Finance:Baumol's cost disease

Baumol's cost disease, also known as the Baumol effect, is the rise of wages in jobs that have experienced little or no increase in labor productivity, in response to rising salaries in other jobs that have experienced higher productivity growth. The phenomenon was described by William J. Baumol and William G. Bowen in the 1960s[1][2] and is an example of cross elasticity of demand.

The rise of wages in jobs without productivity gains derives from the requirement to compete for workers with jobs that have experienced productivity gains and so can naturally pay higher salaries, just as classical economics predicts. For instance, if the retail sector pays its managers 19th-century-style wages, retail managers may decide to quit to get jobs in the automobile sector, where wages are higher because of higher labor productivity. Thus, retail managers' salaries increase not due to labor productivity increases in the retail sector but due to productivity and corresponding wage increases in other industries. These higher labor costs in the retail sector, despite little increase in productivity, are an example of Baumol's cost disease.

Description

Increases in labor productivity tend to result in higher wages.[3][4] Productivity growth is not uniform across the economy, however. Some sectors experience high productivity growth while others experience little or negative productivity growth.[5] Yet wages have tended to rise not only in sectors with high productivity growth but also in those with little to no productivity growth.

The American economists William J. Baumol and William G. Bowen proposed that wages in sectors with stagnant productivity rise out of the need to compete for workers with sectors that experience higher productivity growth, which can afford to raise wages without raising prices. With higher labor costs, but little increase in productivity, sectors with low productivity growth see their costs of production rise. As summarized by Baumol in a 1967 paper:[6]

If productivity per man hour rises cumulatively in one sector relative to its rate of growth elsewhere in the economy, while wages rise commensurately in all areas, then relative costs in the nonprogressive sectors must inevitably rise, and these costs will rise cumulatively and without limit...Thus, the very progress of the technologically progressive sectors inevitably adds to the costs of the technologically unchanging sectors of the economy, unless somehow the labor markets in these areas can be sealed off and wages held absolutely constant, a most unlikely possibility.

Origins

Performing arts

The original study inspiring the concept of Baumol's cost disease was conducted for the performing arts sector.[1] American economists William J. Baumol and William G. Bowen pointed out that the same number of musicians is needed to play a Beethoven string quartet today as was needed in the 19th century—in other words, the productivity of classical music performance has not increased. However, the real wages of musicians have increased substantially since the 19th century.

Early references

The concept was alluded to as early as 1776 by Adam Smith in The Wealth of Nations:[7]

Let us suppose, for example, that in the greater part of employments the productive powers of labour had been improved to tenfold, or that a day's labour could produce ten times the quantity of work which it had done originally; but that in a particular employment they had been improved only to double, or that a day's labour could produce only twice the quantity of work which it had done before. In exchanging the produce of a day's labour in the greater part of employments for that of a day's labour in this particular one, ten times the original quantity of work in them would purchase only twice the original quantity in it. Any particular quantity in it, therefore, a pound weight, for example, would appear to be five times dearer than before. In reality, however, it would be twice as cheap.

Effects

Macroeconomic effects

Price and output

Firms may respond to increases in labor costs induced by the Baumol effect in a variety of ways, including:[8]

- Cost and price disease: Prices in stagnant industries tend to grow faster than average

- Stagnant output: Real output in low-productivity-growth industries tends to grow more slowly relative to the overall economy

- Employment effects: Firms in stagnant industries may reduce employment, decrease hours, or increase non-monetary compensation

A 2008 study by American economist William Nordhaus showed as much, concluding that "Baumol-type diseases" in technologically stagnant sectors have led to "rising relative prices and declining relative real outputs".[8] In the realm of prices, Nordhaus showed that in the United States from 1948–2001 "productivity trends are associated almost percentage-point for percentage-point with price decline". Industries with low productivity growth thus saw their relative prices increase, leading Nordhaus to conclude: "The hypothesis of a cost-price disease due to slow productivity growth is strongly supported by the historical data. Industries with relatively lower productivity growth show a percentage-point for percentage-point higher growth in relative prices." A similar conclusion held for real output: "The real output/stagnation hypothesis is strongly confirmed. Technologically stagnant industries have shown slower growth in real output than have the technologically dynamic ones. A one percentage-point higher productivity growth was associated with a three-quarters percentage-point higher real output growth."

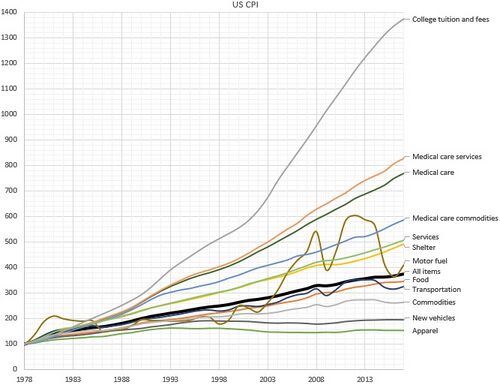

An important implication of Baumol's cost disease is that it should be expected that, in a world with technological progress, the costs of manufactured goods will tend to fall (as productivity in manufacturing continually increases) while the costs of labor-intensive services like education, legal services, and health care (where productivity growth is persistently slow) will tend to rise (see chart).[lower-alpha 1][11]

Affordability

While Baumol's cost disease suggests that costs in low-productivity-growth industries will continually rise, Baumol argues the "stagnant-sector services will never become unaffordable to society. This is because the economy's constantly growing productivity simultaneously increases the community's overall purchasing power."[12] To see this, consider an economy with a real national income of $100 billion with healthcare spending amounting to $20 billion (20%), leaving $80 billion for other purchases. Say that, over 50 years, due to productivity growth real national income doubles to $200 billion (an annual growth rate of about 1.4%). To end up with the same amount of income left over after healthcare spending as 50 years prior, healthcare spending would have to rise by 500%, to $120 billion. In this situation, healthcare would no longer take up 20% of national income but fully 60%. If healthcare costs were to rise to anything less than 60% of national income, there would be more money left over for other purchases (for instance, if healthcare costs were to rise from 20% of national income to 40% of national income, there would be $120 billion left over for other purchases—40% more than 50 years prior). So it can be seen that even if productivity growth were to lead to substantial healthcare cost increases through Baumol's cost disease, the wealth increase brought on by that productivity growth would still leave society able to purchase more goods than before.

Government spending

Baumol's cost disease has major implications for government spending. Since most government spending goes towards services that are subject to the cost disease—law enforcement, education, healthcare etc.—the cost to the government of providing these services will rise as time goes on.[13][14]

Labor force distribution

One implication of the Baumol effect is a shift in the distribution of the labor force from high-productivity industries to low-productivity industries.[6] In other words, the cost disease suggests that the share of the workforce employed in low-productivity industries will rise over time.

The reason for this can be seen through a thought experiment offered by Baumol in his book The Cost Disease:[15]

- Let us assume for simplicity that the share of the economy's total output that comes from the progressive sector [industries with high productivity growth], as measured in physical units rather than money, does not change. Because the economy has only two sectors, progressive and stagnant [industries with low productivity growth], whose production together accounts for all of its output, it follows that the stagnant sector also must maintain a constant share of the total.

- This has significant implications for the distribution of the economy's labor force. By definition, labor productivity grows significantly faster in the progressive sector than in the stagnant sector, so to keep a constant proportion between the two sectors' output, more and more labor has to move from the progressive sector into the stagnant sector.[lower-alpha 2]

As predicted by the Baumol effect, the proportion of the United States labor force employed in stagnant industries has grown substantially since the 1960s. In particular, the United States has morphed from a manufacturing economy into a service economy (see chart).[16] However, how much of this is due to the Baumol effect rather than other causes is disputed.[17][18] In a 2010 study, the economist Talan B. İşcan devised a model from which he concluded that both Baumol and Engel effects played significant roles in the rising share of employment in services in the United States (though he noted that "considerable gaps between the calibrated model and the actual data remain").[19] An older 1968 study by economist Victor Fuchs likewise concluded that the Baumol effect played a major role in the shift to services, although he determined that demand shifts like those proposed in Engel's law played only a minor role.[20] The economists Robert Rowthorn and Ramana Ramaswamy also concluded that relatively faster growth of productivity in manufacturing played a role in the shift to services.[21] The economist Tom Elfring, however, argued in a 1989 paper that the Baumol effect has played a secondary role to growth in demand for services since the 1970s.[22] Alternative theories for the shift to services include demand-side theories (the Baumol effect is broadly a supply-side explanation) like the three-sector model devised by Allan Fisher[23] and Colin Clark[24] in the 1930s, which posit that services satisfy higher needs than goods and so as income grows a higher share of income will be used for the purchase of services;[18] changes in the inter-industry division of labor, favoring specialized service activities;[18] outsourcing to countries with lower labor costs;[25] increasing participation of women in the labor force;[26] and trade specialization.[27]

The Baumol effect has also been used to describe the reallocation of labor out of agriculture (in 1930, 21.5% of the workforce was employed in agriculture and agriculture made up 7.7% of GDP; by 2000, only 1.9% of the workforce was employed in agriculture and agriculture made up only 0.7% of GDP[28]).[29] In a 2009 study, the economists Benjamin N. Dennis and Talan B. İşcan concluded that after the 1950s relatively faster productivity growth in agriculture was the key driver behind the continuing shift in employment from agriculture to non-farm goods (prior to the 1950s, they determined that Engel's law explained almost all labor reallocation out of agriculture).[30]

Economic growth and aggregate productivity

In his original paper on the cost disease, Baumol argued that in the long run the cost disease implies a reduction in aggregate productivity growth and correspondingly a reduction in economic growth.[6] This follows straightforwardly from the labor distribution effects of the cost disease. As a larger and larger share of the workforce moves from high-productivity-growth industries to low-productivity-growth industries, it is natural to expect that the overall rate of productivity growth will slow. Since economic growth is driven in large part by productivity growth, economic growth would also slow.

The economist Nicholas Oulton, however, argued in a 2001 paper that Baumol's cost disease may counterintuitively result in an increase in aggregate productivity growth.[31] This could occur if many services produce intermediate inputs for the manufacturing sector, i.e. if a significant number of services are business services.[lower-alpha 3] In this case, even though the slow-growth service sector is increasing in size, because these services further boost the productivity growth of the shrinking manufacturing sector overall productivity growth may actually increase. Relatedly, the economist Maurizio Pugno described how many stagnant services, like education and healthcare, contribute to human capital formation, which enhances growth and thus "oppos[es] the negative Baumol effect on growth".[32]

The economist Hiroaki Sasaki, however, disputed Oulton's argument in a 2007 paper.[33] Sasaki constructed an economic model that takes into account the use of services as intermediate inputs in high-productivity-growth industries and still concluded that a shift in labor force distribution from higher-productivity-growth manufacturing to lower-productivity-growth services decreases the rate of economic growth in the long run. Likewise, the economists Jochen Hartwig and Hagen Krämer concluded in a 2019 paper that, while Outlon's theory is "logically consistent", it is "not in line with the data", which shows a lowering of aggregate productivity growth.[34]

Education

The Baumol effect has been applied to the education sector,[35][36][37] including by Baumol himself.[38][39] By most measures, productivity growth in the education sector over the last several decades has been low or even negative;[40][41] the average student-teacher ratio in American universities, for instance, was sixteen to one in 2011, just as it was in 1981.[37] Yet, over this period, tuition costs have risen substantially.[42] It has been proposed that this is at least partially explained by the Baumol effect: even though there has been little or even negative productivity growth in the education sector, because of productivity increases across other sectors of the economy universities today would not be able to attract professors with 1980s-level salaries, so they are forced to raise wages to maintain their workforce. To afford the increased labor costs, universities raise tuition (i.e. they increase prices).[43]

Evidence on the role of the Baumol effect in rising education costs has been mixed. Economists Robert B. Archibald and David H. Feldman, both of the College of William & Mary, argued in a 2006 study, for instance, that the Baumol effect is the dominant driver behind increasing higher education costs.[44] Other studies, however, have found a lesser role for the Baumol effect. In a 2014 study, the economists Robert E. Martin and Carter Hill devised a model that determined that the Baumol effect explained only 23%–32% of the rise in higher education costs.[45] The economists Gary Rhoades and Joanna Frye went further in a 2015 study and argued that the Baumol effect could not explain rising tuition costs at all, as "relative academic labor costs have gone down as tuition has gone up".[46] The cost disease may also have only limited effects on primary and secondary education: a 2016 study on per-pupil public education spending by Manabu Nose, an economist at the International Monetary Fund, found that "the contribution of Baumol's effect was much smaller than implied by theory"; Nose argued that it was instead rising wage premiums paid for teachers in excess of market wages that were the dominant reason for increasing costs, particularly in developing countries.[47]

Alternative explanations for rising higher education costs include Bowen's revenue theory of cost,[45][48] reduced public subsidies for education,[49][50] administrative bloat,[49][51] the commercialization of higher education,[52] increased demand for higher education,[53] the easy availability of federal student loans,[54][55] difficulty comparing prices of different universities,[56] technological change,[36] and lack of a central mechanism to control price increases.[50]

Healthcare

The Baumol effect has been applied to the rising cost of healthcare,[39] as the healthcare industry has long had low productivity growth.[57][58] Empirical studies have largely confirmed the large role of Baumol's cost disease in the rising cost of healthcare in the United States,[59][60][61][62][63] although there is some disagreement.[64] Likewise, a 2021 study determined that "Baumol's cost disease ha[s] a significant positive impact on health expenditure growth" in China.[65] However, a paper by economists Bradley Rossen and Akhter Faroque on healthcare costs in Canada found that "the cost disease...is a relatively minor contributor [in the growth of health-care spending in Canada], while technical progress in health care and growth in per capita incomes are by far the biggest contributors".[66]

Despite substantial technological innovation and capital investment, the healthcare industry has struggled to significantly increase productivity. As summarized by the economists Alberto Marino, David Morgan, Luca Lorenzoni, and Chris James:[67]

- "Technological advancements, capital investments and economies of scale do not make for a cumulative rise in output that is on par with progressive sectors of the economy...[A]utomation and better technology generally do not allow for large productivity increases. A health professional is difficult to substitute, in particular by using new technologies, which may actually also bring an increase in volume (e.g. faster diagnostic tests). Increases in volume likely brought about by new technology will also drive up expenditure, since new health professionals will have to be hired to treat everyone. Moreover, new technologies require more specialised training for say [sic] doctors, driving wages up further since more years of experience are required."

Service industry

Baumol's cost disease is often used to describe consequences of the lack of growth in productivity in the quaternary sector of the economy and public services, such as public hospitals and state colleges.[35] Labor-intensive sectors that rely heavily on non-routine human interaction or activities, such as health care, education, or the performing arts, have had less growth in productivity over time. As with the string quartet example, it takes nurses the same amount of time to change a bandage or college professors the same amount of time to mark an essay today as it did in 1966, as those types of activities rely on the movements of the human body, which cannot yet be engineered to perform more quickly, accurately, or efficiently in the same way that a machine, such as a computer, have.[68] In contrast, goods-producing industries, such as the car manufacturing sector and other activities that involve routine tasks, workers are continually becoming more productive by technological innovations to their tools and equipment.

The reported productivity gains of the service industry in the late 1990s are largely attributable to total factor productivity.[69] Providers decreased the cost of ancillary labor through outsourcing or technology. Examples include offshoring data entry and bookkeeping for health care providers and replacing manually-marked essays in educational assessment with multiple choice tests that can be automatically marked.

Technical description

In the 1967 paper Macroeconomics of Unbalanced Growth: The Anatomy of Urban Crisis, Baumol introduced a simple two-sector model to demonstrate the cost disease.[6] To do so, he imagined an economy consisting of only two sectors: sector one, which has constant productivity (that is, the number of goods workers can produce per man hour does not change as time goes on), and sector two, which sees productivity grow at a constant compounded rate (that is, the number of goods workers can produce per man hour grows at a rate , where is time). To simplify, he assumed that the quantity of goods produced by these two sectors (the "output" of each of the two sectors) is directly proportional to the quantity of labor employed (that is, doubling the number of workers doubles the output, tripling the number of workers triples the output, and so on) and that output depends only upon labor productivity and the quantity of labor. Since there is no increase in labor productivity in sector one, the output of sector one at time (denoted ) is:

where is the quantity of labor employed in sector one and is a constant that can be thought of as the amount of output each worker can produce at time . This equation simply says that the amount of output sector one produces equals the number of workers in sector one multiplied by the number of goods each worker can produce. Since productivity does not increase, the number of goods each worker produces remains and output remains constant through time.

Since the labor productivity of sector two increases at a constant compounded rate , the output of sector two at time (denoted ) is:

where is the quantity of labor employed in sector two and is a constant that can be thought of as the amount of output each worker can produce at time . Since productivity grows at a constant compounded rate , the number of goods each worker produces at time equals , and the output of sector two grows at a rate proportional to productivity growth.

To more clearly demonstrate how wages and costs change through time, wages in both sectors are originally set at the same value . It is then assumed that wages rise in direct proportion to productivity (i.e., a doubling of productivity results in a doubling of wages, a tripling of productivity results in a tripling of wages, and so on). This means that the wages of the two sectors at time determined solely by productivity are:

- (since productivity remains unchanged), and

- (since productivity increases at a rate )

These values, however, assume that workers do not move between the two sectors. If workers are equally capable of working in either sector, and they choose which sector to work in based upon which offers a higher wage, then they will always choose to work in the sector that offers the higher wage. This means that if sector one were to keep wages fixed at , then as wages in sector two grow with productivity workers in sector one would quit and seek jobs in sector two. Firms in sector one are thus forced to raise wages to attract workers. More precisely, in this model the only way firms in either sector can attract workers is to offer the same wage as firms in the other sector—if one sector were to offer lower wages, then all workers would work in the other sector.

So to maintain their workforces, wages in the two sectors must equal each other: . And since it is sector two that sees its wage naturally rise with productivity, while sector one's does not naturally rise, it must be the case that:

- .

This typifies the labor aspect of the Baumol effect: as productivity growth in one sector of the economy drives up that sector's wages, firms in sectors without productivity growth must also raise wages to compete for workers.[lower-alpha 4]

From this simple model, the consequences on the costs per unit output in the two sectors can be derived. Since the only factor of production within this model is labor, each sector's total cost is the wage paid to workers multiplied by the total number of workers. The cost per unit output is the total cost divided by the amount of output, so with representing the unit cost of goods in sector one at time and representing the unit cost of goods in sector two at time :

Plugging in the values for and from above:

It can be seen that in the sector with growing labor productivity (sector two), the cost per unit output is constant since both wages and output rise at the same rate. However, in the sector with stagnant labor productivity (sector one), the cost per unit output rises exponentially since wages rise exponentially faster than output.

This demonstrates the cost aspect of the Baumol effect (the "cost disease"). While costs in sectors with productivity growth—and hence wage growth—need not increase, in sectors with little to no productivity growth (who nonetheless must raise wages to compete for workers) costs necessarily rise. Furthermore, if the productivity growth differential persists (that is, the low-productivity-growth sectors continue to see low productivity growth into the future while high-productivity-growth sectors continue to see high productivity growth), then costs in low-productivity-growth sectors will rise cumulatively and without limit.

Baumol's model can also be used to demonstrate the effect of the cost disease on the distribution of labor. Assume that, despite the change in the relative costs and prices of the two industries, the magnitude of the relative outputs of the two sectors are maintained. A situation similar to this could occur, for instance, "with the aid of government subsidy, or if demand for the product in question were sufficiently price inelastic or income elastic". The output ratio and its relation to the labor ratio, ignoring constants and , is then given by:

Letting (i.e. is the total labor supply), it follows that:

- or

It can be seen that as approaches infinity, the quantity of labor in the non-progressive sector approaches the total labor supply while the quantity of labor in the progressive sector approaches zero. Hence, "if the ratio of the outputs of the two sectors is held constant, more and more of the total labor force must be transferred to the non-progressive sector and the amount of labor in the other sector will tend to approach zero".

See also

Notes

- ↑ Note that low productivity growth does not afflict all services. Telecommunications, for example, has seen substantial productivity growth.[9] Service industries are simply more likely than manufactured goods industries to be immune to productivity growth, for the reasons that they are often less able to be standardized and that the quality of services are more likely to be closely linked to the amount of labor provided.[10]

- ↑ A technical description of this effect can be found in Technical description

- ↑ In the two-sector model Baumol devised in his original paper (see Technical description), services are produced only for final consumption.

- ↑ Note that this is an assumption of the model. As Baumol states in the original paper, "We suppose wages are equal in the two sectors and are fixed at dollars per unit of labor, where itself grows in accord with the productivity of sector 2, our 'progressive' sector." The preceding two paragraphs simply demonstrate the logic of that assumption.

References

- ↑ 1.0 1.1 Baumol, W. J.; Bowen, W. G. (March 1965). "On the Performing Arts: The Anatomy of Their Economic Problems". The American Economic Review 55 (1/2): 495–502. http://pages.stern.nyu.edu/~wbaumol/OnThePerformingArtsTheAnatomyOfTheirEcoProbs.pdf.

- ↑ Baumol, William J.; Bowen, William G. (1966). Performing Arts, The Economic Dilemma: A Study of Problems Common to Theater, Opera, Music, and Dance. Cambridge, Mass.: M.I.T. Press. ISBN 0262520117. https://archivesofthecentury.org/myportfolio/performing-arts-the-economic-dilemma/.

- ↑ Anderson, Richard G. (2007). "How Well Do Wages Follow Productivity Growth?". https://files.stlouisfed.org/files/htdocs/publications/es/07/ES0707.pdf.

- ↑ Feldstein, Martin (July 2008). "Did wages reflect growth in productivity?". Journal of Policy Modeling 30 (4): 591–594. doi:10.1016/j.jpolmod.2008.04.003. https://www.nber.org/system/files/working_papers/w13953/w13953.pdf.

- ↑ Baily, Martin Neil; Bosworth, Barry; Doshi, Siddhi (January 2020). "Productivity comparisons: Lessons from Japan, the United States, and Germany". p. 14. https://www.brookings.edu/wp-content/uploads/2020/01/ES-1.30.20-BailyBosworthDoshi.pdf.

- ↑ 6.0 6.1 6.2 6.3 Baumol, William J. (June 1967). "Macroeconomics of Unbalanced Growth: The Anatomy of Urban Crisis". The American Economic Review 57 (3): 415–426. http://piketty.pse.ens.fr/files/Baumol1967.pdf.

- ↑ "An Inquiry into the Nature and Causes of the Wealth of Nations, by Adam Smith". https://www.gutenberg.org/files/3300/3300-h/3300-h.htm#chap10.

- ↑ 8.0 8.1 Norhaus, William D. (February 2008). "Baumol's Diseases: A Macroeconomic Perspective". The B.E. Journal of Macroeconomics 8 (1). doi:10.2202/1935-1690.1382. https://www.nber.org/system/files/working_papers/w12218/w12218.pdf.

- ↑ Modica, Nathan F.; Chansky, Brian (May 2019). "Productivity trends in the wired and wireless telecommunications industries". https://www.bls.gov/opub/btn/volume-8/pdf/productivity-trends-in-the-wired-and-wireless-telecommunications-industries.pdf.

- ↑ Baumol, William J. (2012) (in English). The Cost Disease: Why Computers Get Cheaper and Health Care Doesn't. New Haven: Yale University Press. pp. 22–24. ISBN 978-0300198157. https://yalebooks.yale.edu/book/9780300198157/cost-disease.

- ↑ Lee, Timothy B. (May 4, 2017). "William Baumol, whose famous economic theory explains the modern world, has died". https://www.vox.com/new-money/2017/5/4/15547364/baumol-cost-disease-explained.

- ↑ Baumol, William J. (2012) (in English). The Cost Disease: Why Computers Get Cheaper and Health Care Doesn't. New Haven: Yale University Press. pp. xx. ISBN 978-0300198157. https://yalebooks.yale.edu/book/9780300198157/cost-disease.

- ↑ Baumol, William J. (2012) (in English). The Cost Disease: Why Computers Get Cheaper and Health Care Doesn't. New Haven: Yale University Press. pp. 27. ISBN 978-0300198157. https://yalebooks.yale.edu/book/9780300198157/cost-disease.

- ↑ Baumol, William J. (September 1993). "Health care, education and the cost disease: A looming crisis for public choice". Public Choice 77 (1): 17–28. doi:10.1007/978-94-017-3402-8_3. ISBN 978-94-017-3404-2. https://link.springer.com/chapter/10.1007/978-94-017-3402-8_3.

- ↑ Baumol, William J. (2012) (in English). The Cost Disease: Why Computers Get Cheaper and Health Care Doesn't. New Haven: Yale University Press. pp. 80. ISBN 978-0300198157. https://yalebooks.yale.edu/book/9780300198157/cost-disease.

- ↑ Short, Doug (September 5, 2011). "Charting The Incredible Shift From Manufacturing To Services In America". https://www.businessinsider.com/charting-the-incredible-shift-from-manufacturing-to-services-in-america-2011-9.

- ↑ Urquhart, Michael (April 1984). "The employment shift to services: where did it come from?". Monthly Labor Review 107 (4): 15–22. https://stats.bls.gov/opub/mlr/1984/04/art2full.pdf. "Suggested explanations for the faster growth of services employment include changes in the demand for goods and services as a result of rising incomes and relative price movements, slower productivity growth in services, the increasing participation of women in the labor force since World War II, and the growing importance of the public and nonprofit sector in general. But no consensus exists on the relative importance of the above factors in developing an adequate explanation of the sectoral shifts in employment.".

- ↑ 18.0 18.1 18.2 Schettkat, Ronald; Yocarini, Lara (January 13, 2004). The Shift to Services: A Review of the Literature. doi:10.2139/ssrn.487282. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=487282. Retrieved March 26, 2022.

- ↑ İşcan, Talan B. (January 2010). "How Much Can Engel's Law and Baumol's Disease Explain the Rise of Service Employment in the United States?". The B.E. Journal of Macroeconomics 10 (1): 1–43. doi:10.2202/1935-1690.2001. https://www.degruyter.com/document/doi/10.2202/1935-1690.2001/html.

- ↑ Fuchs, Victor (1968). The Service Economy. National Bureau of Economic Research. ISBN 978-0870144769.

- ↑ Rowthorn, Robert; Ramaswamy, Ramana (1999). "Growth, Trade, and Deindustrialization". IMF Staff Papers 46 (1): 18–41. https://www.imf.org/external/pubs/ft/wp/wp9860.pdf.

- ↑ Elfring, Tom (1989). "The Main Features and Underlying Causes of the Shift to Services". The Service Industries Journal 9 (3): 337–356. doi:10.1080/02642068900000040. https://www.tandfonline.com/doi/abs/10.1080/02642068900000040.

- ↑ Fisher, Allan G.B. (1935). The Clash of Progress and Security. Macmillan Publishers. ISBN 9780678001585.

- ↑ Clark, Colin (1940). The Conditions of Economic Progress. Macmillan Publishers. ISBN 9780598475732.

- ↑ Scharpf, F. W. (1990). "Structures of Postindustrial Society or Does Mass Unemployment Disappear in the Service and Information Economy". in Appelbaum, E.. Labor Market Adjustments to Structural Change and Technological Progress. New York: Praeger Publishers. pp. 17–36. ISBN 978-0-275-93376-0.

- ↑ Urquhart, Michael (April 1984). "The employment shift to services: where did it come from?". Monthly Labor Review 107 (4): 15–22. https://stats.bls.gov/opub/mlr/1984/04/art2full.pdf.

- ↑ Rowthorn, R. E.; Wells, J.R. (1987). De-Industrialization and Foreign Trade. Cambridge University Press. ISBN 978-0521269476.

- ↑ Dimitri, Carolyn; Effland, Anne; Conklin, Neilson (June 2005). "The 20th Century Transformation of U.S. Agriculture and Farm Policy". https://www.ers.usda.gov/webdocs/publications/44197/13566_eib3_1_.pdf.

- ↑ Baumol, William J. (2012) (in English). The Cost Disease: Why Computers Get Cheaper and Health Care Doesn't. New Haven: Yale University Press. pp. 117–119. ISBN 978-0300198157. https://yalebooks.yale.edu/book/9780300198157/cost-disease.

- ↑ Dennis, Benjamin N.; İşcan, Talan B. (April 2009). "Engel versus Baumol: Accounting for structural change using two centuries of U.S. data". Explorations in Economic History 46 (2): 186–202. doi:10.1016/j.eeh.2008.11.003. https://www.sciencedirect.com/science/article/pii/S0014498308000429.

- ↑ Oulton, Nicholas (October 2001). "Must the growth rate decline? Baumol's unbalanced growth revisited". Oxford Economic Papers 53 (4): 605–627. doi:10.1093/oep/53.4.605. https://academic.oup.com/oep/article-abstract/53/4/605/2361814.

- ↑ Pugno, Maurizio (January 2006). "The service paradox and endogenous economic growth". Structural Change and Economic Dynamics 17 (1): 99–115. doi:10.1016/j.strueco.2005.02.003. https://www.sciencedirect.com/science/article/pii/S0954349X05000263.

- ↑ Sasaki, Hiroaki (December 2007). "The rise of service employment and its impact on aggregate productivity growth". Structural Change and Economic Dynamics 18 (4): 438–459. doi:10.1016/j.strueco.2007.06.003. https://www.sciencedirect.com/science/article/abs/pii/S0954349X07000318.

- ↑ Hartwig, Jochen; Krämer, Hagen (December 2019). "The 'Growth Disease' at 50 – Baumol after Oulton". Structural Change and Economic Dynamics 51: 463–471. doi:10.1016/j.strueco.2019.02.006. https://www.sciencedirect.com/science/article/pii/S0954349X18301322.

- ↑ 35.0 35.1 Helland, Eric; Alexander Tabarrok (2019). "Why Are the Prices So Damn High? Health, Education, and the Baumol Effect". Mercatus Center. https://www.mercatus.org/system/files/helland-tabarrok_why-are-the-prices-so-damn-high_v1.pdf.

- ↑ 36.0 36.1 Archibald, Robert B.; Feldman, David H. (2014) (in English). Why Does College Cost So Much?. Oxford University Press. ISBN 978-0190214104.

- ↑ 37.0 37.1 Surowiecki, James (November 13, 2011). "Debt by Degrees". The New Yorker. http://www.newyorker.com/talk/financial/2011/11/21/111121ta_talk_surowiecki.

- ↑ Baumol, William J. (June 1967). "Macroeconomics of Unbalanced Growth: The Anatomy of Urban Crisis". The American Economic Review 57 (3): 415–426. http://piketty.pse.ens.fr/files/Baumol1967.pdf. "The relatively constant productivity of college teaching…suggests that, as productivity in the remainder of the economy continues to increase, costs of running the educational organizations will mount correspondingly, so that whatever the magnitude of the funds they need today, we can be reasonably certain that they will require more tomorrow, and even more on the day after that.".

- ↑ 39.0 39.1 Baumol, William J. (2012) (in English). The Cost Disease: Why Computers Get Cheaper and Health Care Doesn't. New Haven: Yale University Press. pp. 3–32. ISBN 978-0300198157. https://yalebooks.yale.edu/book/9780300198157/cost-disease.

- ↑ "Labor Productivity and Costs: Elementary and Secondary Schools". February 23, 2018. https://www.bls.gov/lpc/education.htm.

- ↑ Garrett, Thomas A; Poole, William (January 1, 2006). "Stop Paying More for Less: Ways to Boost Productivity in Higher Education". https://www.stlouisfed.org/publications/regional-economist/january-2006/stop-paying-more-for-less-ways-to-boost-productivity-in-higher-education.

- ↑ Carnevale, Anthony P.; Gulish, Artem; Campbell, Kathryn Peltier (2021). "If Not Now, When? The Urgent Need for an All-One-System Approach to Youth Policy". Georgetown University. p. 13. https://1gyhoq479ufd3yna29x7ubjn-wpengine.netdna-ssl.com/wp-content/uploads/cew-all_one_system-fr.pdf.

- ↑ Bundick, Brent; Pollard, Emily (2019). "The Rise and Fall of College Tuition Inflation". https://www.kansascityfed.org/documents/461/2019-The%20Rise%20and%20Fall%20of%20College%20Tuition%20Inflation.pdf.

- ↑ Archibald, Robert B.; Feldman, David H. (October 21, 2016). "Explaining Increases in Higher Education Costs". The Journal of Higher Education 79 (3): 268–295. doi:10.1080/00221546.2008.11772099. https://economics.wm.edu/wp/cwm_wp42.pdf.

- ↑ 45.0 45.1 Martin, Robert E.; Hill, R. Carter (March 2014). Baumol and Bowen Cost Effects in Research Universities. doi:10.2139/ssrn.2153122. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2153122.

- ↑ Rhoades, Gary; Frye, Joanna (April 2015). "College tuition increases and faculty labor costs: A counterintuitive disconnect". https://old.coe.arizona.edu/sites/default/files/rhoadesfryefacultylabortuitionincreases.pdf.

- ↑ Nose, Manabu (July 9, 2016). "Estimation of drivers of public education expenditure: Baumol's effect revisited". International Tax and Public Finance 24 (3): 512–535. doi:10.1007/s10797-016-9410-7. https://link.springer.com/article/10.1007/s10797-016-9410-7.

- ↑ Matthews, Dylan (September 2, 2013). "The Tuition is Too Damn High, Part VI — Why there's no reason for big universities to rein in spending". The Washington Post. https://www.washingtonpost.com/news/wonk/wp/2013/09/02/the-tuition-is-too-damn-high-part-vi-why-theres-no-reason-for-big-universities-to-rein-in-spending/.

- ↑ 49.0 49.1 Martin, Robert (2002). "Why Tuition Costs Are Rising So Quickly". Challenge 45 (2): 88–108. doi:10.1080/05775132.2002.11034164. https://www.tandfonline.com/doi/abs/10.1080/05775132.2002.11034164.

- ↑ 50.0 50.1 Ripley, Amanda (September 11, 2018). "Why Is College in America So Expensive?". https://www.theatlantic.com/education/archive/2018/09/why-is-college-so-expensive-in-america/569884/.

- ↑ Johnson, J. David (2020). "Administrative Bloat in Higher Education". https://www.cambridgescholars.com/resources/pdfs/978-1-5275-5358-3-sample.pdf.

- ↑ Renehan, Stewart (August 2015). "Rising Tuition in Higher Education: Should we be Concerned?". Visions for the Liberal Arts 1 (1). https://core.ac.uk/reader/129490130.

- ↑ Hoffower, Hillary (June 26, 2019). "College is more expensive than it's ever been, and the 5 reasons why suggest it's only going to get worse". https://www.businessinsider.com/why-is-college-so-expensive-2018-4.

- ↑ Bennet, William J. (February 18, 1987). "Our Greedy Colleges". https://www.nytimes.com/1987/02/18/opinion/our-greedy-colleges.html.

- ↑ Robinson, Jenna A. (December 2017). "The Bennett Hypothesis Turns 30". https://www.jamesgmartin.center/wp-content/uploads/2017/12/Bennett_Hypothesis_Paper_Final-1.pdf.

- ↑ Akers, Beth (August 27, 2020). "A New Approach for Curbing College Tuition Inflation". https://www.manhattan-institute.org/new-approach-curbing-college-tuition-inflation.

- ↑ Sheiner, Louise; Malinovskaya, Anna (May 2016). "Measuring Productivity in Healthcare: An Analysis of the Literature". https://www.brookings.edu/wp-content/uploads/2016/08/hp-lit-review_final.pdf.

- ↑ "Labor Productivity and Costs: Private Community Hospitals". June 11, 2021. https://www.bls.gov/lpc/hospitals_2013.htm.

- ↑ Colombier, Carsten (November 2017). "Drivers of Health-Care Expenditure: What Role Does Baumol's Cost Disease Play?". Social Science Quarterly 98 (5): 1603–1621. doi:10.1111/ssqu.12384. https://onlinelibrary.wiley.com/doi/abs/10.1111/ssqu.12384.

- ↑ Hartwig, Jochen (May 2008). "What drives health care expenditure?—Baumol's model of 'unbalanced growth' revisited". Journal of Health Economics 27 (3): 603–623. doi:10.2139/ssrn.910879. PMID 18164773. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=910879.

- ↑ Hartwig, Jochen (April 2009). "Can Baumol's model of unbalanced growth contribute to explaining the secular rise in health care expenditure? An alternative test". Applied Economics 43 (2): 173–184. doi:10.1080/00036840802400470. https://www.tandfonline.com/doi/abs/10.1080/00036840802400470.

- ↑ Bates, Laurie J.; Santerre, Rexford E. (March 2013). "Does the U.S. health care sector suffer from Baumol's cost disease? Evidence from the 50 states". Journal of Health Economics 32 (2): 386–391. doi:10.1016/j.jhealeco.2012.12.003. PMID 23348051. https://www.sciencedirect.com/science/article/pii/S0167629612001877.

- ↑ Pomp, Marc; Vujić, Sunčica (December 2008). "Rising health spending, new medical technology and the Baumol effect". https://www.cpb.nl/sites/default/files/publicaties/download/rising-health-spending-new-medical-technology-and-baumol-effect.pdf.

- ↑ Atanda, Akinwande; Menclova, Andrea Kutinova; Reed, W. Robert (February 2018). "Is health care infected by Baumol's cost disease? Test of a new model". Health Economics 27 (5): 832–849. doi:10.1002/hec.3641. PMID 29423941. https://onlinelibrary.wiley.com/doi/abs/10.1002/hec.3641.

- ↑ Wang, Linan; Chen, Yuqian (2021). "Determinants of China's health expenditure growth: based on Baumol's cost disease theory". International Journal for Equity in Health 20 (1): 213. doi:10.1186/s12939-021-01550-y. PMID 34565389.

- ↑ Rossen, Bradley; Faroque, Akhter (Spring 2016). "Diagnosing the Causes of Rising Health-Care Expenditure in Canada: Does Baumol's Cost Disease Loom Large?". American Journal of Health Economics 2 (2): 184–212. doi:10.1162/AJHE_a_00041. https://www.journals.uchicago.edu/doi/abs/10.1162/AJHE_a_00041.

- ↑ Marino, Alberto; Morgan, David; Lorenzoni, Luca; James, Chris (June 2017). "Future trends in health care expenditure: A modelling framework for cross-country forecasts". OECD Health Working Papers 95. doi:10.1787/247995bb-en. https://www.oecd-ilibrary.org/social-issues-migration-health/future-trends-in-health-care-expenditure_247995bb-en.

- ↑ Surowiecki, James (July 7, 2003). "What Ails Us". The New Yorker. https://www.newyorker.com/magazine/2003/07/07/what-ails-us.

- ↑ Bosworth, Barry P; Jack E Triplett (September 1, 2003). "Productivity Measurement Issues in Services Industries: "Baumol's Disease" Has been Cured". Brookings Institution. http://www.brookings.edu/research/articles/2003/09/01business-bosworth.

External links

- Charles Hugh Smith (December 11, 2010). "America's Economic Malady: A Bad Case of 'Baumol's Disease'". DailyFinance.com. http://www.dailyfinance.com/story/taxes/americas-economic-illness-baumols-dis/19752285/?source=patrick.net#articleHeader.

- Sparviero, Sergio; Preston, Paschal (December 1, 2010). "Creativity and the Positive Reading of Baumol Cost Disease". The Service Industries Journal 30 (12): 1903–1917. doi:10.1080/02642060802627541. http://www.ssrn.com/abstract=1531602.

- Preston, Paschal; Sparviero, Sergio (December 30, 2009). "Creative Inputs as the Cause of Baumol's Cost Disease: The Example of Media Services.". Journal of Media Economics 22 (4): 239–252. doi:10.1080/08997760903375910. http://www.ssrn.com/abstract=1531555.