Finance:Inada conditions

This article may be too technical for most readers to understand. Please help improve it to make it understandable to non-experts, without removing the technical details. (August 2017) (Learn how and when to remove this template message) |

In macroeconomics, the Inada conditions are a set of mathematical assumptions about the shape and boundary behaviour of production or utility functions that ensure well-behaved properties in economic models, such as diminishing marginal returns and proper boundary behavior, which are essential for the stability and convergence of several macroeconomic models. The conditions are named after Ken-Ichi Inada, who introduced them in 1963.[1][2] These conditions are typically imposed in neoclassical growth models — such as the Solow–Swan model, the Ramsey–Cass–Koopmans model, and overlapping generations models — to ensure that marginal returns are positive but diminishing, and that the marginal product of an input becomes infinite when its quantity approaches zero and vanishes when its quantity becomes infinitely large.

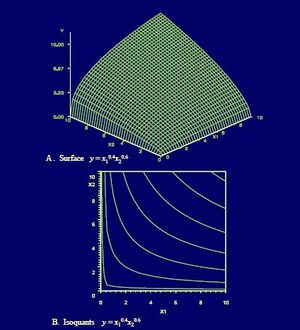

Economically, these properties guarantee well-behaved model dynamics: they rule out “corner solutions” such as zero capital accumulation or unbounded growth, ensure the existence of a unique and stable steady state, and promote smooth substitution between inputs. A Cobb–Douglas production function satisfies the Inada conditions, while some constant elasticity of substitution (CES) functions do not. Although stylized and not strictly realistic, the conditions are mathematically convenient and widely used in theoretical work because they simplify the analysis of long-run convergence and stability in dynamic macroeconomic models.

The Inada conditions are commonly associated with preventing pathological behaviors in production functions, such as infinite or zero capital accumulation.

Statement

Given a continuously differentiable function , where and , the conditions are:

- the value of the function at is 0:

- the function is concave on , i.e. the Hessian matrix needs to be negative-semidefinite.[3] Economically this implies that the marginal returns for input are positive, i.e. , but decreasing, i.e.

- the limit of the first derivative is positive infinity as approaches 0: , meaning that the effect of the first unit of input has the largest effect

- the limit of the first derivative is zero as approaches positive infinity: , meaning that the effect of one additional unit of input is 0 when approaching the use of infinite units of

Consequences

The elasticity of substitution between goods is defined for the production function as , where is the marginal rate of technical substitution. It can be shown that the Inada conditions imply that the elasticity of substitution between components is asymptotically equal to one (although the production function is not necessarily asymptotically Cobb–Douglas, a commonplace production function for which this condition holds).[4][5]

In stochastic neoclassical growth model, if the production function does not satisfy the Inada condition at zero, any feasible path converges to zero with probability one, provided that the shocks are sufficiently volatile.[6]

References

- ↑ Inada, Ken-Ichi (1963). "On a Two-Sector Model of Economic Growth: Comments and a Generalization". The Review of Economic Studies 30 (2): 119–127. doi:10.2307/2295809.

- ↑ Uzawa, Hirofumi (1963). "On a Two-Sector Model of Economic Growth II". The Review of Economic Studies 30 (2): 105–118. doi:10.2307/2295808.

- ↑ Takayama, Akira (1985). Mathematical Economics (2nd ed.). New York: Cambridge University Press. pp. 125–126. ISBN 0-521-31498-4. https://archive.org/details/mathematicalecon00taka.

- ↑ Barelli, Paulo; Pessoa, Samuel de Abreu (2003). "Inada Conditions Imply That Production Function Must Be Asymptotically Cobb–Douglas". Economics Letters 81 (3): 361–363. doi:10.1016/S0165-1765(03)00218-0.

- ↑ Litina, Anastasia; Palivos, Theodore (2008). "Do Inada conditions imply that production function must be asymptotically Cobb–Douglas? A comment". Economics Letters 99 (3): 498–499. doi:10.1016/j.econlet.2007.09.035.

- ↑ Kamihigashi, Takashi (2006). "Almost sure convergence to zero in stochastic growth models". Economic Theory 29 (1): 231–237. doi:10.1007/s00199-005-0006-1. https://www.rieb.kobe-u.ac.jp/academic/ra/dp/English/dp140.pdf.

Further reading

- Barro, Robert J.; Sala-I-Martin, Xavier I. (2004). Economic Growth (Second ed.). London: MIT Press. pp. 26–30. ISBN 0-262-02553-1. https://books.google.com/books?id=jD3ASoSQJ-AC&pg=PA26.

- Gandolfo, Giancarlo (1996). Economic Dynamics (Third ed.). Berlin: Springer. pp. 176–178. ISBN 3-540-60988-1. https://books.google.com/books?id=ouC6AAAAIAAJ&pg=PA176.

- Romer, David (2011). "The Solow Growth Model". Advanced Macroeconomics (Fourth ed.). New York: McGraw-Hill. pp. 6–48. ISBN 978-0-07-351137-5.

|