Finance:Credit control in India

Credit control is a tool used by Reserve Bank of India, a major weapon of the monetary policy used to control the demand and supply of money i.e liquidity in the economy. Central Bank i.e RBI regulates the credit that the commercial banks grant. Such a method is used by RBI to bring Economic Development with Stability in the nation. It means that banks will not only control inflationary trends in the economy but also boost economic growth which would in the long run lead to increase in real national income stability. In view of its functions such as issuing notes and custodian of cash reserves, credit is not being controlled by RBI as it would lead to Social and Economic instability in the country.

Need for credit control

Controlling credit in the economy is amongst the most important functions of the Reserve Bank of India. The basic and important needs of credit control in the economy are-

- To stir up the overall growth of the "priority sector" i.e. those sectors of the economy which are recognized by the government as "prioritized" depending upon their economic condition or government interest. These sectors broadly totals to around 15 in number.[1]

- To keep a check over the channelization of credit so that it is not delivered for undesirable purposes.

- To achieve the objective of controlling inflation as well as deflation.

- To boost the economy by accelerating the flow of adequate volume of bank credit to different sectors.

- To help the economy develop.

Objectives of credit control

The broad objectives of credit control policy in India have been as follows:

- To ensure an adequate level of liquidity enough for attaining high economic growth rate along with maximum utilisation of resource without generating high inflationary pressure.

- To attain stability in the rate of exchange and money market of the country.

- To meet the financial requirement during a slump in the economy and in the normal times as well.

- To control business cycle and meet business needs.

Methods of credit control

There are two methods that the RBI uses to control the money supply in the economy. They are:

- Qualitative method

- Quantitative method

During inflation, Reserve Bank of India tightens its policies to regulate the money supply, whereas during deflation it allows the commercial bank to pump money in the economy.

Qualitative method

By Quality we mean the uses through which bank credit is directed.

For example- the bank may feel that spectators or big capitalists are getting a disproportionately large share in the total credit, causing various disturbances and inequality in the economy, while the small-scale industries, consumer goods industries and agriculture are starved of credit.

Correcting this type of disparity is a matter of qualitative credit control.

Qualitative methods control the manner of cash channelisation and credit in the economy. It is a 'selective method' of control as it restricts credit for certain section where as expands for the other known as the 'priority sector' depending on the situation.

Tools used under this method are-

Marginal requirement

Marginal requirement of loan current value of security offered for ban-value of loans granted. The marginal requirement is increased for those business activities, the flow of whose credit is to be restricted in the economy.

For Example:- A person mortgages his property worth ₹ 1,00,000 against loan. The bank will give loan of ₹ 80,000. The marginal requirement here is 20%

Rationing of credit

Under this method there is a maximum limit to loans and advances that can be made, which the commercial banks cannot exceed. RBI fixes ceiling for specific categories. Such rationing is used for situations when credit flow is to be checked, particularly for speculative activities. Minimum of "capital: total assets" (ratio between capital and total asset) can also be prescribed by Reserve Bank of India.

Publicity

RBI uses media for the publicity of its views on the current market condition and its directions that will be required to be implemented by the commercial banks to control the unrest. Though this method is not very successful in developing nations due to existence of high rate of financial illiteracy making it difficult for people to understand such policies and its implications.

Direct Action

Under the Banking Regulation Act, the Central Bank is authorised to take strict action against any of the commercial banks that refuses to abide by the directions given by it. There can be a restriction on advancing of loans imposed by Reserve Bank of India on such banks.

For e.g. – RBI had put up certain restrictions on the working of the Metropolitan co-operative banks. Also the 'Bank of Karad' had to come to an end in 1992.[2]

Moral Suasion

This method is also known as "moral persuasion" as the method that the Reserve Bank of India, being the apex bank uses here, is that of persuading the commercial banks to follow its directions/orders on the flow of credit. It can also be a part of meetings between RBI and Commercial Banks. RBI persuades the commercial bank to follow their policies. RBI puts a pressure on the commercial banks to put a ceiling on credit flow during inflation and be liberal in lending during deflation.

Quantitative method

By quantitative credit control we mean the control of the total quantity of credit.

For Example- consider that the Central Bank, on the basis of its calculations, considers that Rs. 50,000 is the maximum safe limit for the expansion of credit. But the actual credit at that given point of time is Rs. 55,000(say). Thus it then becomes necessary for the central bank to bring it down to 50,000 by tightening its policies. Similarly if the actual credit is less, say 45,000, then the apex bank regulates its policies in favor of pumping credit into the economy.

Different tools used under this method are-

Bank rate

Bank rate is also known as the discount rate. It is the official minimum rate at which the central bank of the country is ready to re discount approved bills of exchange or lend on approved securities.

Section 49 of the Reserve Bank of India Act 1934, defines Bank Rate as "the standard rate at which it (RBI) is prepared to buy or re-discount bills of exchange or other commercial paper eligible for purchase under this Act".

When the commercial bank for instance, has lent or invested all its available funds and has little or no cash over and above the prescribed minimum, it may ask the central bank for funds. It may either re-discount some of its bills with the central bank or it may borrow from the central bank against the collateral of its own promissory notes.

In either case, the central bank accommodates the commercial bank and increases the latter's cash reserves. This Rate is increased during the times of inflation when the money supply in the economy has to be controlled.

At any time there are various rates of interest ruling in the market, like the deposit rate, lending rate of commercial banks, market discount rate and so on. But, since the central bank is the leader of the money market and the lender of the last resort, all other rates are closely related to the bank rate. The changes in the bank rate are, therefore, followed by changes in all other rates as the money market.

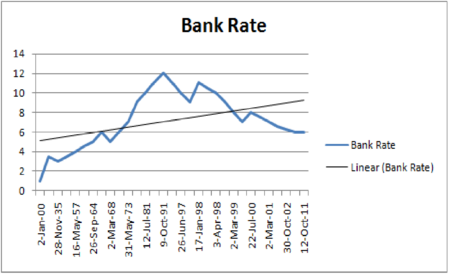

The graph on the right hand side shows variations in the bank rate since 1935–2011.

Working of the bank rate

Changes in bank rate are introduced with a view to controlling the price levels and business activity, by changing the demand for loans. Its working is based upon the principle that changes in the bank rate results in changed interest rate in the market.

Suppose a country is facing inflationary pressure. The central bank, in such situations, will increase the bank rate thereby resulting to a hiked lending rate. This increase will discourage borrowing. It will also lead to a fall in the business activity due to following reasons:

- Employment of some factors of production will have to be reduced by the business people.

- The manufacturers and stock exchange dealers will have to liquidate their stocks, which they held through bank loans, to pay off their loans.

The effect of rise in bank rate by the Central Bank is depicted pictorially in the diagram above. Hence, we can conclude that hike in bank rate leads to fall in price level and a fall in the bank rate leads to an increase in price level i.e. they share an inverse relationship.

References

- ↑ "Priority Sector Lending – FAQs". http://www.rbi.org.in/scripts/faqview.aspx?id=8. Retrieved 30 September 2011.

- ↑ Nanda, Sachin. "Role of RBI in Indian Economy". https://www.scribd.com/doc/8521810/Role-of-RBI-in-Indian-Economy. Retrieved 30 September 2011.

- ↑ "Chronology of Bankrate". http://www.rbi.org.in/scripts/chro_bankrate.aspx. Retrieved 12 October 2011.

External links