Finance:Lundberg lag

From HandWiki

Revision as of 05:24, 1 August 2021 by imported>MedAI (fixing)

| Proposed economic waves | |

|---|---|

| Cycle/wave name | Period (years) |

| Kitchin cycle (inventory, e.g. pork cycle) | 3–5 |

| Juglar cycle (fixed investment) | 7–11 |

| Kuznets swing (infrastructural investment) | 15–25 |

| Kondratiev wave (technological basis) | 45–60 |

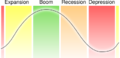

The Lundberg lag, named after the Swedish economist Erik Lundberg, stresses the lag between changes in the demand and response in output. This is one lag which points out that business cycles do not follow a completely random fashion but can be explained with a few different important regularities.[1][2]

See also

Notes and references

- ↑ Burda, Wyplosz (2005): Macroeconomics: A European Text, Fourth Edition, Oxford University Press

- ↑ Van Doorn, J. (1975), "Micro-Disequilibrium Economics", Disequilibrium Economics, Macmillan Education UK, pp. 28–44, doi:10.1007/978-1-349-02131-4_2, ISBN 9780333155912

|