Finance:Student debt

Student debt is a form of financial aid specifically designed to assist students in covering the costs associated with their education. Unlike mortgage or credit card debt, student loans often operate under distinct regulations governing renegotiation and bankruptcy in many countries.

Similar to other forms of debt, student loans can enter into default status if the borrower fails to respond to requests from the educational institution or the lender regarding information, payment, or negotiation within a specified period. Once in default, the debt may be transferred to a student loan guarantor or a collection agency for further action. This process is governed by specific laws and procedures that vary by jurisdiction.

Canada

As of 2018[update], Canada ranked third in the world (behind Russia and South Korea ) for percentage of people ages 25-34 who have completed tertiary education.[1] As of September 2012, the average debt for a Canadian post-university was 28,000 Canadian dollars with that accumulated debt taking an average of 14 years to fully repay based on an average starting salary of $39,523.[2] To temporarily assist low-income citizens with student debt, Canada has implemented the Interest Relief program, granting 6 months free of mandatory payments for a maximum of 30 months. During the grace period, the Canadian government covers the interest for these loans, ensuring the debt amount remains the same after the grace period's end.[3] Students are relieved of their debt after 15 years.[4] As a whole, Canadians have accumulated more than $15 billion in 2010, rising to about $18.2 billion in 2017 (both figures are only on government-backed loans). In 2018, however, the total student debt (for both government and private sponsored loans) was $28 billion.[5][6]

Chile

In 2014, the Chilean activist and artist Francisco Tapia, also known as "Papas Fritas" (French Fries), reportedly burned debt papers worth $500 million from Viña del Mar University as part of an art project. This action took place during a period when the university was facing closure due to financial irregularities. Tapia displayed the ashes of the burnt papers in a van as a symbolic act.

In an interview broadcast in the United States, Tapia asserted that the papers had been destroyed completely and that as a result, the associated debt no longer existed. He stated, "It is a concrete fact that the papers were burned. They are gone, burned completely, and there's no debt. Since these papers don't exist anymore, there's no way to charge the students." This event garnered attention both for its artistic statement and its implications for the university's financial situation.[7]

Denmark

In Denmark, both Danish students and those from the European Union (EU) are not required to pay tuition fees when enrolling in higher education institutions. Additionally, students in Denmark are eligible to receive government-funded student grants to support their educational endeavors. This public support is available to all Danish citizens over the age of 18 who choose to pursue further education. However, the scheme and eligibility criteria for grants and loans differ for foreign citizens. Despite these differences, financial support remains accessible to applicants from EU member states.[8] In addition to public support, there are numerous corporate-sponsored scholarships available for international students in Denmark. These scholarships often have varying requirements and criteria for eligibility, providing opportunities for students with diverse backgrounds and academic achievements to receive financial assistance for their studies.[citation needed]

Finland

Students from Switzerland, the European Union (EU), or the European Economic Area (EEA) are exempt from paying tuition fees when pursuing studies at Finnish universities.[9] In the context of Finnish universities, exemptions from tuition fees are available to non-Finnish citizens pursuing studies in Finland. In addition to the absence of tuition fees, students are eligible to receive government-funded student grants. These grants are typically allocated to cover housing expenses and may reimburse up to 80% of rental costs for students living independently or those who do not qualify for child benefits.

[10] Through Kela, 40% of students take out student loans in addition to student grants. Student loans average to about 650 EUR a month for higher education within Finland and an average amount of 800 EUR a month for Finnish students studying abroad.[11] These loans are not through Kela itself, but is a guaranteed loan through the student's bank of choice. Besides student loans and grants, Finland also compensates its citizens, and others that qualify, a meal subsidy, school transport subsidy, and a student loan compensation for students who finish schooling in a target time.[12][13]

In August 2017, Finland saw student loan drawdowns double to 143 million EUR from August 2016 as a result of being able to borrow 650 EUR a month from the previous 400 EUR a month. The reform for financial aid resulted in students that qualify for government-guaranteed loans to increase to over 60%.[14]

France

The average tuition fees for a bachelor's degree in France is around 190 euros per year, approximately 620 euros per year for engineering degrees, around 260 euros per year for a master's degree, and around 400 euros per year for a PhD.[15] These fee structures are similar to those in Germany. Housing, transportation, and health insurance costs are not included in the tuition fees.[16] Students are able to take out loans to pay for these expenses. However, less than 2% of students take out loans, as there is financial assistance available to pay for the full tuition or half of the tuition for low-income families, depending on their needs.[17]

Germany

Germany's higher education system consists of both public and private universities, with the majority being public institutions. This composition contributes to lower levels of student debt among graduates. In the case of undergraduate studies at public universities in Germany, tuition fees are generally waived, making them tuition-free for students. However, students are typically required to pay an enrollment fee of no more than €250 per year, which is approximately US$305. Private universities in Germany, on the other hand, often charge tuition fees. The average cost of tuition at private universities is around €10,000 per semester, which translates to about US$12,000. This significant difference in costs between public and private institutions is a key factor in shaping the financial landscape for students pursuing higher education in Germany.[18]

In Germany, private universities account for approximately 7.1% of total enrollment, with the majority of students attending public universities. Private universities in Germany often offer a smaller teacher-to-student ratio and specialize in specific academic programs, such as law and medicine.[19] This has led to a recent increase in enrollment at private universities, particularly in these specialized fields. However, despite the advantages offered by private institutions, most students still prefer public universities due to the significant difference in tuition costs.

At public universities in Germany, students typically do not have to pay tuition fees for undergraduate studies. However, they may need to cover living expenses, which range from €3,600 to €8,200 per year depending on the location of the university. To cover these living costs, students can take out interest-free loans. Regardless of the amount borrowed, no student is required to repay more than €10,000. This system ensures that students are not burdened with high levels of debt upon graduation.

As of 2005, the average debt at graduation for students in Germany was €5,600, which is approximately US$6,680. This relatively low level of debt, combined with the opportunity to earn a bachelor's degree from well-respected universities at a reasonable cost, has made Germany an attractive destination for students from around the world. This is evidenced by the increasing enrollment of international students in German universities.[20][21]

United Kingdom

The United Kingdom, like the United States, faces significant challenges related to student debt, with some of the highest rates observed globally. The growth of student debt in the UK over the past five decades has been largely driven by government initiatives aimed at increasing access to higher education. To address the repayment of student loans, the UK has implemented a system based on "Income Contingent Loans," where graduates repay their loans at a rate determined by their post-graduation income.[22]

However, concerns have been raised about potential changes in government policy that could lead to graduates being required to repay more of their debts.[23] The Institute for Fiscal Studies has estimated that 75% of graduates will not fully repay their student loans.[24] Economist Sebastian Burnside has highlighted that student debt is the fastest-growing type of borrowing in the UK and is becoming increasingly economically significant.[25]

In 2015, a student named Brooke Purvis from Central Saint Martins announced that he would burn his student loan as a form of protest art, aiming to raise awareness about the issue of student debt.[26] This artistic action was seen as addressing the materialistic nature of money and shedding light on the political aspects of the UK student loan system.[27][28][29][30][31][32]

United States

In 2023, the typical federal student loan borrower owed almost $40,000 and there were about 45 million student loan borrowers. Only mortgage debt is larger in the United States.[33]

History

As of 2023, the average federal student loan borrower in the United States owed almost $40,000, and there were approximately 45 million student loan borrowers in the country.[34] This level of debt makes student loans the second-largest category of debt in the United States, surpassed only by mortgage debt.

Several factors contribute to the student debt crisis. One factor is the declining income premium for graduates compared to non-graduates, particularly for those born since 1980. Another factor is the high interest rates on student loans. Additionally, changes in federal guidelines have affected who can borrow and how much debt they can take on. Some scholars attribute the student debt crisis to neoliberal policies that have increased tuition costs while reducing state funding for higher education.[35]

The years of the Reagan presidency saw an increase in student debt, and following the Great Recession, student debt climbed significantly as states cut public funding for higher education. In contrast, student debt did not significantly impact American life as late as the 1960s.[36]

Over the 30-year period from 1991–1992 to 2021–2022, private college tuitions (adjusted for inflation) doubled, while public school tuitions increased by 2.5 times.[37] In 1991–1992, state and local governments covered about three-quarters of the cost of public college, with tuition paying for the rest. In addition, since federal student loans do not limit the amount a lender can borrow, this has allowed public as well as private colleges to increase their tuitions.[37]

Reports indicate that borrowers who graduated in the early 1990s were able to manage their student loans without significant burden. However, from 2005 to 2012, the average student debt increased by 58%, rising from $17,233 to $27,253. This increase occurred despite decreases in credit card and auto debt during the same period. The cost of attaining a college degree has increased by over 1,000% within the past three decades, far outpacing inflation.[38][38][39]

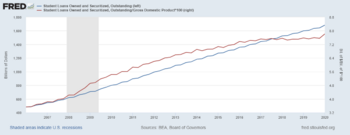

In 2018, a total of 44.2 million borrowers owed a total of over $1.5 trillion in student debt. In addition to more borrowers, and the total amount owed having more than doubled (up 250%) from $600 Billion to $1.5 Trillion in 10 years, according to Forbes Magazine,[40] the rate of delinquency greater than 90 days, or default, has doubled to over 11% nationwide, according to the Federal Reserve.[41] A report by the Brookings Institution warned that the default rate could reach nearly 40% by 2023.[42]

In 2019, Theresa Sweet and other student loan debtors filed a claim against the US Department of Education, arguing that they had been defrauded by their colleges. The debtors filed under a rule known as Borrower Defense to Repayment.[43] In November 2022, federal judge William Alsup ruled for immediate relief for about 200,000 student debtors and in April 2023 US Supreme Justice Elena Kagan declined to grant emergency relief to three for-profit colleges.[44]

Statistics

There are two types of loans students borrow in the US: Federal loans and Private loans. Federal loans have a fixed interest rate, usually lower than private loans' interest, set annually by the congress. The direct subsidized loan with the maximum amount of $5,500 has an interest rate of 4.45%, while the direct plus loan with the maximum amount of $20,500 has an interest rate of 7%.[45] As for private loans, there are more options like fixed interest rate, variable interest rate, and income based monthly plans whose interest rates vary depending on the lender, credit history and cosigners. The average interest rate for a private loan in 2017 was 9.66%.[46] The Economist reported in June 2014 that U.S. student loan debt exceeded $1.2 trillion with over 7 million debtors in default. In 2014, there was approximately $1.3 trillion of outstanding student loan debt in the U.S. that affected 44 million borrowers who had an average outstanding loan balance of $37,172.[46] As of 2018, outstanding student loan debt totals 1.5 trillion.[47]

The interest rates are a major factor in the alarming debt numbers, however, the booming of prices of college is another major factor for US tremendous student debt. The Public universities increased their fees by a total of 27% over the five years ending in 2012, or 20% adjusted for inflation. Public university students paid an average of almost $8,400 annually for in-state tuition, with out-of-state students paying more than $19,000. For two decades ending in 2012, college costs rose 1.6% more than inflation each year. Government funding per student fell 27% between 2007 and 2012. Student enrollments rose from 15.2 million in 1999 to 20.4 million in 2011, but have fallen each year since 2010–2011.[48][49] Bloomberg reported in July 2014 that: "The biggest growth in the program came in the past decade, as student debt rose an average of 14 percent a year, to $966 billion in 2012 from $364 billion in 2004, according to New York Fed data."[50]

There were around 37 million student loan borrowers with outstanding student loans in 2013. According to the Federal Reserve Bank of New York, outstanding student loan debt in the United States lies between $902 Billion and $1 Trillion with around $864 Billion in Federal student loan debt.[51] As of Quarter 1 in 2012, the average student loan balance for all age groups is $24,301.[51] About one-quarter of borrowers owe more than $28,000; 10% of borrowers owe more than $54,000; 3% owe more than $100,000; and less than 1%, or 167,000 people, owe more than $200,000.[51] Of the 37 million borrowers who have outstanding student loan balances, 14%, or about 5.4 million borrowers, have at least one past due student loan account.[51] For every student loan borrower who defaults, at least two more borrowers become delinquent without default.[51] In 2010 for the first time ever, student loan debt exceeded credit card debt and in 2011 student debt surpassed auto loans (both of which were decreasing).[52] According to Mark Kantrowitz, publisher of FinAid.org, student loan debt is growing by $3,000 per second.[52] According to a report by The Institute for College Access and Success the average debt from those who graduated in 2013 topped $30,000 in six states and was only below $20,000 in one state.[53] Data released by the Federal Reserve Bank of New York showed that in the fourth quarter of 2014 delinquency rates for students dipped to the point where approximately one in nine student loans is past due.[54] As of 2015 over half of outstanding student loans are in deferral, delinquency or default.[55] Rising student loan debt is exacerbating wealth inequality.[56]

Student loan borrowers that attended a for profit, and two year community colleges, in comparison, earn low annual salaries; an average of $22,000 for people withdrawing from schools as of 2010. This means that these people have troubles paying back their loans. The new evidence is reliable with the previous data. For example, the statistics presenting that default rates are essentially lower within the demographic of borrowers with large loans than within borrowers with small loans. However, the new evidence which goes back twenty years, shows how much the scenery of borrowing has changed. Currently, most borrowers are older and attended a for profit or two year community college. About ten years ago, the standard borrower was an established student at a four-year university.[57]

In recent years, tuition has been rising due to the cuts of government funding in education. As an example, more specifically, the University of Pittsburgh has had an increase in tuition of 3.9 percent for the academic school year of 2014–2015. In 2014, the U.S. Department of Education ranked Pitt as the most expensive public university for tuition and fees at $16,240, just ahead of Penn State University.[58]

In 2005, the difference in median annual income between those with a bachelor's degree vs. those with a high school diploma was $16,638, though this varies considerably by field of study.[59]

In January 2019, the Federal Reserve said that student loan debt has more than doubled in the last decade, and is forcing many in the millennial generation to delay buying homes.[60] A 2019 survey by Bankrate found that student loan debt is also forcing millennials to delay other financial and life milestones, such as building emergency savings, saving for retirement, or paying off other debts.[61] Beth Akers, a senior fellow at the Manhattan Institute for Policy Research, points out that 66% of millennials have no college debt; most who do have debt proportional to their income; and that for those who drop out or fail to get a high-income job after getting an expensive degree, there are government programs that limit payments to a reasonable percentage of income and that forgive loans after 10–20 years if they cannot be repaid.[62]

Social and political reactions

The increasing burden of student debt has sparked significant reactions among young people across the United States. In response to this issue, the Occupy Colleges and Occupy Student Debt movements joined forces in 2012 with the aim of garnering support from students nationwide. This merger sought to amplify the voices of students and raise awareness about the challenges posed by mounting student debt, as well as to advocate for potential solutions to address this pressing issue.[63] The Occupy Student Debt campaign has seen significant use of social media. Students across the United States have shared their personal student debt experiences on various social platforms.[64] While some success stories of students eliminating debt have been reported,[65] these success stories have been met with skepticism. Since last October, Occupy Student Debt has provided a platform for over 800 students to share their experiences.[63] As a result, other organizations such as Rebuild the Dream, Education Trust, and the Young Invincibles have also joined the effort, launching similar platforms. The Occupy College movement has organized over ten direct actions of its own.[63][66]

In addition, they gathered over 31,000 signatures on the White House's petition site, “We the People”. This led to President Obama announcing the Pay as You Earn initiative. Another petition titled 'Support the Student Loan Forgiveness Act of 2012' on MoveOn.org, seeking similar relief for student borrowers, has garnered over one million signatures.[67][68][69] HR 4170: “The Student Loan Forgiveness Act of 2012” would give relief to borrowers with both federal and private student loans.[70] HR 4170, also known as the Student Loan Forgiveness Act of 2012, includes the “10-10” program. This program enables borrowers to pay 10% of their discretionary income for a period of ten years, after which the remaining balance is forgiven.[70]

In April 2012, student loan debt reached US$1 trillion.[71] The severity of the student debt burden has been deemed significant enough to pose a threat to the middle class, leading some to call for a general bailout.[72][73] Anthropologist David Graeber, author of Debt, argues that student debt is "destroying the imagination of youth" and added: "If there’s a way of a society committing mass suicide, what better way than to take all the youngest, most energetic, creative, joyous people in your society and saddle them with, like $50,000 of debt so they have to be slaves? There goes your music. There goes your culture. There goes everything new that would pop out. And in a way, this is what’s happened to our society. We’re a society that has lost any ability to incorporate the interesting, creative and eccentric people."[74]

On November 12, 2015, students organized rallies at over 100 college campuses across the United States. These rallies aimed to protest the burden of crippling student loan debt and to advocate for tuition-free higher education at public colleges and universities. Notably, these demonstrations occurred shortly after fast-food workers had gone on strike to demand a minimum wage of $15 per hour and improved union rights.[75]

According to a February 2018 research paper from the Levy Economics Institute of Bard College, cancelling student debt in the United States would lead to a boost in consumer demand, economic growth, and employment. The paper suggests that over the subsequent decade, this measure could result in an annual GDP increase ranging between $86 billion and $108 billion. Additionally, it could potentially create between 1.2 and 1.5 million new jobs, leading to a decreased unemployment rate of 0.22 to 0.36 percent.[76]

In April 2019, Elizabeth Warren, a U.S. Senator from Massachusetts seeking the nomination in the 2020 Democratic Party presidential primaries, included a proposal to her presidential platform to cancel student debt and make public colleges tuition free.[77] In June 2019, U.S. Senator from Vermont Bernie Sanders, who is also seeking the 2020 Democratic nomination, offered a plan for the cancellation of all 1.8 trillion in outstanding student loan debt which would be paid for with a tax on Wall Street speculation.[78]

According to a Hill-HarrisX poll, 58% of registered voters are in favor of making public colleges tuition free and also support abolishing all outstanding student loan debt.[79]

It was revealed in September 2019 that the U.S. Army is using the student debt crisis to boost recruitment, more so than the ongoing conflicts it is engaged in, and because of this exceeded its recruitment goals. The Head of Army Recruiting Command, Maj. Gen. Frank Muth, said that "one of the national crises right now is student loans, so $31,000 is [about] the average. You can get out [of the Army] after four years, 100 percent paid for state college anywhere in the United States."[80]

Some studies have shown that student debt can have significant effects on a student's mental health and attitude towards education.[81] These effects include feelings of anxiety, nervousness and tension, as well as difficulty sleeping and worry of criticism from peers.[82] Student debt and these feelings associated with it have also been shown to negatively impact the student's academic performance.[83]

In a video report from Reason magazine, analyst Emma Camp evaluated the potential impact of outright debt forgiveness. She concluded that there are inherent inequities in abolishing all student debt outright, as opposed to allowing individuals who are most in need to declare bankruptcy and relieve themselves of student debts they cannot repay. Camp argues that wholesale debt forgiveness could lead to increased inflation and worsen the economy, not only in the United States but also in any other location where such indiscriminate debt forgiveness might occur.[84]

See also

- College admissions in the United States

- College tuition in the United States

- Debt relief

- EdFund

- Free education

- Higher education bubble in the United States

- Higher Education Price Index

- Post-secondary education

- Private university

- Student benefit

- Student loan

- Tuition

- Tuition agency

- Tuition center

- Tuition fees

- Tuition freeze

- Refinancing

References

- ↑ "Education attainment - Population with tertiary education - OECD Data" (in en). https://data.oecd.org/eduatt/population-with-tertiary-education.htm.

- ↑ "Student debt: Average payback takes 14 years". Financial Post. 4 September 2012. http://business.financialpost.com/2012/09/04/student-debt-average-payback-takes-14-years/.

- ↑ "Interest Relief for Canada Student Loans". 2007-06-17. http://www.hrsdc.gc.ca/en/learning/canada_student_loan/interest_relief.shtml.

- ↑ Canada, Employment and Social Development. "Repayment Assistance Plan - Canada.ca" (in en). https://www.canada.ca/en/employment-social-development/services/education/repayment-assistance-plan.html.

- ↑ "Canadian Federation of Students". http://www.cfs-fcee.ca.

- ↑ Jessica Vomiero (31 May 2018). "Canadian students owe $28B in government loans, some want feds to stop charging interest". Global News. https://globalnews.ca/news/4222534/canadian-student-loans-government-interest/.

- ↑ Goodman, Amy (2014-05-23). "Exclusive: Chilean Robin Hood? Artist Known as "Papas Fritas" on Burning $500M Worth of Student Debt". Democracy Now!. http://www.democracynow.org/2014/5/23/exclusive_chilean_robin_hood_artist_known.

- ↑ "English - su.dk". https://www.su.dk/english/.

- ↑ "Tuition fees in Finland: 8 things you need to know" (in en). https://www.study.eu/article/tuition-fees-in-finland-8-things-you-need-to-know.

- ↑ "Economics of Education in Europe - Analytical Reports" (in en). http://www.eenee.de/eeneeHome/EENEE/Analytical-Reports.html.

- ↑ "Grants and Loans in Finland | EFG - European Funding Guide" (in en). http://www.european-funding-guide.eu/articles/grants-and-loans/grants-and-loans-finland.

- ↑ "Student financial aid reform 2017 in Finland" (in en-US). https://minedu.fi/en/student-financial-aid-system.

- ↑ "Student loan compensation" (in en-US). https://www.kela.fi/web/en/student-loan-compensation.

- ↑ "Student-loan drawdowns record high in August" (in en). https://www.suomenpankki.fi/en/Statistics/mfi-balance-sheet/older-news/2017/opintolainoja-nostettiin-ennatysmaara/.

- ↑ "Low university tuition fees in France". https://www.campusfrance.org/en/tuition-fees-France.

- ↑ "Low university tuition fees in France". https://www.campusfrance.org/en/tuition-fees-France.

- ↑ "Les bourses de l'enseignement supérieur" (in fr). http://www.linternaute.fr/argent/guide-de-vos-finances/1407390-les-bourses-de-l-enseignement-superieur/.

- ↑ Playdon, Jane (2018-04-24). "How Much Does it Cost to Study in Germany". https://www.topuniversities.com/student-info/student-finance/how-much-does-it-cost-study-germany.

- ↑ Trines, Stefan (28 January 2021). "Education in Germany". https://wenr.wes.org/2016/11/education-in-germany.

- ↑ "Around 850 a Month for Living Expenses". https://www.study-in.de/en/plan-your-stay/money-and-costs/cost-of-living_28220.php.

- ↑ Usher, Alex. Global Debt Patterns.

- ↑ Nissen, Sylvia; Hayward, Bronwyn; McManus, Ruth (2019-07-03). "Student debt and wellbeing: a research agenda" (in en). Kōtuitui: New Zealand Journal of Social Sciences Online 14 (2): 245–256. doi:10.1080/1177083X.2019.1614635. ISSN 1177-083X.

- ↑ Bachan, Ray (2013-01-16). "Students' expectations of debt in UK higher education". Studies in Higher Education 39 (5): 848–873. doi:10.1080/03075079.2012.754859. ISSN 0307-5079. http://dx.doi.org/10.1080/03075079.2012.754859.

- ↑ Williams, Jeffrey J. (2008). "Student Debt and The Spirit of Indenture". Dissent 55 (4): 73–78. doi:10.1353/dss.2008.0076. ISSN 1946-0910. http://dx.doi.org/10.1353/dss.2008.0076.

- ↑ UK student loan debt soars to more than £100bn The Guardian

- ↑ Aftab Ali (30 October 2015). "Central Saint Martins artist, Brooke Purvis, to set fire to his student loan in protest against capitalism". The Independent. https://www.independent.co.uk/student/news/central-saint-martins-artist-brooke-purvis-to-set-fire-to-his-student-loan-in-protest-against-a6714636.html.

- ↑ "This British art student is burning his student loan to make a valuable point about money". 26 November 2015. http://www.theplaidzebra.com/this-british-art-student-is-burning-his-student-loan-to-make-a-valuable-point-about-money/.

- ↑ "Artist Brooke Purvis is burning his student loan in a protest against money - Metro News". Metro. 28 October 2015. http://metro.co.uk/2015/10/28/this-person-is-burning-his-entire-student-loan-in-the-name-of-art-5467464/.

- ↑ Kirstie McCrum (3 November 2015). "Man to burn his entire student loan as a protest in the name of art". Mirror. https://www.mirror.co.uk/news/weird-news/man-burn-entire-student-loan-6756597.

- ↑ Cait Munro (28 October 2015). "Art Student Burns Student Loan - artnet News". artnet News. https://news.artnet.com/art-world/student-burns-loan-money-brooke-purvis-350411.

- ↑ "Meeting the Man Who Plans to Set His Entire Student Loan On Fire". VICE. https://www.vice.com/en_uk/read/this-guy-is-burning-his-entire-student-loan-for-art-729.

- ↑ "The guy burning his entire student loan doesn't deserve your attention". 29 October 2015. http://thetab.com/2015/10/29/the-guy-burning-his-entire-student-loan-doesnt-deserve-your-attention-59961.

- ↑ Underwood, Emily (2023-09-29). "The knotty economics of student loan debt" (in en). Knowable Magazine | Annual Reviews. doi:10.1146/knowable-092923-1. https://knowablemagazine.org/article/society/2023/knotty-economics-student-loan-debt.

- ↑ Emmons, William R.; Kent, Ana H.; Ricketts, Lowell R. (2019). "Is College Still Worth It? The New Calculus of Falling Returns". Federal Reserve Bank of St. Louis Review (Federal Reserve Bank of St. Louis) 101 (4): 297–329. doi:10.20955/r.101.297-329. https://files.stlouisfed.org/files/htdocs/publications/review/2019/10/15/is-college-still-worth-it-the-new-calculus-of-falling-returns.pdf. Retrieved 2020-02-10.

- ↑ The Neoliberal Agenda and the Student Debt Crisis in U.S. Higher Education. Routledge. 2017. p. xxxiv. ISBN 978-1138194656. https://books.google.com/books?id=yDklDwAAQBAJ&pg=PR34.

- ↑ Schwarz, Jon (August 25, 2022). "The Origin of Student Debt: Reagan Adviser Warned Free College Would Create a Dangerous "Educated Proletariat"". The Intercept. https://theintercept.com/2022/08/25/student-loans-debt-reagan/.

- ↑ 37.0 37.1 Dickler, Jessica; Nova, Annie (May 6, 2022). "This is how student loan debt became a $1.7 trillion crisis". CNBC. https://www.cnbc.com/2022/05/06/this-is-how-student-loan-debt-became-a-1point7-trillion-crisis.html. "Over the 30 years between 1991-92 and 2021-22, average tuition prices more than doubled, increasing to $10,740 from $4,160 at public four-year colleges, and to $38,070 from $19,360 at private institutions, after adjusting for inflation, according to the College Board. ... With nearly no limit on the amount students can borrow to help cover the rising cost of college, "there is an incentive to drive up tuition," she said. Now, "schools can charge as much as they want," [Diana Furchtgott-Roth, an economics professor at George Washington University and former chief economist at the Department of Labor] added."

- ↑ 38.0 38.1 Touryalai, Halah. "Student Loan Increase". Forbes. https://www.forbes.com/sites/halahtouryalai/2013/01/29/more-evidence-on-the-student-debt-crisis-average-grads-loan-jumps-to-27000/.

- ↑ "The Student Debt Crisis - Center for American Progress". http://www.americanprogress.org/issues/higher-education/report/2012/10/25/42905/the-student-debt-crisis/.

- ↑ "Student Loan Debt Statistics in 2018: A $1.5 Trillion Crisis". https://www.forbes.com/sites/zackfriedman/2018/06/13/student-loan-debt-statistics-2018/#50a5ed8d7310.

- ↑ "A rising mountain of student debt | Federal Reserve Bank of Minneapolis". https://www.minneapolisfed.org/publications/fedgazette/a-rising-mountain-of-student-debt.

- ↑ Scott-Clayton, Judith. "The looming student loan default crisis is worse than we thought". Brookings Institution. https://www.brookings.edu/research/the-looming-student-loan-default-crisis-is-worse-than-we-thought/.

- ↑ Turner, Cory. "Judge rules to erase the student loans of 200K borrowers who say they were ripped off". National Public Radio. https://www.npr.org/2022/11/17/1135615520/student-loan-forgiveness-borrower-defense#:~:text=Cardona%20(formerly%20Sweet%20v.,their%20likely%20salary%20after%20graduation..

- ↑ Stratford, Michael. "Supreme Court rejects bid to block major class-action settlement on student debt relief". Politico. https://www.politico.com/news/2023/04/13/supreme-court-class-action-settlement-student-debt-relief-00091970.

- ↑ "Federal Student Aid at a Glance". https://studentaid.ed.gov/sa/sites/default/files/aid-glance-2018-19.pdf.

- ↑ 46.0 46.1 "Student loan interest rates edge higher and higher". 18 July 2017. https://www.cnbc.com/2017/07/18/student-loan-interest-rates-edge-higher-and-higher.html.

- ↑ vanden Heuvel, Katrina (June 19, 2018). "Americans Are Drowning in Student-Loan Debt. The US Should Forgive All of It". The Nation. https://www.thenation.com/article/americans-drowning-student-loan-debt-us-forgive/.

- ↑ "Creative destruction". The Economist. 28 June 2014. https://www.economist.com/news/leaders/21605906-cost-crisis-changing-labour-markets-and-new-technology-will-turn-old-institution-its.

- ↑ "The digital degree". The Economist. 27 June 2014. https://www.economist.com/news/briefing/21605899-staid-higher-education-business-about-experience-welcome-earthquake-digital.

- ↑ "Bloomberg-Student Debt-July 2014". https://www.bloomberg.com/quicktake/student-debt/.

- ↑ 51.0 51.1 51.2 51.3 51.4 "Student Loan Debt Statistics". American Student Assistance. http://www.asa.org/policy/resources/stats/default.aspx.

- ↑ 52.0 52.1 "Student Loans: Debt for Life". Bloomberg Businessweek. http://www.businessweek.com/articles/2012-09-06/student-loans-debt-for-life.

- ↑ The Institute for College Access and Success http://ticas.org/content/pub/average-debt-2013-grads-tops-30k-6-states-only-1-below-20k-0

- ↑ Federal Reserve Bank of New York http://www.newyorkfed.org/newsevents/news/research/2015/rp150217.html

- ↑ Chuck Collins (March 13, 2015). The Student Debt Time Bomb . Moyers & Company. Retrieved March 23, 2015.

- ↑ Carolyn Thompson (March 27, 2014). $1 trillion student loan debt widens US wealth gap . Associated Press. Retrieved July 7, 2014.

- ↑ Dynarski, Susan (2015-09-10). "New Data Gives Clearer Picture of Student Debt". The New York Times. ISSN 0362-4331. https://www.nytimes.com/2015/09/11/upshot/new-data-gives-clearer-picture-of-student-debt.html.

- ↑ "University of Pittsburgh approves 3.9 percent tuition increase". http://www.post-gazette.com/news/education/2014/07/18/University-of-Pittsburgh-spproves-3-9-percent-tuition-increase/stories/201407180160.

- ↑ Source: US Census Bureau. See charts at Income in the United States.

- ↑ Noguchi, Yuki (February 1, 2019). "Heavy Student Loan Debt Forces Many Millennials To Delay Buying Homes". NPR. https://www.npr.org/2019/02/01/689660957/heavy-student-loan-debt-forces-many-millennials-to-delay-buying-homes.

- ↑ Bursztynsky, Jessica (March 1, 2019). "More people put off home buying, due to student debt: Survey". CNBC. https://www.cnbc.com/2019/03/01/suvery-finds-more-people-put-off-home-buying-due-to-student-debt.html.

- ↑ "Actually, most millennials aren't drowning in college debt". https://www.bostonglobe.com/opinion/2019/09/02/millennials-aren-all-drowning-student-debt/qtSfS05pd68z6VfmTTcyVN/story.html.

- ↑ 63.0 63.1 63.2 Abrams, Natalia (9 July 2012). Occupy Colleges and Occupy Student Debt Join Forces. http://www.thenation.com/blog/168795/occupy-colleges-and-occupy-student-debt-join-forces#. Retrieved 20 February 2013.

- ↑ "Occupy Student Debt". http://occupystudentdebt.com/.

- ↑ Martin, Emmie (8 March 2017). "How one 31-year-old paid off $220,000 in student loans in 3 years". http://www.businessinsider.com/how-ebony-horton-paid-off-220000-worth-of-student-loans-in-3-years-2017-3.

- ↑ Goodman, Amy (2011-11-29). "Occupy Student Debt: Students Urged to Refuse to Pay Off Loans as Schools Hike Tuition". Democracy Now!. http://www.democracynow.org/2011/11/29/occupy_student_debt_students_urged_to.

- ↑ Kristof, Gregory (15 June 2012). "Hansen Clarke's Student Loan Forgiveness Act Finds Big Support Online". Huffington Post. https://www.huffingtonpost.com/2012/06/15/student-loan-forgiveness-act_n_1601271.html/.

- ↑ Hopkins, Katy. "1 Million People Show Support for Student Loan Forgiveness Act". https://www.usnews.com/education/blogs/student-loan-ranger/2013/01/09/meet-the-author-behind-the-student-loan-forgiveness-act-petition/.

- ↑ Park, Minjae. "Fix the Economy, Forgive Student Debt". http://www.washingtonmonthly.com/college_guide/blog/fix_the_economy_forgive_studen.php.

- ↑ 70.0 70.1 Applebaum, Robert. "HR 4170 : The Student Loan Forgiveness Act of 2012". http://hr4170.com/.

- ↑ Goodman, Amy (2012-04-25). "1T Day: As U.S. Student Debt Hits $1 Trillion, Occupy Protests Planned for Campuses Nationwide". Democracy Now!. http://www.democracynow.org/2012/4/25/1_t_day_as_us_student.

- ↑ Hickman, John. "Writing off a Generation". http://likethedew.com/2014/04/20/writing-generation/#.

- ↑ Goodman, Amy (2013-07-03). "Failure to Stop Doubling of Student Loan Rates Sparks Call to Tackle "Systemic" Debt Crisis". Democracy Now!. http://www.democracynow.org/2013/7/3/failure_to_stop_doubling_of_student.

- ↑ David Graeber: ‘There Has Been a War on the Human Imagination’ . Truthdig. Retrieved November 16, 2014.

- ↑ Students across US march over debt, free public college . Al Jazeera America. November 12, 2015.

- ↑ Levitz, Eric (February 9, 2018). "We Must Cancel Everyone's Student Debt, for the Economy's Sake". New York. https://nymag.com/daily/intelligencer/2018/02/lets-cancel-everyones-student-debt-for-the-economys-sake.html.

- ↑ Taylor, Astra. "Elizabeth Warren's plan to end student debt is glorious. We can make it a reality". The Guardian. https://www.theguardian.com/commentisfree/2019/apr/24/elizabeth-warren-student-debt-cancel-grassroots.

- ↑ Nobles, Ryan; Krieg, Gregory (June 23, 2019). "Bernie Sanders to unveil plan to cancel all $1.6 trillion of student loan debt". https://www.cnn.com/2019/06/23/politics/bernie-sanders-student-loan-debt-cancellation/index.html.

- ↑ "Majority of voters support free college, eliminating student debt". The Hill. September 12, 2019. https://thehill.com/hilltv/rising/461106-majority-of-voters-support-free-college-eliminating-student-debt.

- ↑ McDonald, Scott (September 17, 2019). "Army Uses Student Debt Crisis, Not Ongoing Wars, to Meet Recruiting Goals in 2019". Newsweek. https://www.newsweek.com/army-uses-student-debt-crisis-not-ongoing-wars-meet-recruiting-goals-2019-1459843.

- ↑ Davies, Emma; Lea, Stephen E. G. (1995). Student Attitudes to Student Debt Scale. doi:10.1037/t22819-000. http://dx.doi.org/10.1037/t22819-000. Retrieved 2022-04-30.

- ↑ Cooke, Richard; Barkham, Michael; Audin, Kerry; Bradley, Margaret; Davy, John (February 2004). "Student debt and its relation to student mental health". Journal of Further and Higher Education 28 (1): 53–66. doi:10.1080/0309877032000161814. ISSN 0309-877X. http://dx.doi.org/10.1080/0309877032000161814.

- ↑ Pisaniello, Monique Simone; Asahina, Adon Toru; Bacchi, Stephen; Wagner, Morganne; Perry, Seth W; Wong, Ma-Li; Licinio, Julio (July 2019). "Effect of medical student debt on mental health, academic performance and specialty choice: a systematic review". BMJ Open 9 (7): e029980. doi:10.1136/bmjopen-2019-029980. ISSN 2044-6055. PMID 31270123. PMC 6609129. http://dx.doi.org/10.1136/bmjopen-2019-029980.

- ↑ Camp, Emma; Thompson, Danielle (29 July 2022). "Don't Cancel Student Debt". Reason. https://reason.com/video/2022/07/29/dont-cancel-student-debt/?utm_medium=email.

Further reading

- Best, J. and Best, E. (2014). The Student Loan Mess: How Good Intentions Created a Trillion-Dollar Problem. Atkinson Family Foundation.

- Schwarz, Jon (August 25, 2022). "The Origin of Student Debt: Reagan Adviser Warned Free College Would Create a Dangerous "Educated Proletariat"". The Intercept. https://theintercept.com/2022/08/25/student-loans-debt-reagan/.

External links

|