Donchian channel

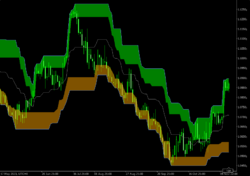

The Donchian channel is an indicator used in market trading developed by Richard Donchian.[1] It is formed by taking the highest high and the lowest low of the last n periods. The area between the high and the low is the channel for the period chosen.[2]

The formulas for calculating the upper channel, lower channel, and the middle line at any given point of the chart are the following: [math]\displaystyle{ \textit{Upper} = \textit{Highest High}(N) }[/math] [math]\displaystyle{ \textit{Lower} = \textit{Lowest Low}(N) }[/math] [math]\displaystyle{ \textit{Middle} = {\textit{Upper} + \textit{Lower} \over 2}, }[/math]

where N is usually equal to 20.

It is commonly available on most trading platforms. On a charting program, a line is marked for the high and low values visually demonstrating the channel on the markets price (or other) values.

The Donchian channel is a useful indicator for seeing the volatility of a market price. If a price is stable the Donchian channel will be relatively narrow. If the price fluctuates, a lot the Donchian channel will be wider. Its primary use, however, is for providing signals for long and short positions. If a security trades above its highest n periods high, then a long is established. If it trades below its lowest n periods low, then a short is established.

Originally the n periods were based upon daily values. With today's trading platforms, the period may be of the value desired by the investor. i.e.: day, hour, minute, ticks, etc.[3]

See also

- Bollinger bands

- Financial modeling

References

- ↑ Chen, James. "Donchian Channels Formula, Calculations, and Uses" (in en). https://www.investopedia.com/terms/d/donchianchannels.asp.

- ↑ Cox, Richard. "Donchian Channel Trading Guide" (in en). https://www.asktraders.com/learn-to-trade/technical-analysis/donchian-channels/.

- ↑ "Donchian Ultimate — Donchian Channel Indicator for MT4/MT5/cTrader" (in en-US). https://www.earnforex.com/metatrader-indicators/Donchian-Ultimate/.

|