Finance:KFC Index

The KFC Index[1][2][3] is an informal guide to measure purchasing power parity comparing exchange rates in African countries. Inspired by the Big Mac Index, the key difference between the two indices is that the KFC Index focuses solely on Africa; the Big Mac Index coverage is worldwide but not as applicable to Africa since McDonald's has little presence there, whereas KFC chains operate in almost 20 countries across the continent.

Overview

The KFC index was created by Sagaci Research (a Pan-African primary market research firm) as an informal way to gauge whether currencies in African countries are “correctly valued”. It is based on the theory of purchasing power parity, which states exchange rates should move towards the rate that would equalize the prices of an identical basket of goods and services between two countries. In this case, the concerned goods are KFC's Original 12/15 piece Bucket and geographically specific to African countries. The KFC Index also covers the United States, France, Spain and the United Kingdom.

For example, the average price of KFC's Original 12 pc. Bucket in United States in January 2016 was $20.50; in Namibia it was only $13.40 at market exchange rates. Therefore, the index suggests that the Namibian dollar was undervalued by 33% at that time.

Inspiration

The index takes its name from the international fast food chain Kentucky Fried Chicken (KFC) and is modeled on The Economist´s “Big Mac Index”, which covers countries with McDonald's presence (about 60 countries). In Africa, the McDonald's chain is only present in Morocco, South Africa and Egypt. KFC, on the other hand, has operations in almost 20 African countries, which is the highest of any international fast food chain and therefore a more applicable benchmark to use. The index was not intended as a precise gauge of currency misalignment but merely a tool to make exchange-rate theory more digestible.

Limitations

As in the case of the Big Mac Index, the KFC Index was not created to be a highly accurate and precise tool for measuring purchasing power parity and its limitations include factors such as inflation, dietary preferences, socio-economic classifications, levels of competition and local costs (e.g. advertising, production and taxes).

Currency volatility – due to the nature of developing economies (in this case all countries in Africa), there is more likely to be high volatility in currencies, therefore undertaking this analysis over a one to three month basis could produce large changes and different conclusions.

Black market – as there is a thriving market for US Dollars in some countries, it may produce conflicting results compared to the official exchange rate. Angola and Nigeria are examples of these types of markets. The report produced by Sagaci Research takes into account black market exchange rates.

Figures

The February 2016 publication states:

Most overvalued currencies

![]() Angola 72%

Angola 72%

![]() Morocco 30%

Morocco 30%

Most undervalued currencies

![]() South Africa -48%

South Africa -48%

![]() Egypt -34%

Egypt -34%

![]() Namibia -32%

Namibia -32%

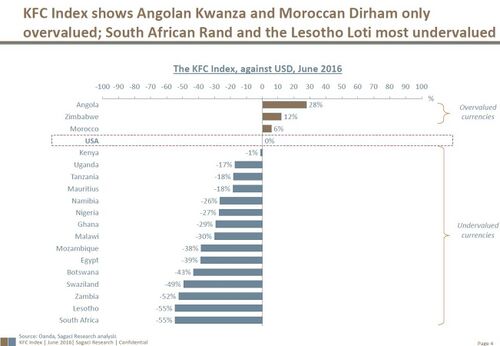

The June 2016 publication[4] [5] states:

References

- ↑ "Angola's currency is the most overvalued in Africa, based on the "KFC Index"". Quartz. 4 March 2016. http://qz.com/630276/630276/.

- ↑ "Fried Chicken Index Shows Angola Kwanza Most Overvalued Currency". Bloomberg. 1 March 2016. https://www.bloomberg.com/news/articles/2016-03-01/fried-chicken-index-shows-angola-kwanza-most-overvalued-currency.

- ↑ "The KFC Index". The Atlas. 1 March 2016. https://www.theatlas.com/charts/EJP-vmf3l.

- ↑ "KFC Index shows Angolan and Moroccan currencies overvalued". How We Made It In Africa. 2 August 2016. http://www.howwemadeitinafrica.com/kfc-index-shows-angolan-moroccan-currencies-overvalued/.

- ↑ "Sagaci Research updates Chicken Bucket Index; purchasing power parity across Africa revealed". African Business Review. 28 July 2016. http://www.africanbusinessreview.co.za/finance/2424/Sagaci-Research-updates-Chicken-Bucket-Index-purchasing-power-parity-across-Africa-revealed.

|