History:Economy of the Qing dynasty

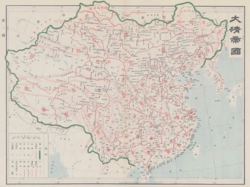

The economy of the Qing dynasty (1636–1912) was a large and varied economy and was the most populated country on Earth for nearly two centuries. The High Qing era saw a period of rapid growth both demographically and economically followed by a near century of stagnation brought about by the unequal treaties, rebellions, floods and a fiscally conservative and decentralised government.

Some scholars have described the period up to the High Qing era as a second commercial revolution, which was even more transformative than the first that occurred during the Song dynasty. By the end of the 18th century what historians sometimes refer to as a "circulation economy" or "commodity economy" developed, in which commercialization penetrated local rural society to an unprecedented degree.[1] During this period the European trend to imitate Chinese artistic traditions, known as chinoiserie gained great popularity in Europe in the 18th century due to the rise in trade with China and the broader current of Orientalism.[2]

Agriculture

Due to the mid-century rebellions there is a distinct lack of data in the latter half of the Late Qing era this has therefore led to a great reliance on estimates of production and a reduction to general trends over specific numbers however the population largely remained close to 400,000,000 throughout the 1800s and early 1900s with a significant decrease during the mid-century era due to rebellions, floods, famines and other issues.[3]

The Qing dynasty controlled a large portion of Asia including areas beyond modern China thus its agriculture was widely varied, general trends however can be identified, namely that Southern China ( generally south of the Yangtze river) produced rice and North of the river produced wheat. Further provincial staples and agricultural patterns are also identifiable, generally Guangxi and Guangdong specialised in double-cropping of rice with Zhejiang, Hunan and Jiangxi producing rice and tea. Jiangsu, Anhui and Hubei in contrast produced both rice and wheat with wheat being grown in the winter, Shandong, Henan and Zhili (Hebei) produced winter wheat and kaoliang Shaanxi and Shanxi in addition to Eastern Gansu and South Ningxia produced winter wheat too alongside millet, Manchuria produced soybeans and kaolinag with Sichuan, Yunnan and Guizhou producing rice. Inner and Outer Mongolia was predominantly pasture land Xinjiang was reliant on oases for agriculture and in Tibet agriculture was predominantly in valleys with the remainder used for pasture.[3]

The peasants themselves engaged in a multitude of activities growing multiple crops of different species as well as engaging in handicraft production, in less arable areas the peasantry adapted by growing most of their own grain in annual crops and legumes in semi-annual crops whilst producing handicraft goods or working as labourers wherever possible to supplement their income and as peace and prosperity continued throughout the 18th century the populace increasingly diversified in roles.[4] In the more arable and productive areas in Northern China families grew multiple crops a year generally one food and one industrial crop such as cotton and mulberry, in Southern China the productive lands often grew 2 food crops one of which was retained the other sold or they followed the North China regime of one food and one industrial. In the far south of China the custom was 3 crops 2 of rice and 1 of wheat or beans.[5]

Generally, the Qing Emperors discouraged the production of non-grain crops believing them to be immoral and simultaneously causing food shortages, though tobacco was not banned the Yongzheng Emperor stated to the Grand Council that its cultivation was harmful, the Emperor even contemplated introducing agricultural supervisory bodies nation-wide to encourage 'correct' agriculture though this plan was never implemente the Emperor did disparage the wasting of grain especially using it to feed livestock.[6]

Agricultural productivity

The Qing intelligentsia recognised the weakness of the Qing methods of agriculture comparing the prosperous agriculture of Europe which fed more people with less land than China with far fewer labourers, this argument in favour of mechanisation and modernised farming techniques. This desire for modernisation was repeated by the officials particularly Zhang Zhidong who noted that China already had issues of food supply and the nation was overpopulated, his solution was chemistry in the form of fertiliser which he theorised would allow China to support 300% its current population over 1,200,000 a figure lower than China's population in the modern era.[7]

Population pressure

Throughout the Qing period there was an immense increase in population this placed an extraordinary pressure upon the land to both provide work and feed the people in 1873-1893 alone the population rose by 8% whilst cultivated land rose only 1% accordingly land plots decreased in size however there was not a corresponding fall in living standards or an increase in poverty simultaneously though they did not improve the entire 1800s was a long period of stagnation for the agricultural sector the ability of the agricultural sector to continue feeding a growing population on the land was due to the shift to more calorie-dense and correspondingly labour-intensive crops rather than any technological, agricultural or institutional reform or improvement.[8] The total food output of major food crops was in excess of 2,000,000,000 piculs or 120,957,964 tonnes an amount capable of providing food for the entire nation.[9] The large labour surplus of China applied for successive centuries if not millennia allowed for a large yield per unit for rice it stood at 2.3 tons/hectare in the 1600s in contrast India in the 1960s only achieved 1.36 tons/hectare and China in the same period had only risen to 2.5 tons/hectare a negligible increase per unit, these impressive units however disguise the fact that the vast majority of the 2.3 tons were the food for the farmers who grew it and little was left for the market this limited excess of food combined with a high demand for labour due to intensive agricultural methods meant that industrialisation was hindered and slowed.[10]

There were signs of demographic strain as the number of marriages and births declined in the early 19th century, additionally many of the inhabitants of the overcrowded regions migrated to other areas of China particularly the upper Yellow and Yangtze regions which exacerbated tensions leading to the White Lotus Rebellion as well as soil depletion, land degradation and flooding as a result of deforestation as the maize planted proved too intense for the local soils to accommodate in the quantity in which they were planted.[11]

Agricultural trade

Tea access to which was a key factor in the Opium wars ceased to be the dominant export crop of China in 1887 being overtaken by silk as both raw and refined silk exports increased throughout the dynasty, China also increasingly exported raw cotton as its domestic yarn industry was outpriced by cheap yarn from the factories of Japan and India which reduced demand for yarn and therefore demand for cotton in China as well as increasing prices for raw cotton internationally which increased its demand abroad. However, the largest growth in cultivation was that of Opium though there is no national data that exists in regards to this growth of cultivation it was recorded that opium imports fell in quantity throughout the Late Qing period.[8] Sir Robert Hart of the Imperial Maritime Customs Service estimated total production to be 334,000 piculs which is over 2,000 tonnes.[12] Edkins also notes that the customs service recorded 12,600 piculs passing Yichang in 1894 and 22,000 in 1897 a considerable increase in only 3 years and 400 piculs less opium is imported annually at the port of Zhenjiang acorrding to the commissioner of the city.[12]

Domestically, the movement of foodstuffs was widespread as the coastal areas, Hubei, Shanxi and Zhili imported food from the rest of China and by the early 1800s the value of the domestic trade of foodstuffs was over 168,000,000 taels annually an amount 3 times that of the grain tax.[13]

Regionalism and Centralisation

Despite the 1700s seeing a large tendency towards national market integration with Jiangnan being the focal point of wealth by the 19th century the tendency swung back towards economic regionalisation, rather than surplus labour being applied to already farmed plots boosting productivity untilled land became cleared and settled especially in the frontier regions and beyond Jiangnan agricultural productivity did not increase.[14] In Northern China cash crop production fell as the growing population raised the demand for food a return to subsistence that reversed previous trends towards a market economy and the urban population largely declined as the rural population boomed the rate of urbanisation reaching 5% half that of the Southern Song dynasty.[15][16]

Jiangnan's chief trade of cloth was soon displaced as Hubei began exchanging its cotton for food from Sichuan leading to a Sichuanese cloth industry undermining Jiangnan, the decline of Jiangnan's ability to export goods also affected its ability in turn to purchase goods from other provinces.[15]

Industry and Trade

The late Qing routinely ran a trade deficit only reversed by the remittances of overseas Chinese and spending of foreigners without which from the entire period 1865-1911 there would be a deficit with a trade deficit in 1905 amounted to almost the entirety of the value of Qing exports this outflow of capital was not conducive or indicative of a developing economy which traditionally rely on the export of goods.[17]

| year | imports | exports | Remittances | Foreign spending | Balance |

|---|---|---|---|---|---|

| 1865 | 55,700,00 | 54,100,00 | 50,000,000 | +48,400,000 | |

| 1875 | 67,800,000 | 68,900,000 | 50,000,000 | +51,100,000 | |

| 1885 | 88,200,000 | 65,000,000 | 50,000,000 | +26,800,000 | |

| 1895 | 171,000,000 | 143,300,000 | 50,000,000 | 30,000,000 | +52,300,000 |

| 1905 | 447,100,000 | 227,900,000 | 50,000,000 | 12,500,000 | -156,700,000 |

| 1911 | 471,500,000 | 377,300,000 | 50,000,000 | 12,500,000 | -31,700,000 |

Banking

Foreign banks

The modern system of banking a key driver in providing capital to modern economic ventures was entirely absent in China prior to 1850 with British banks such as HSBC (and its predecessors) and the Oriental Banking company maintaining a monopoly on modern Chinese banking until the Germans established the Deutsch-Asiatische bank in 1889 the other countries soon followed however the Chinese did not establish their own banks until 1898. The foreign banks however were much more varied in their roles than their role as banks would allow them to be in Europe, they acted as representatives of their governmental treasuries, took deposits of the Chinese maritime customs service and the salt tax used as securities for foreign loans, as well as issuing bank notes despite a lack of permission from the Qing government citing their extraterritorial right to do so being the only reliable banks for decades the foreign banks became extremely wealthy and powerful with over 35,000,000 taels worth of bank notes in circulation with high estimates placing circulation at 300,000,000.[18]

Chinese banks

During the Hundred days reform the Guangxu emperor approved the formation of a government sponsored private bank, this was the Commercial bank of China with 5,000,000 taels. In 1905 it was joined by the Hubu (later Da Qing) bank with 10,000,000 taels and in 1907 the Bank of Communications the number of banks thus proliferated with 59 by 1914 this growing banking industry though not useful to the Qing, they would prove instrumental to the subsequent warlords and the Nanjing government.[19]

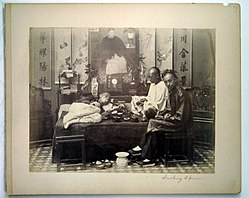

Daoguang Depression

The reign of the Daoguang Emperor (r. 1820–1850) saw a prolonged period of economic depression within the Qing Dynasty, the primary expression of this depression was in steep deflation as prices and wages fell precpitiously. In Hebei agricultural prices fell by 40% from 1820 to 1850 before recovering by 1844 handicraft goods fell by a smaller 30% wages however fell by over 40%. This pattern of deflation was not isolated to Hebei as in Beijing wages fell by 25% from 1823 to 1838 in terms of silver.[20] This steep deflation in terms of silver depressed the entirety of the economy, this has predominantly been explained by the reversal of the silver exchange from a surplus to a deficit brought about by the large-scale importation of opium which resulted in an outflow of nearly 134,000,000 pesos in the reign of Daoguang. This view however has recently been challenged as the Opium trade only accounted for less than half of the exportation of opium and rather that the rising price of silver internationally lead to the outflow of silver and that when silver prices fell in 1857 the exchange once again reversed and silver once again entered the Qing economy despite a larger scale of opium importation.[21]

The bronze coin also suffered severe deflation and given this was a larger component of the rural economy this had the most severe effects as the adulteration and debasement of coins resulted in their falling values with coined silver such as the Peso already prevalent in the south bronze was largely replaced as the medium of exchange within Jiangnan who valued the standardised peso. Additionally, bronze and silver were not exchanged at a fixed rate and thus the demand for exchange varied wildly seasonally and even more so over time with the falling demand for bronze the price of silver relative increased dramatically. In Hebei 2300 bronze coins were required for a tael of silver in 1850 when in 1820 1250 was sufficient simultaneously the prices in Jiangsu rose to 2000 whilst in Zhejiang where silver was predominant the price did not rise above 1700.[22] This difference of exchange at a local level is a key indicator of the different demands and supply of the currencies as the demand for bronze fell much more than the supply of silver did the exchange rate swung markedly towards silver.[23]

Revenue

The administration of taxation

The Qing system of taxation was highly decentralised with the Throne assigning quotas for taxation on a local basis with the county or other government body providing the amount demanded by Beijing and keeping the rest for its own spending, the system of taxation was reliant overwhelmingly on the land and both its qualitative and quantitative value as well as a tax on registered male labourers per household, given the Qing did not register all land exchanges or movement of people this made the system reliant on frequent surveys which were carried out very rarely at a national level and infrequently at a local level leading to revenue struggling to keep pace with the growing expenses.[24] The bulk of tax collection was conducted by the Lijia which consisted of 110 households divided into 11 groups of 10, the Lijia reported directly to the county government, the quotas issued to Beijing would be sent to the provinces who subdivided it per county who then subdivided it per Lijia. Theoretically, this would result in an equal tax burden per household but in reality the Lijia members often negotiated amongst themselves as how to raise the revenue required for the quota to be fulfilled or to discuss a waiving of the taxes due to natural disaster which was a practice the Qing Emperors allowed inline with Confucian political thought.[25]

High Qing

Formal Taxation

The Qing system of government finance was extremely decentralised without any singular budget being published and taxes being allocated ad hoc this precludes any reliable collection of data and leads to discrepancies between sources therefore only estimates can be provided. The government also inline with Confucian political thought at the time did little investment within the economy beyond what was viewed as strictly necessary such as providing for defense and internal order.[26] The Qing practice of largely drawing upon a land-poll tax also limited the amount revenue could be increased as only population growth and clearing/conquering new land could lead to large revenue increases, this can be seen as revenue only increased from 36,100,000 taels in 1725[27] to 43,300,000 taels in 1812 before actually declining to 38,600,000 taels in 1841.[26] In a similar period of time the population increased from less than 200,000,000 to over 400,000,000 yet revenue scarcely increased for the Throne (provincial and local budgets did rise).[26] The principal reason for this stagnation was the fixing of head tax rates by the Kangxi Emperor in 1712 which created a very inelastic revenue system which was very inflexible the Qing government had to devise workarounds to raise revenue, these included the meltage fee (a tax on appraisal of coinage) which was given to the officials as a way to combat corruption by accounting for their lack of pay. The second was making taxpayers pay for the collection costs, the third was the autonomy afforded to officials to set the official exchange rate from copper cash to grain or silver which would be accepted thus allowing for an artificial exchange rate to be set to allow for increased collection.[26]

Kangxi

During the early 1700s the Qing had recovered from the demographic disaster represented in the Ming-Qing transition and expenses rose yet revenue did not as the mobile populace and administrative/financial impediments prevented regular independent surveys as the local communities deliberately underreported their status to avoid taxes, this was remedied by the Kangxi emperor who absorbed the head tax into the poll tax creating a fixed quota of 3,350,000 taels on top of the land tax whilst the amount could be lowered in case of disaster it was expressly stated by Kangxi that it would never be risen.[28]

Yongzheng

However, the reforms of Kangxi did not fix the budget deficit as expenses continued to rise and were accounted for at a local level by a multitude of surcharges levied atop regular taxation despite the illegality of such surcharges per Qing law, the extent of these surcharges varied locally but could amount to up to 80% of the formal tax quota a substantial amount of money these surcharges paid for local administrator salaries and services such as legal and policing services as well as some small-scale infrastructure works such as waterworks.[29][30] This system of informal unregulated taxation naturally led to corruption as administrators would manipulate exchange rates and pocket the surplus or they would levy direct taxes atop the land tax such as the meltage fee this corruption often affected the smaller landholders and tax payers as they lacked the influence and power to challenge corruption which the gentry and larger landholders held.[31][30]

The Yongzheng emperor attempted to reign in corruption and malpractice regarding surcharges by a formalisation of the system where the meltage fee (huohao) depending on local circumstances became a formalised tax atop the land tax from 10 to 30% and was used to pay for the salaries of local officials and therefore prevent excessive surcharges which previously exceeded 30%.[30] However, this did not prevent the additional surcharges as the primary reason for their existence was the absence of central government monitoring which was combatted through targeted auditing in corruption prone areas and the system worked.[32]

Qianlong

By the time of the Qianlong Emperor the rate of surcharges steadily increased once again and senior officials memorialised the throne appealing for the reversal of reforms as the surcharges were once again applied atop the meltage which was applied atop the poll tax which was applied atop the land tax thus leading to an overburdened populace despite these appeals the meltage fee remained in existence and as corruption rose as Qianlong's reign continued the rate of surcharges increased continually to the level that the Yongzheng saw necessary to implement reform.[33] The reason for this continued corruption was the lack of formal oversight as the Qing bureaucracy remained stagnant in numbers despite a doubling of the population of the empire and collection of taxes was not administered by the Bureaucracy but instead was delegated to the local elite. This stagnation persisted from Yongzheng until the Taiping era as land tax beyond minimal changes responding to war or calamity did not change nor did the amount of bureaucrats, no land surveys were conducted and the 1690 tax registers continued in usage, only the commercial and salt taxes saw rising revenue but even these then stagnated by the middle of the 18th century thus in 1835 the Qing government was broadly working with the same revenue it had in 1735.[34]

| Date | Land-poll tax | Grain tribute

(shi)* |

Meltage fee | Salt tax | Tariffs | Misc. | Total(excl. grain) |

|---|---|---|---|---|---|---|---|

| 1685

(Early Kangxi) |

27,270,000 | 4,330,000 | N/A | 2,760,000 | 1,200,000 | 910,000 | 32,140,000 |

| 1725

(Early Yongzheng) |

30,070,000 | 4,730,000 | 4,000,000 | 4,430,000 | 1,350,000 | 990,000 | 40,840,000 |

| 1753

(Early Qianlong) |

29,380,000 | 8,400,000 | 3,000,000

(1766) |

7,010,000 | 4,300,000 | 1,420,000 | 45,110,000 |

| 1812

(Mid Jiaqing) |

29,530,000 | 7,400,000

(1820) |

4,500,000 | 5,790,000 | 4,810,000 | 1,510,000 | 46,140,000 |

| 1841

(Mid Daoguang) |

29,430,000 | 7,400,000

(1820) |

N/A | 7,470,000 | 4,350,000 | N/A | 41,250,000 |

*A shi of grain fluctuated around 2 taels for the entire period within the table

Informal taxation

Entirely separate and alluded to in the previous formal taxation there was a large amount demnaded in informal taxation in the grain and land-poll tax, though little figures exist given the informal nature of these taxes the local governments collected an additional 50-60% demanded in formal taxation when averaged nationally as per the estimates of the provincial government themselves, thus the actual revenue was more akin to 50,000,000 taels annually and that of the grain tax being nearly 20,000,000 Shi.[36]

Late Qing

1850-1894

The effects of the mid-century rebellions and the Opium wars necessitated a large fiscal reform the first of these was the large expansion of customs and the founding of the Imperial Maritime Customs service which in 1854 began to regularly remit the revenue directly to the Throne rather than to the provinces this allowed the government to increase spending rapidly and to combat the mid-century rebellions as its basic fiscal system began to collapse.[26]

The provincial governments under pressure from the Throne to "donate" money to fund suppression of rebellions sought to formalise the surcharges upon taxes (chiefly the grain tax) that the Emperors themselves refused to formalise, in Hunan this was a 130% surcharge 100% of which went to the military and 30% to provincial needs, this measure first approved by Luo Bingzhang was then rapidly applied in Hubei, Jiangxi and Anhui boosting their total revenues by up to 15%. The formalisation was accompanied by the abolition of the informal charges and punitive measures for any further extraction this in Hubei reduced the burden of taxation by 8,000 cash coins per shi of land a marked decrease from the 13,000 per shi. Thus the policies of the Yongzheng emperor were restored a century after their introduction and subsequent repeal.[37] However, unlike the era of Yongzheng these measures were not repaid as memorials to reverse the reforms were vigorously opposed by Liu Kunyi who attacked the opposition and highlighting their own tax dodging the Throne sided with Liu and the measures remained in place as the Throne argued that since the new taxes had been in place for over 10 years and had not caused unrest their permanence was acceptable to the masses.[38]

The second tax create in the period was the Likin which was broadly beyond the control of the Throne as the provinces set, collected and spent the tax almost entirely independently. The Likin itself a response to the mid-century rebellions was created to finance the armies used to crush the rebellions it was an ad valorem internal transit tax with rates set below 10% and most commonly at 2% per tax barrier the tax was further collected at the production of the good and also at its sale point thus a good could be taxed multiple times as it travelled through China this provided over 10,000,000 taels to the Qing as it implementation expanded throughout the nation during the 1850s and 1860s.[39][26][40] The tax was split into 3 parts that which was reported to the Throne which was further subdivided into that which went into the coffers of the Throne (20%) and that which remained with the provincial coffers (80%), the third portion was the unreported portion which was entirely retained by the provincial government.[26]

These new taxes allowed the Qing to suppress the many rebellions and expend the required 70,000,000 taels to do so but even these were not sufficient and a budget deficit of 10,000,000 taels remained the normal amount for the next decade.[17]

The Qing government in the Tongzhi restoration was beset by a series of debates over the existence of Lijin, one of the proponents of the tax described the tax as merely trimming the branches of a tree which are superfluous as opposed to trimming the roots which represented the peasantry which would weaken the whole structure, thus the Lijin was preferred as it would dampen investment in mercantile activities and by extension industry though this was not considered at this point, it would instead drive investment towards agriculture which had a proportionally lower tax burden. The Qing government maintained its fiscally conservative and Malthusian ideology refusing to increase agricultural taxation whilst drawing upon the commercial sector for revenue, this was the opposite of Japan where the government introduced a universal land tax and invested into industry and commerce these policies hindered industrial development.[41]

The Throne itself did institute some fiscal reform largely in the 1870s-1880s as the Hubu sought to directly raise revenues as the nation stabilised following the mid-century calamities these contributed to the overall doubling of the Throne revenue which occurred in the period 1850-1890 these reforms were mostly in the form of the salt tax and miscellaneous taxes and paled in comparison to the Likin and Customs revenue.[26]

However, despite the need for more revenue by the end of the rebellions the Qing government actually reduced taxation in the lower Yangtze region in Zhejiang this amounted to a 20% tax cut equivalent to 800,000 shi for the grain tax, simultaneously the provincial authorities further cut down on informal taxation reducing taxation by a further 860,000 shi and 3,500,000 strings of copper cash, there was no attempt to later bring back these taxes and instead further petitions were made to the throne to reduce taxation even further, the only exception was Sichuan which was historically undertaxed due to the severe destruction of the Ming-Qing transition which severely depopulated the province, the surcharges remained in force in Sichuan as it only brought the taxation levels in line with the rest of China and did not represent an additional burden beyond normal levels of taxation.[42]

The increase in taxes brought about by the Hubu and in local areas was outpaced by growing expenditures as the campaign to retake Xinjiang and other expenses in the province totalled 50,000,000 taels and the Sino-French war a further 30,000,000 taels natural disasters as well as their prevention amounted to another 30,000,000 as well as 19 years of 5,000,000 (45,000,000) being spent on the Imperial navy equivalent to nearly two year's expenditure.[17]

| Tax | Edkins[43](1893) | Fairbank[26](1890-1895 average) | Pao Chao[44]

(1887) |

Zhang[45] |

|---|---|---|---|---|

| Land-poll tax | 23,329,534 | 25,088,000 | 31,184,042 | 23,170,000 |

| Miscellaneous taxes | 1,732,319 | 5,500,000 | 7,780,000 | |

| Rent from state property | 721,504 | N/A | ||

| Grain tax | 4,447,764 | 6,562,000 | 123,600 | 8,400,000 |

| Opium duty | 2,229,000 | |||

| Meltage fee | 3,036,736 | N/A | 3,000,000 | |

| Salt tax | 7,679,829 | 13,659,000 | 12,500,000 | 13,650,000 |

| Native customs | 2,844,375 | 1,000,000 | ||

| Likin | 14,277,304 | 12,952,000

(excl. opium and salt) |

16,548,199 | 12,950,000 |

| Foreign Customs | 16,801,180 | 21,989,000 | 22,990,000 | |

| Title purchases | 4,090,171 | (in miscellaneous) | ||

| Payment of previously

postponed taxation |

2,093,993 | |||

| Surplus caused by troop

disbandment |

2,055,301 | |||

| Grain tax collected in kind | 3,624,532 Shih of rice

52,441,600 catties of hay |

|||

| Grand Total | 83,110,009 | 88,979,000 | 60,355,841 | 91,940,000 |

The revenue according to the existing data is to be assumed to be around 80–90,000,000 taels as the incomplete data of Pao Chao falls short of the others though the indidivdual taxes listed are higher the lack of other taxes makes it difficult to achieve a complete image.

Land Surveys

Following the introduction of the land survey ban in the 1740s no land surveys were conducted in the Qing dynasty until a century later in the 1950s when Hu Linyi ordered the implementation of new surveys to implement the other reform policy of formalising surcharges, this initial reform was slow but as the 1860s and 1870s progressed stability was restored and more provinces carried out renewed surveys. There was no opposition from the throne and what little local opposition remained was overcome by the pressing demand for revenue brought about by rebellion eventually even the frontier regions of Xinjiang, Taiwan and Manchuria carried out surveys and official tillage increased by over 10% from 800,000,000 mu to 910,000,000 but given the local nature and weak Qing bureaucracy it is probable that the actual figure was in excess of this figure.[46]

1894-1911

Following the First Sino-Japanese war the financial burden on the Qing government was increased heavily as not only did it contract loans to pay for the war it additionally had to pay the large indemnity dictated by the Treaty of Shimonoseki, in the period of 1894-1898 the Qing government contracted a total of 350,457,485 taels in loans with varying interest rates (4.5%-7%). These additional expenditures completely set aside the ramshackle balanced budget maintained by the Qing government until this point and the weight of interest payments and loan repayment necessitated a further increase in revenue.[47] Further loans were contracted after the Boxer rebellion not only for the Boxer indemnity but also for other requirements particularly railways, between 1894 and 1911 a total of 746,220,453 taels of loans were arranged 330,500,000 of which was for railway construction and secured by the railways themselves and thus did not represent a burden on the government directly, 25,500,000 was borrowed for industrial purposes namely the Hanyang works, 5,400,000 for telegraphic infrastructure and 640,000 for miscellaneous purposes.[47] These loans and indemnities were almost entirely secured on existing taxes and thus the Hubu was robbed of millions of taels in revenue creating a deficit of nearly 17,000,000 taels.[47]

By 1899 the central government expenditure reached 101,000,000 taels on a revenue of 88,400,000 taels the largest of these expenditures was foreign debt service which amounted to 30% of the revenue and to pay off existing debts further loans were contracted creating a never-ending cycle of debt as the Qing government proved unwilling to raise taxes on agriculture its largest economic sector.[17]

There was an attempt to raise money via public bonds a total of 100,000,000 were offered at 5% interest for a period of 20 years however the merchants and gentry and other potential lenders found the terms extortionate and did not trust the government to pay back the funding and the bonds were suspended after 1,000,000 were sold.[47]

The Qing government managed to pay back nearly 477,000,000 taels in principal and interest before its collapse this was double the entire capitalisation of Qing industrial enterprises both domestic and foreign and was largely financed by an increased tax burden on the common citizen though the initial burden itself was extremely light and there is no direct correlation between increased taxes and the Xinhai revolution despite common depictions of the heavy taxes of the Qing government.[47] Though this still left £139,000,000 (equivalent to over 600,000,000 taels) of debt outstanding which was placed on the shoulders of the equally ineffective Republic of China.[17]

Grain transport

The transportation of grain firstly by the Grand Canal and then by ship was an important part of the Qing system of rule as the grain transported was responsible for not only feeding the Imperial court but also the Bannermen and their families however in 1901 this system was abandoned due to its inherent inefficiency due to its costs as well as causing suffering due to the taxation needed to finance it. The provinces were ordered instead to sell the grain collected for silver and instead ship this at a minimal cost with the surplus being held for the Hubu, this proposal originally made by Feng Guifen decades prior was adopted decades after his death by Feng's account each picul (equivalent to shih) of grain cost 18 taels to transport however in 1901 the transport was mostly done by ship and therefore immensely cheaper at only 80% of a tael per picul/shih meaning total transportation cost per Pao Chao would be just under 2,900,000 taels annually a great saving.[44][48]

Final reforms

In 1901 the weight of the Boxer indemnity finally awakened the Qing Court to its fiscal weakness and the need for reform was unavoidable. Thus for the first time since the 1720s the formal agricultural tax was raised in gradual stages from 1901 to 1911 by 18,000,000 taels a large increase in a virtually stagnant form of taxation amounting to over 50%.[49] However, even this 50% increase left Qing agricultural taxes at less than 1% or even 0.3% as per the Imperial Maritime Customs Service which estimated that even a 1% tax would yield 250,000,000 taels, even when compared to the agricultural India which possessed at that time half the arable land of China the Raj still managed to collect 100,000,000 taels equivalent in taxation.[50]

The largest change however was the replacement of the system of quotas where the government spent only as its revenue allowed it to with a fully comprehensive budget where revenue was expected to catch expenditures flipping the entire foundation of State finances upon its head. The first implementations of the budget were in direct response to the Boxer indemnity as the share of the indemnity was passed to the provinces who were expected to contribute, Hubei raised its agricultural taxes by 30% and instituted a budget to allow for its contribution to be paid off on time this was followed by other provinces, in Zhili for example agricultural taxation doubled. The Central government followed soon after ordering audits and raising taxes universally for a dramatic increase in its budget to over 200,000,000 taels with 80,000,000 coming from the Salt, Lijin and commercial taxes and the rest from agriculture and tariffs. Thus, revenue rose from 90,000,000 in 1894 to 123,000,000 in 1908 to over 200,000,000 in 1911.[51]

See also

- Economic history of China before 1912

- Economy of the Han dynasty

- Economy of the Song dynasty

- Economy of the Ming dynasty

- Criticism of Qing dynasty's economic performance

- Paper money of the Qing dynasty

- Qing dynasty coinage

References

- ↑ Rowe, William (2010), China's Last Empire - The Great Qing, Harvard University Press, p. 123, ISBN 9780674054554

- ↑ Beevers, David (2009). Chinese Whispers: Chinoiserie in Britain, 1650–1930. Brighton: Royal Pavilion & Museums. pp. 19. ISBN 978-0-948723-71-1.

- ↑ 3.0 3.1 Fairbank, John King, ed (1989). The Cambridge history of China. 11: Late Ch'ing 1800 - 1911: Pt. 2 / ed. by John K. Fairbank (Authorized Taiwan ed., 2. print ed.). Taipei, Taiwan: Caves Books. pp. 3–4. ISBN 978-0-521-22029-3.

- ↑ Peterson, Willard J., ed (2002). The Cambridge history of China. vol. 9, pt. 1: The Ch'ing Empire to 1800 / ed. Willard J. Peterson. 9. Cambridge: Cambridge Univ. Pr. pp. 610. ISBN 978-0-521-24334-6.

- ↑ Peterson, Willard J., ed (2002). The Cambridge history of China. vol. 9, pt. 1: The Ch'ing Empire to 1800 / ed. Willard J. Peterson. 9. Cambridge: Cambridge Univ. Pr. pp. 611–612. ISBN 978-0-521-24334-6.

- ↑ Peterson, Willard J., ed (2002). The Cambridge history of China. vol. 9, pt. 1: The Ch'ing Empire to 1800 / ed. Willard J. Peterson. 9. Cambridge: Cambridge Univ. Pr. pp. 606–608. ISBN 978-0-521-24334-6.

- ↑ Zhang, Taisu (2022). The ideological foundations of Qing taxation: belief systems, politics, and institutions. Cambridge, United Kingdom New York, NY: Cambridge University Press. pp. 298. ISBN 978-1-108-99595-5.

- ↑ 8.0 8.1 Fairbank, John King, ed (1989). The Cambridge history of China. 11: Late Ch'ing 1800 - 1911: Pt. 2 / ed. by John K. Fairbank (Authorized Taiwan ed., 2. print ed.). Taipei, Taiwan: Caves Books. pp. 6–9. ISBN 978-0-521-22029-3.

- ↑ Fairbank, John King, ed (1989). The Cambridge history of China. 11: Late Ch'ing 1800 - 1911: Pt. 2 / ed. by John K. Fairbank (Authorized Taiwan ed., 2. print ed.). Taipei, Taiwan: Caves Books. pp. 11. ISBN 978-0-521-22029-3.

- ↑ Fairbank, John King, ed (1989). The Cambridge history of China. 11: Late Ch'ing 1800 - 1911: Pt. 2 / ed. by John K. Fairbank (Authorized Taiwan ed., 2. print ed.). Taipei, Taiwan: Caves Books. pp. 15. ISBN 978-0-521-22029-3.

- ↑ Von Glahn, Richard (2016). The economic history of China: from antiquity to the nineteenth century. Cambridge, United Kingdom New York, USA Port Melbourne, Australia Delhi, India Singapore: Cambridge University Press. pp. 361–363. ISBN 978-1-107-61570-0.

- ↑ 12.0 12.1 Edkins, Joseph (1903). The revenue and taxation of the Chinese empire. Shanghai Presbyterian Mission Press. pp. 162–164.

- ↑ Peterson, Willard J., ed (2002). The Cambridge history of China. vol. 9, pt. 1: The Ch'ing Empire to 1800 / ed. Willard J. Peterson. 9. Cambridge: Cambridge Univ. Pr. pp. 612–613. ISBN 978-0-521-24334-6.

- ↑ Von Glahn, Richard (2016). The economic history of China: from antiquity to the nineteenth century. Cambridge, United Kingdom New York, USA Port Melbourne, Australia Delhi, India Singapore: Cambridge University Press. pp. 372. ISBN 978-1-107-61570-0.

- ↑ 15.0 15.1 Von Glahn, Richard (2016). The economic history of China: from antiquity to the nineteenth century. Cambridge, United Kingdom; New York, USA; Port Melbourne, Australia; Delhi, India; Singapore: Cambridge University Press. ISBN 978-1-107-61570-0.

- ↑ Skinner, William (1977). Regional Urbanization in Nineteenth-Century China. Stanford University Press. pp. 220–245.

- ↑ 17.0 17.1 17.2 17.3 17.4 17.5 Hsü, Immanuel Chung-yueh (2000). The rise of modern China: = Zhong guo jin dai shi (6. ed.). New York: Oxford University Press. pp. 431. ISBN 978-0-19-512504-7.

- ↑ Hsü, Immanuel Chung-yueh (2000). The rise of modern China: = Zhong guo jin dai shi (6. ed.). New York: Oxford University Press. pp. 432–433. ISBN 978-0-19-512504-7.

- ↑ Hsü, Immanuel Chung-yueh (2000). The rise of modern China: = Zhong guo jin dai shi (6. ed.). New York: Oxford University Press. pp. 431–433. ISBN 978-0-19-512504-7.

- ↑ Peng, Kaixing (2006). Qingdai yilaide liangjia: lishixuede jieshi yu zaijieshi. Shanghai: Shanghai renmin chubanshe. pp. 90.

- ↑ Von Glahn, Richard (2016). The economic history of China: from antiquity to the nineteenth century. Cambridge, United Kingdom New York, USA Port Melbourne, Australia Delhi, India Singapore: Cambridge University Press. pp. 365–369. ISBN 978-1-107-61570-0.

- ↑ So, Billy K. L. (16 June 2017). The Economy of Lower Yangzi Delta in Late Imperial China: Connecting Money, Markets, and Institutions. Taylor & Francis. ISBN 978-1-138-10938-4.

- ↑ Von Glahn, Richard (2016). The economic history of China: from antiquity to the nineteenth century. Cambridge, United Kingdom New York, USA Port Melbourne, Australia Delhi, India Singapore: Cambridge University Press. pp. 367–370. ISBN 978-1-107-61570-0.

- ↑ Zhang, Taisu (2022). The ideological foundations of Qing taxation: belief systems, politics, and institutions. Cambridge, United Kingdom New York, NY: Cambridge University Press. pp. 38–40. ISBN 978-1-108-99595-5.

- ↑ Zhang, Taisu (2022). The ideological foundations of Qing taxation: belief systems, politics, and institutions. Cambridge, United Kingdom New York, NY: Cambridge University Press. pp. 40–43. ISBN 978-1-108-99595-5.

- ↑ 26.0 26.1 26.2 26.3 26.4 26.5 26.6 26.7 26.8 Fairbank, John King, ed (1989). The Cambridge history of China. 11: Late Ch'ing 1800 - 1911: Pt. 2 / ed. by John K. Fairbank (Authorized Taiwan ed., 2. print ed.). Taipei, Taiwan: Caves Books. pp. 58–63. ISBN 978-0-521-22029-3.

- ↑ Hsieh, Pao Chao (2019). The Government of China, 1644-1911. Routledge. pp. 201. ISBN 978-1138316706.

- ↑ Zhang, Taisu (2022). The ideological foundations of Qing taxation: belief systems, politics, and institutions. Cambridge, United Kingdom New York, NY: Cambridge University Press. pp. 43–45. ISBN 978-1-108-99595-5.

- ↑ Zhang, Taisu (2022). The ideological foundations of Qing taxation: belief systems, politics, and institutions. Cambridge, United Kingdom New York, NY: Cambridge University Press. pp. 44–46. ISBN 978-1-108-99595-5.

- ↑ 30.0 30.1 30.2 Peterson, Willard J., ed (2002). The Cambridge history of China. vol. 9, pt. 1: The Ch'ing Empire to 1800 / ed. Willard J. Peterson. 9. Cambridge: Cambridge Univ. Pr. pp. 604–606. ISBN 978-0-521-24334-6.

- ↑ Zhang, Taisu (2022). The ideological foundations of Qing taxation: belief systems, politics, and institutions. Cambridge, United Kingdom New York, NY: Cambridge University Press. pp. 46. ISBN 978-1-108-99595-5.

- ↑ Zhang, Taisu (2022). The ideological foundations of Qing taxation: belief systems, politics, and institutions. Cambridge, United Kingdom New York, NY: Cambridge University Press. pp. 46–47. ISBN 978-1-108-99595-5.

- ↑ Zhang, Taisu (2022). The ideological foundations of Qing taxation: belief systems, politics, and institutions. Cambridge, United Kingdom New York, NY: Cambridge University Press. pp. 47–48. ISBN 978-1-108-99595-5.

- ↑ Zhang, Taisu (2022). The ideological foundations of Qing taxation: belief systems, politics, and institutions. Cambridge, United Kingdom New York, NY: Cambridge University Press. pp. 47–49. ISBN 978-1-108-99595-5.

- ↑ Zhang, Taisu (2022). The ideological foundations of Qing taxation: belief systems, politics, and institutions. Cambridge, United Kingdom New York, NY: Cambridge University Press. pp. 49. ISBN 978-1-108-99595-5.

- ↑ Zhang, Taisu (2022). The ideological foundations of Qing taxation: belief systems, politics, and institutions. Cambridge, United Kingdom New York, NY: Cambridge University Press. pp. 51–52. ISBN 978-1-108-99595-5.

- ↑ Zhang, Taisu (2022). The ideological foundations of Qing taxation: belief systems, politics, and institutions. Cambridge, United Kingdom New York, NY: Cambridge University Press. pp. 284–285. ISBN 978-1-108-99595-5.

- ↑ Zhang, Taisu (2022). The ideological foundations of Qing taxation: belief systems, politics, and institutions. Cambridge, United Kingdom New York, NY: Cambridge University Press. pp. 285. ISBN 978-1-108-99595-5.

- ↑ Zhang, Taisu (2022). The ideological foundations of Qing taxation: belief systems, politics, and institutions. Cambridge, United Kingdom New York, NY: Cambridge University Press. pp. 62. ISBN 978-1-108-99595-5.

- ↑ Hsü, Immanuel Chung-yueh (2000). The rise of modern China: = Zhong guo jin dai shi (6. ed.). New York: Oxford University Press. pp. 430. ISBN 978-0-19-512504-7.

- ↑ Zhang, Taisu (2022). The ideological foundations of Qing taxation: belief systems, politics, and institutions. Cambridge, United Kingdom New York, NY: Cambridge University Press. pp. 294–295. ISBN 978-1-108-99595-5.

- ↑ Zhang, Taisu (2022). The ideological foundations of Qing taxation: belief systems, politics, and institutions. Cambridge, United Kingdom New York, NY: Cambridge University Press. pp. 290–292. ISBN 978-1-108-99595-5.

- ↑ Edkins, Joseph (2019). The Revenue And Taxation Of The Chinese Empire. Wentworth Press. pp. 10–11. ISBN 978-1010896821.

- ↑ 44.0 44.1 Hsieh, Pao Chao (2019). The Government of China, 1644-1911. Routledge. pp. 192–198. ISBN 978-1138316706.

- ↑ Zhang, Taisu (2022). The ideological foundations of Qing taxation: belief systems, politics, and institutions. Cambridge, United Kingdom New York, NY: Cambridge University Press. pp. 99. ISBN 978-1-108-99595-5.

- ↑ Zhang, Taisu (2022). The ideological foundations of Qing taxation: belief systems, politics, and institutions. Cambridge, United Kingdom New York, NY: Cambridge University Press. pp. 295–297. ISBN 978-1-108-99595-5.

- ↑ 47.0 47.1 47.2 47.3 47.4 Fairbank, John King, ed (1989). The Cambridge history of China. 11: Late Ch'ing 1800 - 1911: Pt. 2 / ed. by John K. Fairbank (Authorized Taiwan ed., 2. print ed.). Taipei, Taiwan: Caves Books. pp. 63–70. ISBN 978-0-521-22029-3.

- ↑ Edkins, Joseph (1903). The Revenue And Taxation Of The Chinese Empire. Wentworth Press. pp. 148–153. ISBN 978-1010896821.

- ↑ Zhang, Taisu (2022). The ideological foundations of Qing taxation: belief systems, politics, and institutions. Cambridge, United Kingdom New York, NY: Cambridge University Press. pp. 300. ISBN 978-1-108-99595-5.

- ↑ Zhang, Taisu (2022). The ideological foundations of Qing taxation: belief systems, politics, and institutions. Cambridge, United Kingdom New York, NY: Cambridge University Press. pp. 303. ISBN 978-1-108-99595-5.

- ↑ Zhang, Taisu (2022). The ideological foundations of Qing taxation: belief systems, politics, and institutions. Cambridge, United Kingdom New York, NY: Cambridge University Press. pp. 308–310. ISBN 978-1-108-99595-5.

|