Finance:Dividend recapitalization

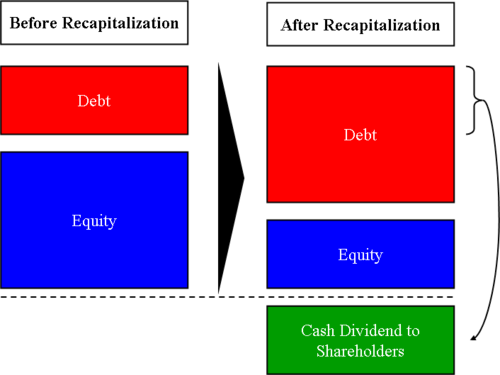

A dividend recapitalization (often referred to as a dividend recap) in finance is a type of leveraged recapitalization in which a payment is made to shareholders. As opposed to a typical dividend which is paid regularly from the company's earnings, a dividend recapitalization occurs when a company raises debt —e.g. by issuing bonds to fund the dividend.[1][2]

These types of recapitalization can be minor adjustments to the capital structure of the company, or can be large changes involving a change in the power structure as well. As with other leveraged transactions, if a firm cannot make its debt payments, meet its loan covenants or rollover its debt it enters financial distress which often leads to bankruptcy. Therefore, the additional debt burden of a leveraged recapitalization makes a firm more vulnerable to unexpected business problems including recessions and financial crises.[3]

Typically a dividend recapitalization will be pursued when the equity investors are seeking to realize value from a private company but do not want to sell their interest in the business.[1][4]

Example

Between 2003 and 2007, 188 companies controlled by private equity firms issued more than $75 billion in debt that was used to pay dividends to the buyout firms.[5]

In their relatively brief period of management of Hostess Brands, maker of Twinkie brand snack cakes and other products, Apollo Global Management and C. Dean Metropoulos and Company added leverage and took a $900 million dividend, "the third largest of 2015" in the private equity industry.[6]

See also

References

- ↑ 1.0 1.1 Bristow, Matthew (29 November 2010). "Dividend Recapitalizations: Cash Alternatives for Private Equity". The Journal Record. http://journalrecord.com/2010/11/29/dividend-recapitalizations-cash-alternatives-for-private-equity/.

- ↑ Stefanova, Mariya (2015) (in en). Private Equity Accounting, Investor Reporting, and Beyond: Advanced Guide for Private Equity Managers, Institutional Investors, Investment Professionals, and Students. Upper Saddle River, NJ: FT Press. pp. 203. ISBN 978-0-13-376152-8. https://books.google.com/books?id=tPrVBgAAQBAJ&dq=dividend+recapitalization&pg=PA203.

- ↑ Creswell, Julie; Peter, Lattman (29 September 2010). "DEALBOOK; Private Equity Thrives Again, but Dark Shadows Loom". The New York Times. https://archive.nytimes.com/query.nytimes.com/gst/fullpage-9F0DE1D91438F93AA1575AC0A9669D8B63.html.

- ↑ Pearl, Joshua; Rosenbaum, Joshua (2013) (in en). Investment Banking: Valuation, Leveraged Buyouts, and Mergers and Acquisitions (Second ed.). Hoboken, NJ: John Wiley & Sons. pp. 217. ISBN 978-1-118-72776-8. https://books.google.com/books?id=j2JSCAAAQBAJ&dq=dividend+recapitalization&pg=PA217.

- ↑ Creswell, Julie (4 October 2009). "Profits for Buyout Firms as Company Debt Soared" (in en-US). The New York Times. ISSN 0362-4331. https://www.nytimes.com/2009/10/05/business/economy/05simmons.html.

- ↑ Corkery, Michael, and Ben Protess, "How the Twinkie Made the Super-Rich Even Richer", The New York Times , December 10, 2016. Retrieved 2016-12-11.

{{Navbox

| name = Private equity and venture capital

| state = autocollapse | title = [[Finance:Private equitPrivate equity and venture capital

| image =| bodyclass = hlist

| group1 = Basic investment types | list1 =

| group2 = History | list2 =

- History of private equity and venture capital

- Early history of private equity

- Private equity in the 1980s

- Private equity in the 1990s

- Private equity in the 2000s

| group3 = Terms and concepts

| list3 =

| Buyout | |

|---|---|

| Venture | |

| Structure |

| group4 = Investors | list4 =

- Corporations

- Institutional investors

- Pension funds

- Insurance companies

- Fund of funds

- Endowments

- Foundations

- Investment banks

- Merchant banks

- Commercial banks

- High-net-worth individuals

- Family offices

- Sovereign wealth funds

- Crowdfunding

| group5 = Related financial terms | list5 =

- AUM

- Cap table

- Capital call

- Capital commitment

- Capital structure

- Distribution waterfall

- EBITDA

- Envy ratio

- High-yield debt

- IPO

- IRR

- Leverage

- Liquidation preference

- M&A

- PME

- Taxation of private equity and hedge funds

- Undercapitalization

- Vintage year

| below =

- Private equity and venture capital investors

- Private equity firms

- Venture capital firms

- Angel investors

- Portfolio companies

}}

|