Scenario analysis

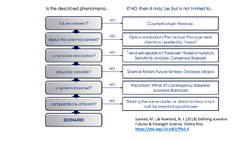

Scenario analysis is a process of analyzing future events by considering alternative possible outcomes (sometimes called "alternative worlds"). Thus, scenario analysis, which is one of the main forms of projection, does not try to show one exact picture of the future. Instead, it presents several alternative future developments. Consequently, a scope of possible future outcomes is observable. Not only are the outcomes observable, also the development paths leading to the outcomes. In contrast to prognoses, the scenario analysis is not based on extrapolation of the past or the extension of past trends. It does not rely on historical data and does not expect past observations to remain valid in the future. Instead, it tries to consider possible developments and turning points, which may only be connected to the past. In short, several scenarios are fleshed out in a scenario analysis to show possible future outcomes. Each scenario normally combines optimistic, pessimistic, and more and less probable developments. However, all aspects of scenarios should be plausible. Although highly discussed, experience has shown that around three scenarios are most appropriate for further discussion and selection. More scenarios risks making the analysis overly complicated.[1][2] Scenarios are often confused with other tools and approaches to planning. The flowchart to the right provides a process for classifying a phenomenon as a scenario in the intuitive logics tradition.[3]

Principle

Scenario-building is designed to allow improved decision-making by allowing deep consideration of outcomes and their implications.

A scenario is a tool used during requirements analysis to describe a specific use of a proposed system. Scenarios capture the system, as viewed from the outside

Scenario analysis can also be used to illuminate "wild cards." For example, analysis of the possibility of the earth being struck by a meteor suggests that whilst the probability is low, the damage inflicted is so high that the event is much more important (threatening) than the low probability (in any one year) alone would suggest. However, this possibility is usually disregarded by organizations using scenario analysis to develop a strategic plan since it has such overarching repercussions.

Applications

Financial

In economics and finance, a financial institution might use scenario analysis to forecast several possible scenarios for the economy (e.g. rapid growth, moderate growth, slow growth) and for financial market returns (for bonds, stocks and cash) in each of those scenarios. It might consider sub-sets of each of the possibilities. It might further seek to determine correlations and assign probabilities to the scenarios (and sub-sets if any). Then it will be in a position to consider how to distribute assets between asset types (i.e. asset allocation); the institution can also calculate the scenario-weighted expected return (which figure will indicate the overall attractiveness of the financial environment). It may also perform stress testing, using adverse scenarios.[4]

Depending on the complexity of the problem, scenario analysis can be a demanding exercise. It can be difficult to foresee what the future holds (e.g. the actual future outcome may be entirely unexpected), i.e. to foresee what the scenarios are, and to assign probabilities to them; and this is true of the general forecasts never mind the implied financial market returns. The outcomes can be modeled mathematically/statistically e.g. taking account of possible variability within single scenarios as well as possible relationships between scenarios. In general, one should take care when assigning probabilities to different scenarios as this could invite a tendency to consider only the scenario with the highest probability.[5]

Geopolitical

In politics or geopolitics, scenario analysis involves reflecting on the possible alternative paths of a social or political environment and possibly diplomatic and war risks.

Critique

While there is utility in weighting hypotheses and branching potential outcomes from them, reliance on scenario analysis without reporting some parameters of measurement accuracy (standard errors, confidence intervals of estimates, metadata, standardization and coding, weighting for non-response, error in reportage, sample design, case counts, etc.) is a poor second to traditional prediction. Especially in “complex” problems, factors and assumptions do not correlate in lockstep fashion. Once a specific sensitivity is undefined, it may call the entire study into question.

It is faulty logic to think, when arbitrating results, that a better hypothesis will render empiricism unnecessary. In this respect, scenario analysis tries to defer statistical laws (e.g., Chebyshev's inequality Law), because the decision rules occur outside a constrained setting. Outcomes are not permitted to “just happen”; rather, they are forced to conform to arbitrary hypotheses ex post, and therefore there is no footing on which to place expected values. In truth, there are no ex ante expected values, only hypotheses, and one is left wondering about the roles of modeling and data decision. In short, comparisons of "scenarios" with outcomes are biased by not deferring to the data; this may be convenient, but it is indefensible.

“Scenario analysis” is no substitute for complete and factual exposure of survey error in economic studies. In traditional prediction, given the data used to model the problem, with a reasoned specification and technique, an analyst can state, within a certain percentage of statistical error, the likelihood of a coefficient being within a certain numerical bound. This exactitude need not come at the expense of very disaggregated statements of hypotheses. R Software, specifically the module “WhatIf,”[6] (in the context, see also Matchit and Zelig) has been developed for causal inference, and to evaluate counterfactuals. These programs have fairly sophisticated treatments for determining model dependence, in order to state with precision how sensitive the results are to models not based on empirical evidence.

Another challenge of scenario-building is that "predictors are part of the social context about which they are trying to make a prediction and may influence that context in the process".[7] As a consequence, societal predictions can become self-destructing.[7] For example, a scenario in which a large percentage of a population will become HIV infected based on existing trends may cause more people to avoid risky behavior and thus reduce the HIV infection rate, invalidating the forecast (which might have remained correct if it had not been publicly known). Or, a prediction that cybersecurity will become a major issue may cause organizations to implement more security cybersecurity measures, thus limiting the issue.

See also

- ACEGES – an agent-based model for scenario analysis

- Climate change mitigation scenarios – possible futures in which global warming is reduced by deliberate actions

- Energy modeling – the process of building computer models of energy systems

- Global Scenario Group

- Morphological analysis

- Scenario planning

- Stress testing

References

- ↑ Aaker, David A. (2001). Strategic Market Management. New York: John Wiley & Sons. pp. 108 et seq. ISBN 978-0-471-41572-5. https://archive.org/details/strategicmarketm00aake/page/108.

- ↑ Bea, F.X., Haas, J. (2005). Strategisches Management. Stuttgart: Lucius & Lucius. pp. 279 and 287 et seq.

- ↑ Spaniol, Matthew J.; Rowland, Nicholas J. (2019). "Defining Scenario". Futures & Foresight Science 1: e3. doi:10.1002/ffo2.3.

- ↑ "Scenario Analysis in Risk Management", Bertrand Hassani, Published by Springer, 2016, ISBN:978-3-319-25056-4, [1]

- ↑ The Art of the Long View: Paths to Strategic Insight for Yourself and Your Company, Peter Schwartz, Published by Random House, 1996, ISBN:0-385-26732-0 Google book

- ↑ "WhatIf: Software for Evaluating Counterfactuals[yes|permanent dead link|dead link}}]", H Stoll, G King, L Zeng - Journal of Statistical Software, 2006

- ↑ 7.0 7.1 Overland, Indra (2019-03-01). "The geopolitics of renewable energy: Debunking four emerging myths". Energy Research & Social Science 49: 36–40. doi:10.1016/j.erss.2018.10.018. ISSN 2214-6296.

Further reading

- "Learning from the Future: Competitive Foresight Scenarios", Liam Fahey and Robert M. Randall, Published by John Wiley and Sons, 1997, ISBN:0-471-30352-6, Google book

- "Shirt-sleeve approach to long-range plans.", Linneman, Robert E, Kennell, John D.; Harvard Business Review; Mar/Apr77, Vol. 55 Issue 2, p141

External links