Finance:Tombstone (financial industry)

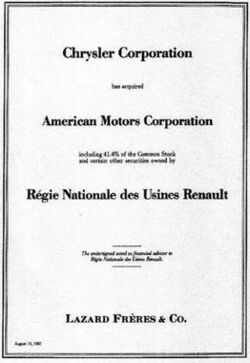

A tombstone is a type of print notice that is most often used in the financial industry to formally announce a particular transaction, such as an initial public offering or placement of stock of a company.

The Securities Act of 1933 required the publication of the tombstone advertisement to be printed in a newspaper and provide the barest of information on the transaction as the last step in the financial deal.[2]

This public disclosure is done in a form that lists the participants in a specified order according to their role in underwriting or brokering the transaction. The lead underwriter or bookrunner appears in the upper left position, with co-lead managers to its right. Other firms appear in brackets grouped by underwriting risk, usually in alphabetical order. Bulge bracket firms appear most often at the top of the brackets. The order is so important that, in 1987, five top investment banks withdrew from a syndicate underwriting a $2.4 billion debt issue for the Farmers Home Administration, because they would have been listed under other, smaller regional banks.[3]

The name of the disclosure comes from the appearance of advertisement used, a 'tombstone ad', so called because the simple, centered text style with large amounts of whitespace and few if any images or other adornments make them resemble some of the tombstones found in cemeteries.[4] Additional information such as "photographs of investment properties or descriptions of the tax benefits of investments" are not allowed in financial tombstones.[5] However, another view is that in the 19th century, financial notices were published in newspapers alongside birth and death notices.[6]

Tombstone ads are considered by the SEC to "condition the market" for the securities, and thus are an offer even though the notice may not specifically describe the transaction.[7] In public offerings, investment bankers can sell securities to investors only by means of a prospectus that has been filed with the SEC; therefore, tombstones announcing such transactions have a notice that they are "not an offer to sell or a solicitation to buy".[8]

Among financial firms, and more specifically, the investment banking community, the term "tombstone" may also refer to a trophy or deal tombstone, known as a deal toy.[9][10]

See also

References

- ↑ Holusha, John (10 March 1987). "Chrysler is buying American Motors; cost is $1.5 billion". The New York Times. https://www.nytimes.com/1987/03/10/business/chrysler-is-buying-american-motors-cost-is-1.5-billion.html?pagewanted=all. Retrieved 2 January 2016.

- ↑ Geisst, Charles R. (2006). Encyclopedia of American business history. Facts On File. p. 380. ISBN 9781438109879. https://books.google.com/books?id=5dGig0fYlj8C&dq=Tombstone+advertisement+history&pg=PA380. Retrieved 2 January 2016.

- ↑ Gilpin, Kenneth N. (October 5, 1987). "Split in 'Tombstone' Ranks". The New York Times. https://www.nytimes.com/1987/10/05/business/split-in-tombstone-ranks.html.

- ↑ Melicher, Ronald; Norton, Edgar. Introduction to Finance: Markets, Investments, and Financial Management. John Wiley & Sons. p. 18.

- ↑ "Securities Act Rules - Section 510. Rule 134 — Communications Not Deemed a Prospectus". U.S. Securities and Exchange Commission. 6 August 2015. https://www.sec.gov/divisions/corpfin/guidance/securitiesactrules-interps.htm. Retrieved 2 January 2016.

- ↑ Valdez, Stephen; Molyneux, Philip (2010). An Introduction to Global Financial Markets (Sixth ed.). Palgrave Macmillan. p. 167. ISBN 9780230243095. https://books.google.com/books?id=XfldAQAAQBAJ&dq=jargon+of+the+trade+(some+say+because+in+the+19th+century+financial+notices+were&pg=PA167. Retrieved 2 January 2016.

- ↑ Tollefsen Law, John Jacob (August 2010). ""General Solicitation" under Federal Securities Laws". tollefsenlaw.com. http://tollefsenlaw.com/general-solicitation-under-rule-506/. Retrieved 2 January 2016.

- ↑ Williamson, J. Peter (1988). The Investment Banking Handbook. Wiley. p. 98. ISBN 9780471815624. https://archive.org/details/investmentbankin00will. Retrieved 2 January 2016. "Financial tombstone notice."

- ↑ Dugan, Ianthe Jeanne (11 February 2009). "Another Wall Street Casualty: The Art of the 'Deal Toy'". The Wall Street Journal. https://www.wsj.com/news/articles/SB123431574025671015. Retrieved 2 January 2016.

- ↑ Valdmanis, Thor (16 December 2004). "Lucite monuments pop up to mark increase in mergers, acquisitions". USA Today. http://usatoday30.usatoday.com/money/companies/2004-12-16-guidant_x.htm. Retrieved 2 January 2016.

|