Finance:Cryptoeconomics

Cryptoeconomics is an evolving economic paradigm for a cross-disciplinary approach to the study of digital economies and decentralized finance (DeFi) applications.[1][2] Cryptoeconomics integrates concepts and principles from traditional economics, cryptography, computer science, and mathematical game theory disciplines.[3] Just as traditional economics provides a theoretical foundation for traditional financial (a.k.a., Centralized Finance or CeFi) services, cryptoeconomics provides a theoretical foundation for DeFi services bought and sold via fiat cryptocurrencies, and legally bound by smart contracts.

Definitions and Goals

The term cryptoeconomics was coined by the Ethereum community during its formative years (2014-2015),[4] but was initially inspired by the application of economic incentives in the original Bitcoin protocol in 2008.[5] Although the phrase is typically attributed to Vitalik Buterin, the earliest public documented usage is a 2015 talk by Vlad Zamfir entitled “What is Cryptoeconomics?”.[6] Zamfir's view of cryptoeconomics is relatively broad and academic: "... a formal discipline that studies protocols that govern the production, distribution, and consumption of goods and services in a decentralized digital economy. Cryptoeconomics is a practical science that focuses on the design and characterization of these protocols". Alternatively, in a 2017 talk, Buterin's view is more narrow and pragmatic: “... a methodology for building systems that try to guarantee certain kinds of information security properties".[7]

The primary goals of cryptoeconomics are to understand how to fund, design, develop, and facilitate the operations of decentralized finance (DeFi) systems,[8] and to apply economic incentives and penalties to regulate the distribution of goods and services in emerging digital economies.[9]

Concepts and principles

Economics

Applies to cryptoeconomics as well as traditional economics.|alt=Graph depicting Quantity on X-axis and Price on Y-axis]] Cryptoeconomics may be considered an evolution of digital economics, which in turn evolved from traditional economics (commonly divided into microeconomics and macroeconomics). Consequently, traditional economic concepts regarding production, distribution, and consumption of goods and services also apply to cryptoeconomics. For example, these include Adam Smith's three basic laws of economics: Law of Supply and Demand, Law of Self Interest, and Law of Competition.[10] They also include more modern economic concepts, such as fiat money theory and Modern Monetary Theory (MMT).[11]

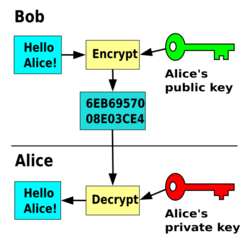

Cryptography

Cryptography is the practice and study of secure communication techniques in the presence of adversarial behavior. More specifically, cryptography is concerned with creating and analyzing protocols that prevent third parties from reading private messages,[12] and addresses various detailed aspects of information security, such as data confidentiality, integrity, authentication, and non-repudiation.[13] Cryptographic techniques are essential to ensure that DeFi electronic commerce transactions are secure and generally irreversible. These cryptographic techniques include:[11]

Computer science

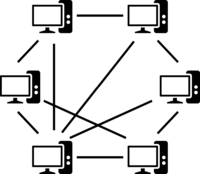

Computer science, the study and practice of computation, automation, and information, is essential to ensure that DeFi electronic commerce transactions are both distributed and decentralized. Computer science techniques applied to cryptoeconomics include:[11]

- peer-to-peer (P2P) network architecture

- distributed ledger technologies (blockchains, directed acyclic graphs [DAGs], hashgraphs)

- digital signatures

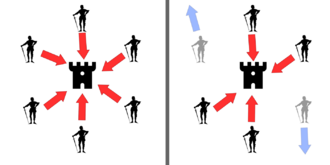

Mathematical game theory

Game theory uses mathematical models to study rational human decision-making within interactive, dynamic environments. Game theory has been proven fundamental to the development of the cryptocurrencies and blockchains that underlie cryptoeconomics, and is one of the reasons why the Bitcoin blockchain has not yet been compromised more than a decade since its creation, despite numerous attempts.[14] Notable mathematical game theory models applied to cryptoeconomics include:[11]

History

The historical roots of cryptoeconomics can be traced to the rise of altcoins (alternative cryptocurrency coins), prominent among them the Ethereum project, which in 2015 pioneered the integration of Turing-complete (computationally complete) smart contracts into its blockchain, thereby enabling a wide range of Decentralized Finance (DeFi) applications.

Cryptoeconomic subdisciplines

Similar to how traditional economics is divided into macroeconomics (regional, national, and international economics) and microeconomics (individual and enterprise economics) subdisciplines, cryptoeconomics can be divided into crypto-macreconomics and crypto-microeconomics subdisciplines.[15]

Crypto-macroeconomics

Crypto-macroeconomics is concerned with the regional, national, and international regulation of cryptocurrencies and DeFi transactions. The Group of Seven (G7) governments' interest in cryptocurrencies became evident in August 2014, when the United Kingdom (UK) Treasury commissioned a study of cryptocurrencies and their potential role in the UK economy, and issued its final report in January 2021.[16] In June 2021, El Salvador became the first country to accept Bitcoin as legal tender.[17] In August 2021, Cuba followed with a legal resolution to recognize and regulate cryptocurrencies such as Bitcoin.[18] However, in September 2021, the government of China, the single largest market for cryptocurrency, declared all cryptocurrency transactions illegal, completing a crackdown on cryptocurrency that had previously banned the operation of intermediaries and miners within China.[19]

Crypto-microeconomics

Crypto-microeconomics is concerned with the individual and enterprise usages of cryptocurrencies and DeFi transactions. A strong majority of USA adults have heard about major cryptocurrencies (Bitcoin, Ether), and 16% say they personally have invested in, traded, or otherwise used one.[20] More than 300 million people use cryptocurrency worldwide, and approximately 46 million Americans have invested in Bitcoin.[21]

Criticisms and controversies

Bitcoin, along with other cryptocurrencies, has been described as an economic bubble by many distinguished economists, including Robert Shiller,[22] Joseph Stiglitz,[23] Richard Thaler,[24] Paul Krugman,[25] and Nouriel Roubini.[26] In addition, Bitcoin and other cryptocurrencies have been criticized for the amount of electricity required for cryptocurrency "mining" (blockchain transaction validation),[27] and for their use to purchase illegal goods.[28][29]

See also

References

- ↑ "MIT Cryptoeconomics Lab" (in en). https://mitsloan.mit.edu/cryptoeconomics-lab/welcome-mit-cryptoeconomics-lab.

- ↑ "Cryptoeconomics - Wikiversity" (in en). https://en.wikiversity.org/wiki/Cryptoeconomics.

- ↑ Berg, Chris; Davidson, Sinclair; Potts, Jason (2019) (in en). Understanding the Blockchain Economy: An Introduction to Institutional Cryptoeconomics. Edward Elgar Publishing. ISBN 978-1-78897-500-1. https://books.google.com/books?id=Ok6rDwAAQBAJ&dq=cryptoeconomics&pg=PT9.

- ↑ Brekke, Jaya; Alsindi, Wassim (2021). "Cryptoeconomics" (in en). Internet Policy Review 10 (2). doi:10.14763/2021.2.1553. https://policyreview.info/glossary/cryptoeconomics.

- ↑ Nakamoto, S. (2008). "Bitcoin: A Peer-to-Peer Electronic Cash System". https://bitcoin.org/bitcoin.pdf.

- ↑ (in en) What Is Cryptoeconomics?, https://www.youtube.com/watch?v=9lw3s7iGUXQ, retrieved 2022-08-06

- ↑ (in en) Introduction to Cryptoeconomics - Vitalik Buterin, https://www.youtube.com/watch?v=pKqdjaH1dRo, retrieved 2022-08-06

- ↑ "A Beginner's Introduction to Cryptoeconomics" (in en). https://academy.binance.com/en/articles/a-beginners-introduction-to-cryptoeconomics.

- ↑ "Crypto FAQ: What are goals of cryptoeconomics?". https://cryptoeconworks.com/faq/what-are-cryptoeconomics-goals.html.

- ↑ "Who Was Adam Smith?" (in en). https://www.investopedia.com/updates/adam-smith-economics/.

- ↑ 11.0 11.1 11.2 11.3 "Crypto FAQ: What is cryptoeconomics & how does it work?". https://cryptoeconworks.com/faq/what-is-cryptoeconomics.html.

- ↑ Bellare, Mihir; Rogaway, Phillip (21 September 2005). "Introduction". Introduction to Modern Cryptography. p. 10.

- ↑ Menezes, A.J.; van Oorschot, P.C.; Vanstone, S.A. (1997). Handbook of Applied Cryptography. ISBN 978-0-8493-8523-0. https://archive.org/details/handbookofapplie0000mene.

- ↑ "Game Theory and Cryptocurrencies" (in en). https://academy.binance.com/en/articles/game-theory-and-cryptocurrencies.

- ↑ "Crypto FAQ: What are crypto-macroeconomics & crypto-microeconomics?". https://cryptoeconworks.com/faq/what-are-crypto-macro-micro-economics.html.

- ↑ "UK regulatory approach to cryptoassets and stablecoins: Consultation and call for evidence". HM Treasury. https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/950206/HM_Treasury_Cryptoasset_and_Stablecoin_consultation.pdf.

- ↑ "Bitcoin legal tender in El Salvador, first country ever". 10 June 2021. https://en.mercopress.com/2021/06/10/bitcoin-legal-tender-in-el-salvador-first-country-ever.

- ↑ "Cuba's central bank now recognizes cryptocurrencies such as bitcoin". 27 August 2021. https://www.cnbc.com/2021/08/27/cubas-central-bank-now-recognizes-cryptocurrencies-like-bitcoin.html.

- ↑ "China declares all crypto-currency transactions illegal" (in en-GB). BBC News. 24 September 2021. https://www.bbc.com/news/technology-58678907.

- ↑ Andrew Perrin. "16% of Americans say they have ever invested in, traded or used cryptocurrency" (in en-US). https://www.pewresearch.org/fact-tank/2021/11/11/16-of-americans-say-they-have-ever-invested-in-traded-or-used-cryptocurrency/.

- ↑ "Cryptocurrency Statistics 2022: How Many People Use Crypto?" (in en-US). 2022-08-04. https://earthweb.com/cryptocurrency-statistics/.

- ↑ Shiller, Robert (1 March 2014). "In Search of a Stable Electronic Currency". The New York Times. https://www.nytimes.com/2014/03/02/business/in-search-of-a-stable-electronic-currency.html.

- ↑ Costelloe, Kevin (29 November 2017). "Bitcoin 'Ought to Be Outlawed,' Nobel Prize Winner Stiglitz Says". Bloomberg. https://www.bloomberg.com/news/articles/2017-11-29/bitcoin-ought-to-be-outlawed-nobel-prize-winner-stiglitz-says-jal10hxd. "It doesn't serve any socially useful function."

- ↑ "Economics Nobel prize winner, Richard Thaler: "The market that looks most like a bubble to me is Bitcoin and its brethren"". ECO Portuguese Economy. 22 January 2018. https://econews.pt/2018/01/22/economics-nobel-prize-winner-richard-thaler-the-market-that-looks-most-like-a-bubble-to-me-is-bitcoin-and-its-brethren/.

- ↑ Krugman, Paul (29 January 2018). "Bubble, Bubble, Fraud and Trouble". The New York Times. https://www.nytimes.com/2018/01/29/opinion/bitcoin-bubble-fraud.html.

- ↑ "Bitcoin biggest bubble in history, says economist who predicted 2008 crash". 2 February 2018. https://www.theguardian.com/technology/2018/feb/02/bitcoin-biggest-bubble-in-history-says-economist-who-predicted-2008-crash.

- ↑ Huang, Jon; O'Neill, Claire; Tabuchi, Hiroko (3 September 2021). "Bitcoin Uses More Electricity Than Many Countries. How Is That Possible?". The New York Times. ISSN 0362-4331. https://www.nytimes.com/interactive/2021/09/03/climate/bitcoin-carbon-footprint-electricity.html.

- ↑ "Monetarists Anonymous". The Economist (The Economist Newspaper Limited). 29 September 2012. http://www.economist.com/node/21563752.

- ↑ Ball, James (22 March 2013). "Silk Road: the online drug marketplace that officials seem powerless to stop". Guardian News and Media Limited. https://www.theguardian.com/world/2013/mar/22/silk-road-online-drug-marketplace.

External links

- CryptoEconomics Works - web information portal

- MIT Cryptoeconomics Lab

- Wikiversity - Cryptoeconomics

Further reading

- Chris Berg, Sinclair Davidson, Jason Potts. Understanding the Blockchain Economy: An Introduction to Institutional Cryptoeconomics. Edward Elgar Publishing, 2019.

- Jian Gong, Wei Xu. Cryptoeconomics: Igniting a New Era of Blockchain. CRC Press, 2020.

|