller will not satisfy the cash settlement required upon assignment of the option, and the result could be a margin call by the seller's broker.

References

- Mark D. Wolfinger, "The Rookie's Guide to Options" The Beginner's Handbook of Trading Equity Options" W&A Publishing, Cedar Falls, 2008.

External links

- Chicago Board Options Exchange

- Australian Stock Exchange

- Investopedia, Options tutorial