Finance:Principal at risk notes

Principal At Risk Notes (PARs) are a type of structured note that allows investors to increase the return on a financial instrument through leverage, by putting at risk some of the capital. A typical PAR note is a derivative created by an investment banks and sold to investors that provides three times upside, up to a specified cap, while risking one times downside based on some underlying security or index. The PAR note is structured to look like a bond from the investors perspective with a maturity date but with modifications to allow an increase in upside at the cost of additional risk of the principal, hence the name.

Characteristics of PAR Note

- They are typically sold during the initial offering period and so are sold by Prospectus only

- Typically maturities range from 14 to 24 months

- Interest is typically paid at maturity, but may offer a guaranteed minimum rate of return

- Upside leverage: Typically pay a multiple of the underlying asset

- Downside leverage: Limited or no principal protection

- Upside may be capped

- Do not provide Principal Protection

Example

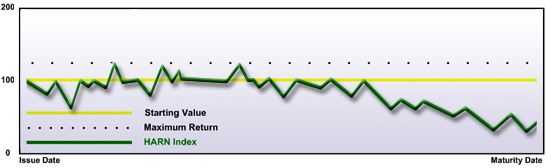

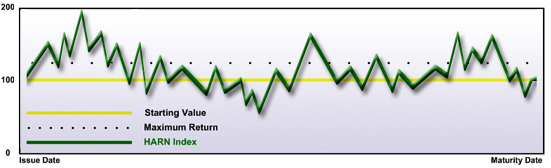

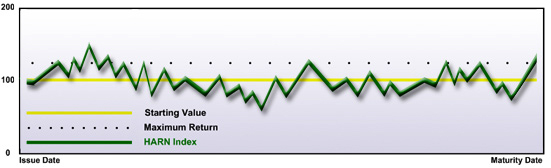

Our hypothetical is a 14 month Note tied to the performance of the fictional HARN Index. It will pay 3 times the upside performance of the Index, capped at a maximum return of 22% for the Note. If the index goes down, the Note will diminish in value at a rate of one for one. There will be no principal protection feature on this note and the investor may lose some or all of their principal. The return is calculated on a point-to-point method.

| Underlying Assets | HARN Index |

| Term | 14 Months |

| Initial Offer Price | $10.00 |

| Capped Value | 22% Maximum Return |

| Participation | 3x Upside (to Cap) |

| 1x Downside | |

| Principal Protection | None |

The Ending Value is 50% Lower

Ending Value Higher

Benefits of PARs

- Enhanced/Leveraged Return

- Upside: Receive a return that is enhanced by leverage so that it will be higher than the actual return, subject to any caps.

- Downside: Losses are not magnified by the leveraged component, and some downside protection may be offered however if the reference asset is off significantly the investor will be subject to loss of principal.

- No requirement for Option Approved accounts: Replication of this strategy would require the use of options. While investors do not need to be option approved they should have a fundamental understanding of option strategies.

- One transaction as opposed to many: Replication of this strategy would require a number of transactions to leverage the upside exposure to the underlying asset. An investment in these notes is a single transaction.

Risks of PARs

- An investment in PARs may result in a loss: Investing in PARs involves risks similar to investing directly in the underlying asset, including a risk of a loss in the investment. Because the value of the PAR is directly related to the level of a particular underlying asset, an investment in the Notes may result in a loss to the investor if the level of the underlying asset declines.

- An investor’s return on PARs may be limited: The opportunity to participate in the possible increases in the level of the underlying asset through an investment in PARs may be limited if the issue has a Capped Value. However, in the event that the level of the underlying asset declines over the term of the Notes, an investor will realize the entire decline.

- Liquidity of exchange listed PARs: Investors should be aware that the listing or quotation of PARs does not necessarily ensure that an active trading market will develop. The potential limited trading market may affect the price that an investor receives for the Notes if they are not held until the maturity date.

- Liquidity of OTC traded PARs: Although HRBFA expects to make a market, it is not required to do so and may cease making those bids at any time. The limited trading market may affect the price that investors receives if they wish to sell prior to maturity.

- Trading Value of PARs may be affected by complex factors: The effect of one factor may offset the increase in the trading value of the PARs caused by another factor. Conversely, the effect of one factor may exacerbate the decrease in the trading value of the Notes caused by another factor. In addition, there are other factors described in the pricing supplement which include:

- The level of the underlying asset

- Changes in the levels of relevant Interest Rates

- Changes in the volatility of the underlying asset

- The credit rating of the Issuer.

Basically, PARs are designed to be held to maturity by the investor. If the investor sells the Note prior to maturity, the value may be different than the investor’s perceived value due to the Risks identified above.

Tax Considerations

- It is highly recommend to have your clients seek professional tax advice.

- PARs should be characterized for all tax purposes as a pre-paid cash-settled forward contracts linked to the level of the underlying asset.

- A U.S. holder’s tax basis in a note will equal the amount paid by the holder to acquire the note.

- Upon receipt of cash on the maturity date of the notes, a U.S. holder will recognize a gain or a loss and the amount of such gain or loss will be the extent to which the amount of cash received differs from the U.S. holder’s tax basis in the note. It is uncertain whether any such gain or loss would be treated as ordinary income or loss or capital gain or loss.

- Upon the sale or exchange of a note prior to the maturity date, a U.S. holder will recognize capital gain or loss in an amount equal to the difference between the amount realized on such sale or exchange and that U.S. holder’s tax basis in the note.

Investor Suitability Profile

- Investors seeking exposure to an individual or basket of indexes, stocks or exchange rates and who believe that the level of that underlying asset will moderately increase over the term of the PAR.

- Investors who intend to hold the investment to maturity.

- Investors who are prepared to risk some or all of their principal.

- Investors who do not need income and are willing to forego this in exchange for the potential of leveraging their initial investment.

- Investors comfortable with the risk of receiving less than the initial investment if the level of the underlying asset decreases over the term of the note.

See also

External links

- Structured Products Association - The official global website of the 2,300-member Structured Products Association, the New York-based trade association for the structured products community.