Company:Bank of North America

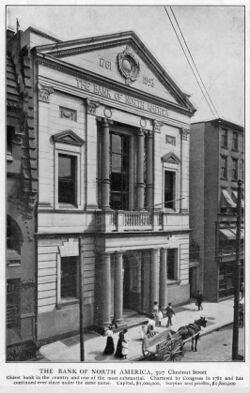

The Bank of North America's original location at 307 Chestnut Street in Philadelphia | |

| Type |

|

|---|---|

| Industry | Financial services |

| Fate | Merger |

| Successor |

|

| Founded | December 31, 1781, in Philadelphia, Pennsylvania |

| Founders | Robert Morris, Alexander Hamilton, William Bingham, et al. |

| Headquarters | Philadelphia, Pennsylvania , United States |

Area served | United States |

Key people |

|

The Bank of North America was the first chartered bank in the United States, and served as the country's first de facto central bank.[1] Chartered by the Congress of the Confederation on May 26, 1781, and opened in Philadelphia on January 7, 1782.[2][3][4]

The bank's founding was based on a plan presented by Superintendent of Finance Robert Morris on May 17, 1781,[5] including recommendations by Revolutionary-era Founding Father Alexander Hamilton, who was appointed the first U.S. Secretary of the Treasury by George Washington. Although Hamilton later noted the bank's "essential" contribution to the American Revolutionary War, the Pennsylvania government objected to its privileges and reincorporated it under state law, making it unsuitable as a national bank under the U.S. Constitution. Congress instead chartered the First Bank of the United States, a new bank, in 1791, while the Bank of North America continued as a private concern.

Revolutionary war period

Congressional charter

In May 1781, Alexander Hamilton revealed that he had recommended Robert Morris for the position of Superintendent of Finance of the United States the previous summer when the constitution of the Articles of Confederation-era executive was being solidified. He also proceeded to lay out a proposal for a national bank that would also serve as a de facto central bank.

Morris corresponded with Hamilton previously on the subject of funding the war, and immediately drafted a legislative proposal based on Hamilton's suggestion and submitted it to the Congress. Morris persuaded Congress to charter the Bank of North America, the first private commercial bank in the United States.[7] His friend, Dr. Hugh Shiell, paid £5000 to the capital stock.[8]

Stock offering

The original charter as outlined by Hamilton called for the disbursement of 1,000 shares priced at $400 each.[9] Benjamin Franklin purchased a single token share as a sign of good faith to Federalists and their new bank. Hamilton used his pseudonym "Publius", later immortalized in the Federalist Papers advocating in the late 1780s for adoption of the United States Constitution, to endorse the bank.[10]

William Bingham, rumored to be the richest man in America after the Revolutionary War,[11] purchased 9.5% of the available shares. The greatest share, however, 63.3%, was purchased on behalf of the United States government by Robert Morris, using a gift in the form of a loan from France and a loan from Netherlands.[12] This had the effect of capitalizing the bank with large deposits of gold and silver coin and bills of exchange. He then issued new paper currency backed by this supply.[13]

Officers

Thomas Willing, a twice former mayor of Philadelphia and partner with Morris in an import-export firm that once dominated the city's slave trade,[14] was named the bank's first president. He held that office from 1781 to 1791, being succeeded by John Nixon, and moving immediately on to become the first president of the First Bank of the United States, a position he held from 1791 to 1807.[15][16]

Banknotes

The bank issued its own notes that superseded the troubled Continental currency bills. These notes were printed on paper with colored fibers pressed into the reverse side as an anti-counterfeiting measure. Unlike the Continental bills, the new notes carried a promise to pay silver on demand. Despite these changes, the bank had difficulty at first persuading people of its good credit, and at one point it employed repossessors to follow people who redeemed notes and urge them to deposit the money back. To promote the impression that it had a large reserve, the bank made a show of moving cash boxes to and from its cellar. Once the stock was fully subscribed and paid, doubts subsided and the notes rose to par value.[2] By 1783, several states including Massachusetts enacted legislation allowing Americans to pay taxes with Bank of North America notes,[17] giving them a crucial aspect of legal tender.

Private bank

In the economic turmoil that followed the American Revolutionary War, the bank's strictness in collecting debts drew opposition from Pennsylvania residents, who petitioned the Pennsylvania General Assembly to revoke the state charter granted to it in 1782. The charter was revoked in 1785, although the bank continued to operate with difficulty under its congressional charter and then under a Delaware charter. The following year, the Pennsylvania General Assembly granted a new charter with several restrictions, including that it could not trade any merchandise other than bullion.[2] Bank of North America, First Bank of the United States, and Bank of New York were the first shares traded on the New York Stock Exchange.

After the passage of the National Bank Act in 1862, the Bank of North America converted its business to operate under the new law. Its unique history presented a problem: the act required a national bank to include the word "national" in its name. The bank's management considered its original name a matter of prestige and took the position that the name remained fixed by the Confederation and state charters. The Comptroller of the Currency chose not to press these legal questions and admitted the bank without a name change.[7]

The bank merged in 1923 with the Commercial Trust Company to become the Bank of North America and Trust Company, which merged in 1929 with the Pennsylvania Company for Insurances on Lives and Granting Annuities. That company, operating as the Pennsylvania Company for Banking and Trust, merged with the First National Bank in 1955 to become The First Pennsylvania Banking and Trust Company, which was acquired by CoreStates Financial Corporation in 1991, by First Union/Wachovia in 1998, and by Wells Fargo in 2008.[3]

See also

- Congressional charter

- Turner v. Bank of North America (1799)

References

- ↑ Markham, Jerry W. (2002). A Financial History of the United States. Armonk, New York: M.E. Sharpe. p. 87. ISBN 978-0765607300. https://books.google.com/books?id=Uazpff00Y5EC&pg=PA87. Retrieved March 17, 2016.

- ↑ 2.0 2.1 2.2 Lewis, Lawrence Jr. (1882). A History of the Bank of North America, the First Bank Chartered in the United States. J. B. Lippincott & Co.. pp. 28, 35. https://babel.hathitrust.org/cgi/pt?id=mdp.39015025362271.

- ↑ 3.0 3.1 Smith, Robert F.. "Bank of North America". http://philadelphiaencyclopedia.org/archive/bank-of-north-america/.

- ↑ Michener, John H. (1906). The Bank of North America, Philadelphia, a national bank, founded 1781. New York: R. G. Cooke, Inc.. p. 37. HG21613.P54. https://archive.org/stream/cu31924032535753#page/n49/mode/2up. Retrieved March 17, 2016.

- ↑ "Establishing a National Bank". Journals of the Continental Congress (U.S. Government Printing Office) 20: 546–549. 1912. https://books.google.com/books?id=fPMMAAAAIAAJ&q=Continental+Journal+Plans+for+Establishing+a+National+Bank&pg=PA546. Retrieved March 17, 2016.

- ↑ Newman, Eric P. (November 28, 2008). Early Paper Money of America (5th ed.). Iola, Wisconsin: KP Books. p. 364. ISBN 978-0896893269.

- ↑ 7.0 7.1 Knox, John Jay (1900). Rhodes, Bradford; Youngman, Elmer Haskell. eds. A History of Banking in the United States. B. Rhodes & Company. p. 40. https://archive.org/details/ahistorybanking01knoxgoog. Retrieved March 17, 2016.

- ↑ Harris, Joseph Smith (January 1, 1903) (in en). Record of the Harris family descended from John Harris, born in 1680 in Wiltshire, England. Dalcassian Publishing Company. https://books.google.com/books?id=7uDIDwAAQBAJ&dq=Hugh+Shiell&pg=PA27.

- ↑ Alberts 1969, p. 106

- ↑ Syrett, Harold Coffin, ed (1962). The Papers of Alexander Hamilton. Columbia University Press. p. 55. ISBN 978-0-231-08905-0.

- ↑ Alberts 1969, pp. 435

- ↑ Alberts, Robert C. (1969). The Golden Voyage: The Life and Times of William Bingham, 1752–1804. Houghton-Mifflin. OCLC 563689565. https://books.google.com/books?id=XBd3AAAAMAAJ. Retrieved March 17, 2016.

- ↑ Dowgin, Christopher (2016). Sub Rosa. p. 83. ISBN 978-0-986-26102-2.

- ↑ Fischer, David Hackett (2022). African Founders. p. 220.

- ↑ "WILLING, Thomas, (1731–1821)". Biographical Information of the United States Congress. US Congress. June 11, 2009. http://bioguide.congress.gov/scripts/biodisplay.pl?index=W000556.

- ↑ National Cyclopaedia of American Biography. James T. White & Co.. 1898. p. 83. https://babel.hathitrust.org/cgi/pt?id=nyp.33433016182630&view=1up&seq=107.

- ↑ Alberts 1969, p. 111

Further reading

- Rappleye, Charles (2010). Robert Morris: Financier of the American Revolution. New York: Simon & Schuster. pp. 229–528. ISBN 978-1416570912. https://archive.org/details/robertm_rap_2010_00_1148/page/229.

External links

| Wikimedia Commons has media related to Bank of North America. |

- The Bank of North America, Philadelphia, a National Bank, Founded 1781: The Story of Its Progress through the Last Quarter of a Century, 1881–1906, by Robert Grier Cooke Incorporated (1906).

- Debates and Proceedings of the General Assembly of Pennsylvania, on the Memorials Praying a Repeal of Suspension of the Law Annulling the Charter of the Bank (ed. Mathew Carey, 1786).

- A History of the Bank of North America, the First Bank Chartered in the United States, by Lawrence Lewis, Jr. (J. B. Lippincott & Co. 1882).

- Legislative and Documentary History of the Bank of the United States: Including the Original Bank of North America, by Matthew St. Clair Clarke and David A. Hall. This collection of documents was aimed to include the entire proceedings, debates, and resolutions of Congress relating to the Bank of North America, the First (1791–1811) Bank of the United States, and the Second (1816–1836) Bank of the United States. These documents were compiled four years before the closing of the Second Bank.

- Legislative and Documentary History of the Banks of the United States, from the Time of Establishing the Bank of North America, 1781, to October 1834; with Notes and Comments, by R. K. Moulton. An attempt to compile all the public documents considered to be essential in attaining a thorough knowledge of the national banking operations of the United States, from 1781 to 1834.

|