Heikin-Ashi (chart)

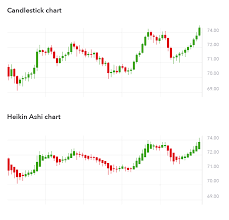

Heikin-Ashi is a Japanese trading indicator that means ‘average pace’.[1] Heikin-Ashi charts have a similar look to candlestick charts, however, they have a more smooth appearance as they are essentially taking an average of the price movements rather than tracking every price movement as with candlesticks. Heikin-Ashi was created in the 1700s by Munehisa Homma [2] who also created the candlestick charts. These charts are used on the stock market to help traders and investors determine and predict price movements based on previous patterns.[3]

Similarly to candlesticks, Heikin-Ashi has a body and a wick on its candles however they do not have the same purpose as on a candlestick chart.[4] the close of a Heikin-Ashi candle is calculated by the average price of the current bar or timeframe, e.g. a daily timeframe would mean that each bar represents the price movements in that specific day. the formula for the close of the bar or candle is calculated by 1/4 * (open + high + low + Close).[5] the open of a Heikin-Ashi starts at the midpoint of the previous candle, it is calculated by the (open of previous bar + the close of the previous bar), divided by 2.[6] the highest and lowest price point is represented by wicks similarly to candlesticks.[1]

The Heikin-Ashi System

The main purpose of a Heikin-Ashi chart is to show the general trend of the price (direction of price) and the strength of each trend,[7] this is represented simply by the wicks or (shadows), these are small lines that stick out from the main body of the candle[8] a series of candles that are going up and have no lower wick signifies a strong uptrend and vice versa with candles going down with no upper wick.[9] a Doji on a heikin-ashi chart signifies that a possible change in the price trend is about to happen.

Heikin-Ashi is used by many traders and is normally paired with other indicators to indicate long(entry) and short(sell) positions.[7]

References

- ↑ 1.0 1.1 Kuepper, Justin. "Heikin-Ashi: A Better Candlestick". https://www.investopedia.com/trading/heikin-ashi-better-candlestick/.

- ↑ "Heikin-Ashi Technique Definition and Example". https://www.investopedia.com/terms/h/heikinashi.asp#:~:text=Heikin%2DAshi%20charts%2C%20developed%20by,used%20to%20create%20each%20candle..

- ↑ "Heikin Ashi Chart Basics". https://www.thebalance.com/heikin-ashi-chart-basics-1031191.

- ↑ "Heikin Ashi Chart Basics". https://www.thebalance.com/heikin-ashi-chart-basics-1031191.

- ↑ Mitchell, Cory. "Heikin-Ashi Technique Definition and Example". https://www.investopedia.com/terms/h/heikinashi.asp.

- ↑ "What Is The Heiken Ashi Indicator And How Do You Use It?". https://admiralmarkets.com/education/articles/forex-indicators/what-is-heiken-ashi-and-how-do-i-use-it.

- ↑ 7.0 7.1 "How to Use a Heikin Ashi Chart". April 19, 2020. https://www.babypips.com/learn/forex/how-to-use-a-heikin-ashi-chart.

- ↑ "How to Use a Heikin Ashi Chart". 20 April 2021. https://www.babypips.com/learn/forex/how-to-use-a-heikin-ashi-chart#:~:text=Because%20the%20Heikin%20Ashi%20candlesticks,)%2C%20the%20stronger%20the%20trend..

- ↑ "Heikin-Ashi [ChartSchool"]. https://school.stockcharts.com/doku.php?id=chart_analysis:heikin_ashi.