Finance:Economic and monetary union

| Part of a series on |

| World trade |

|---|

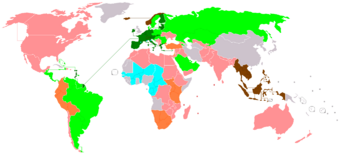

An economic and monetary union (EMU) is a type of trade bloc that features a combination of a common market, customs union, and monetary union. Established via a trade pact, an EMU constitutes the sixth of seven stages in the process of economic integration. An EMU agreement usually combines a customs union with a common market. A typical EMU establishes free trade and a common external tariff throughout its jurisdiction. It is also designed to protect freedom in the movement of goods, services, and people. This arrangement is distinct from a monetary union (e.g., the Latin Monetary Union), which does not usually involve a common market. As with the economic and monetary union established among the 27 member states of the European Union (EU), an EMU may affect different parts of its jurisdiction in different ways. Some areas are subject to separate customs regulations from other areas subject to the EMU. These various arrangements may be established in a formal agreement, or they may exist on a de facto basis. For example, not all EU member states use the Euro established by its currency union, and not all EU member states are part of the Schengen Area. Some EU members participate in both unions, and some in neither.

Territories of the United States, Australian External Territories and New Zealand territories each share a currency and, for the most part, the market of their respective mainland states. However, they are generally not part of the same customs territories.

History

Several countries initially attempted to form an EMU at the Hague Summit in 1969. Afterward, a "draft plan" was announced. During this time, the main member presiding over this decision was Pierre Werner, Prime Minister of Luxembourg.[1] The decision to form the Economic and Monetary Union of the European Union (EMU) was accepted in December 1991, which later became part of the Maastricht Treaty (the Treaty on European Union).[2]

Processes in the European EMU

The EMU involves four main activities.[3]

The first responsibility is to be in charge of implementing effective monetary policy for the euro area with price stability. There is a group of economists whose only role is studying how to improve the monetary policy while maintaining price stability. They conduct research, and their results are presented to the leaders of the EMU. Thereafter, the role of the leaders is to find a suitable way to implement the economists' work into their country's policies. Maintaining price stability is a long-term goal for all states in the EU, due to the effects it might have on the Euro as a currency.

Secondly, the EMU must coordinate economic and fiscal policies in EU countries. They must find an equilibrium between the implementation of monetary and fiscal policies. They will advise countries to have greater coordination, even if that means having countries tightly coupled with looser monetary and tighter fiscal policy. Not coordinating the monetary market could result in risking an unpredictable situation. The EMU also deliberates on a mixed policy option, which has been shown to be beneficial in some empirical studies.[4]

Thirdly, the EMU ensures that the single market runs smoothly. The member countries respect the decisions made by the EMU and ensure that their actions will be in favor of a stable market.[5]

Finally, regulations of the EMU aid in supervising and monitoring financial institutions. There is an imperative need for all members of the EMU to act in unison. Therefore, the EMU has to have institutions supervising all the member states to protect the main aim of the EMU.

Roles of national governments

The economic roles of nations within the EMU are to:

- control fiscal policy that concerns government budgets

- control tax policies that determine how income is raised

- control structural policies that determine pension systems, labor, and capital-market regulations

List of economic and monetary unions

- Economic and Monetary Union of the European Union (EMU) (1999/2002) with the Euro for the Eurozone members

- de facto the sovereign states in the OECS Eastern Caribbean Currency Union with the East Caribbean dollar in the CSME (2006)[6]

- de facto Switzerland–Liechtenstein[7]

Proposed

| Community | Currency | Region | Target date | Notes |

|---|---|---|---|---|

| Economic and Monetary Community of Central Africa (CEMAC) | Central African CFA franc | Africa | Not yet functioning common market | |

| West African Economic and Monetary Union (UEMOA) | West African CFA franc | Africa | Not yet functioning common market | |

| Gulf Cooperation Council (GCC) | Khaleeji | Middle East | Possibly gold backed, but postponed due to the financial crisis of 2007–2008. | |

| East African Community (EAC) | East African shilling | Africa | 2015 | To be used by the future East African Federation |

| Caribbean Single Market and Economy (as part of the CARICOM) | Latin America /Caribbean |

2015 | To supplement the OECS Eastern Caribbean Currency Union | |

| Southern African Customs Union (SACU) | South African Rand | Africa | 2015 | de facto for the CMA member when the SADC economic union is established |

| Southern African Development Community (SADC) | South African Rand (interim proposal) |

Africa | 2016 | To supplement or succeed the CMA and Southern Africa Customs Union |

| South Asian Association for Regional Cooperation | South Asia | |||

| Union of South American Nations (UNASUR) | Latino[8] | Latin America /Caribbean |

2019 | |

| Economic Community of Central African States (ECCAS) | Africa | To supplement the Economic and Monetary Community of Central Africa (CEMAC) | ||

| Economic Community of West African States (ECOWAS) | Africa | 2020 | To succeed UEMOA and WAMZ | |

| African Economic Community | Africa | 2028 | See African Monetary Union | |

| Union State of Russia and Belarus | Russian ruble | Europe | ||

| Arab League | Arab Dinar | Arab states | Arab Dinar has been proposed ever since the creation of the Arab Monetary Fund, expected for serious plans of doing so, after the creation of the proposed Arab Union. | |

| Eurasian Economic Union | Altyn | Eurasia | 2025 | Kazakhstani President Nursultan Nazarbayev had first proposed, in 2009, the creation of a common noncash currency called "yevraz" for the Eurasian Economic Community. It would have reportedly helped insulate the countries from the global economic crisis.[9] In 2012, the idea of the new joint currency found support from Vladimir Putin and Dmitry Medvedev and by 2014 proposals were drafted in Eurasian Commission documents for the establishment of a Eurasian Central Bank and a common currency to be called the altyn which is to be introduced by 2025.[10] |

Previous EMUs

]]

- Monetary union of the Belgium–Luxembourg Economic Union (1922–2002), superseded by the European EMU.

See also

- North American Union and North American Currency Union (Amero)[11]

- Pacific Union (one proposal for Australian dollar)

References

- ↑ "The Hague Summit (1–2 December 1969): completion, enlargement, deepening - Pierre Werner and the European integration process: from the Schuman Plan to the Fontainebleau Summit - CVCE Website". https://www.cvce.eu/en/education/unit-content/-/unit/d1cfaf4d-8b5c-4334-ac1d-0438f4a0d617/01b8a864-db8b-422c-915e-a47d5e86593e.

- ↑ "What is the Economic and Monetary Union? (EMU)". https://ec.europa.eu/info/business-economy-euro/economic-and-fiscal-policy-coordination/economic-and-monetary-union/what-economic-and-monetary-union-emu_en.

- ↑ "How the Economic and Monetary Union works". https://ec.europa.eu/info/business-economy-euro/economic-and-fiscal-policy-coordination/economic-and-monetary-union/how-economic-and-monetary-union-works_en.

- ↑ Blinder, Alan (September 1982). Issues in the Coordination of Monetary and Fiscal Policy. Cambridge, MA. doi:10.3386/w0982.

- ↑ pub/com/factsheets/emu/en/ "The EU and economic and monetary union". http://publications.europa.eu/web pub/com/factsheets/emu/en/.

- ↑ The states participating in both initiatives are Antigua and Barbuda, Dominica, Grenada, Saint Kitts and Nevis, Saint Lucia, Saint Vincent and the Grenadines.

- ↑ Single market through participation in the internal market of the European Union, customs union since 1924, informal currency union since 1920.

- ↑ Proposed by Ecuador's President Rafael Correa on December 15, 2007

- ↑ "Kazakhstan Suggests a New Currency - News". The Moscow Times. http://www.themoscowtimes.com/news/article/kazakhstan-suggests-a-new-currency/375212.html.

- ↑ "Russia, Kazakhstan and Belarus to have new joint currency". 10 April 2014. http://english.pravda.ru/russia/economics/10-04-2014/127325-russia_kazakhstan_belarus_new_currency-0/.

- ↑ Not currently on any political agenda, based mostly off conspiracy theories.

Further reading

- Acocella, N. and Di Bartolomeo, G. and Tirelli, P. [2007], ‘Fiscal leadership and coordination in the EMU’, in: ‘Open Economies Review’, 18(3): 281–9.

- Bergin, Paul (2008). "Monetary Union". in David R. Henderson. Concise Encyclopedia of Economics (2nd ed.). Indianapolis: Library of Economics and Liberty. ISBN 978-0865976658. OCLC 237794267. http://www.econlib.org/library/Enc/MonetaryUnion.html.

External links

- African monetary union inches closer

- United States of Southern Africa?

- East Africa's first steps towards union

- West Africa opts for currency union

- Gulf States push for single currency

- 'Limited gains' from Gulf single currency

- Do the Mercosur Countries Form an Optimum Currency Area?[yes|permanent dead link|dead link}}]

- Argentina plans monetary union

- Economist – Antipodean currencies (Australia and New Zealand)

- Three Perspectives on an Australasian Monetary Union

- Reasons for the collapse of the Rouble Zone

- In Search of the "Ruble Zone"

- OECD Development Centre – the Rand Zone

- A single African currency in our time?

- South Africa proposes adoption of the rand as provisional SADC common currency

|