Finance:Trading room

| Financial markets |

|---|

|

| Bond market |

| Stock market |

| Other markets |

| Over-the-counter (off-exchange) |

| Trading |

| Related areas |

A trading room gathers traders operating on financial markets. The trading room is also often called the front office. The terms "dealing room" and "trading floor" are also used, the latter being inspired from that of an open outcry stock exchange. As open outcry is gradually replaced by electronic trading, the trading room becomes the only remaining place that is emblematic of the financial market. It is also the likeliest place within the financial institution where the most recent technologies are implemented before being disseminated in its other businesses.

Specialized computer labs that simulate trading rooms are known as "trading labs" or "finance labs" in universities and business schools.

Origin

Before the sixties or seventies, the banks' capital market businesses were mostly split into many departments, sometimes scattered at several sites, as market segments: money market (domestic and currencies), foreign exchange, long-term financing, exchange, bond market. By gathering these teams to a single site, banks want to ease:

- a more efficient broadcast of market information, for greater reactivity of traders;

- idea confrontation on market trends and opportunities;

- desk co-ordination towards customers.

Context

The Trading Rooms first appeared among United States bulge bracket brokers, such as Morgan Stanley, from 1971, with the creation of NASDAQ, which requires an equity trading desk on their premises, and the growth of the secondary market of federal debt products, which requires a bond trading desk.

The spread of trading rooms in Europe, between 1982 and 1987, has been subsequently fostered by two reforms of the financial markets organization, that were carried out roughly simultaneously in the United Kingdom and France.

In the United Kingdom, the Big Bang on the London Stock Exchange, removed the distinction between stockbrokers and stockjobbers, and prompted US investment banks, hitherto deprived of access to the LSE, to set up a trading room in the City of London.

In France, the deregulation of capital markets, carried out by Pierre Bérégovoy, Economics and Finance Minister, between 1984 and 1986, led to the creation of money-market instruments, of an interest-rate futures market, MATIF, of an equity options market, MONEP, the streamlining of sovereign debt management, with multiple-auction bond issues and the creation of a primary dealer status. Every emerging market segment raised the need for new dedicated trader positions inside the trading room.

Businesses

A trading room serves two types of business:

- trading, and arbitrage, a business of investment banks and brokers, often referred to as the sell side.

- portfolio management, a business of asset management companies and institutional investors, often referred to as the buy side.

Brokers and investment banks set up their trading rooms first and large asset-management firms subsequently followed them.

The business type determines peculiarities in the organization and the software environment inside the trading room.

Organization

Trading rooms are made up of "desks", specialised by product or market segment (equities, short-term, long-term, options...), that share a large open space.

An investment bank's typical room makes a distinction between:

- traders, whose role is to offer the best possible prices to sales, by anticipating market trends. After striking a deal with a sales, the trader arranges a reverse trade either with another trader belonging to another entity of the same institution or to an outside counterparty;

- market-makers, acting like wholesalers. Trades negotiated by market-makers usually bear standard terms.

Sales make deals tailored to their corporate customers' needs, that is, their terms are often specific. Focusing on their customer relationship, they may deal on the whole range of asset types.

Many large institutions have grouped their cash and derivative desks, while others, such as UBS or Deutsche Bank, for example, giving the priority to customer relationship, structure their trading room as per customer segment, around sales desks.[1]

Some large trading rooms hosts offshore traders, acting on behalf of another entity of the same institution, located in another time-zone. One room in Paris may have traders paid for by the New York City subsidiary, and whose working hours are consequently shifted. On the foreign exchange desk, because this market is live on a 24/24 basis, a rolling book organisation can be implemented, whereby, a London-based trader, for instance, will inherit, at start of day, the open positions handed over by the Singapore, Tokyo, or Bahrain room, and manages them till his own end-of-day, when they are handed over to another colleague based in New York City.

Some institutions, notably those that invested in a rapid development (RAD) team, choose to blend profiles inside the trading room, where traders, financial engineers and front-office dedicated software developers sit side by side. The latter therefore report to a head of trading rather than to a head of IT.

More recently, a profile of compliance officer has also appeared; he or she makes sure the law, notably that relative to market use, and the code of conduct, are complied with.

The middle office and the back office are generally not located in the trading room.

The organisation is somewhat simpler with asset management firms:

- asset managers are responsible for portfolios or funds;

- "traders" are in contact with "brokers" – that is, with the above-mentioned investment banks' "sales"; however, this profile is absent from asset management firms that chose to outsource their trading desk.

The development of trading businesses, during the eighties and nineties, required ever larger trading rooms, specifically adapted to IT- and telephony cabling. Some institutions therefore moved their trading room from their downtown premises, from the City to Canary Wharf,[2] from inner Paris to La Défense, and from Wall Street towards Times Square or New York City's residential suburbs in Connecticut; UBS Warburg, for example, built a trading room in Stamford, Connecticut in 1997, then enlarged it in 2002, to the world's largest one, with about 100,000 sq ft (9,300 m2) floor space, allowing the installation of some 1,400 working positions and 5,000 monitors.[3] The "Basalte" building of Société Générale is the first ever building specifically dedicated to trading rooms; it is fit for double power sourcing, to allow trading continuity in case one of the production sources is cut off.[4] In the 2000s, JP Morgan was planning to construct a building, close to the World Trade Center site, where all six 60,000 sq ft (5,600 m2) floors dedicated to trading rooms would be cantilevered, the available ground surface being only 32,000 sq ft (3,000 m2).[5]

Infrastructure

The early years

Telephone and teleprinter have been the broker's first main tools. The teleprinter, or Teletype, got financial quotes and printed them out on a ticker tape. US equities were identified by a ticker symbol made of one to three letters, followed by the last price, the lowest and the highest, as well as the volume of the day. Broadcasting neared real time, quotes being rarely delayed by more than 15 minutes, but the broker looking for a given security's price had to read the tape...

As early as 1923, the Trans-Lux company installed the NYSE with a projection system of a transparent ticker tape onto a large screen.[6] This system has been subsequently adopted by most NYSE-affiliated brokers till the 1960s.

In 1956, a solution called Teleregister,[7] came to the market; this electro-mechanical board existed in two versions, of the top 50 or top 200 securities listed on the NYSE; but one had to be interested in those equities, and not in other ones...

During the 1960s, the trader's workstation was remarkable for the overcrowding of telephones. The trader juggled with handsets to discuss with several brokers simultaneously. The electromechanical, then electronic, calculator enabled him or her to perform basic computations.

In the 1970s, if the emergence of the PABX gave way to some simplification of the telephony equipment, the development of alternative display solutions, however, lead to a multiplication of the number of video monitors on their desks, pieces of hardware that were specific and proprietary to their respective financial data provider. The main actors of the financial data market were; Telerate, Reuters,[8] Bloomberg with its Bloomberg Terminal, Knight Ridder notably with its Viewtron offering, Quotron and Bridge, more or less specialised on the money market, foreign exchange, securities market segments, respectively, for the first three of them.

The advent of spreadsheets

From the early 1980s, trading rooms multiplied and took advantage of the spread of micro-computing. Spreadsheets emerged, the products on offer being split between the MS-DOS/Windows/PC world and the Unix world. For PC, there was Lotus 1–2–3,[9] it was quickly superseded by Excel, for workstations and terminals. For UNIX, there was Applix and Wingz[10] among others. Along video monitors, left space had to be found on desks to install a computer screen.

Quite rapidly, Excel got very popular among traders, as much as a decision support tool as a means to manage their position, and proved to be a strong factor for the choice of a Windows NT platform at the expense of a Unix or VAX/VMS platform.

Though software alternatives multiplied during this decade, the trading room was suffering from a lack of interoperability and integration. To begin with, there was scant automated transmission of trades from the front-office desktop tools, notably Excel, towards the enterprise application software that gradually got introduced in back-offices; traders recorded their deals by filling in a form printed in a different colour depending on the direction (buy/sell or loan/borrow), and a back-office clerk came and picked piles of tickets at regular intervals, so that these could be re-captured in another system.

The digital revolution

Video display applications were not only wrapped up in cumbersome boxes, their retrieval-based display mode was no longer adapted to markets that had been gaining much liquidity and henceforth required decisions in a couple of seconds. Traders expected market data to reach them in real time, with no intervention required from them with the keyboard or the mouse, and seamlessly feed their decision support and position handling tools.

The digital revolution, which started in the late 1980s, was the catalyst that helped meet these expectations. It found expression, inside the dealing room, in the installation of a digital data display system, a kind of local network. Incoming flows converged from different data providers,[11] and these syndicated data were distributed onto traders' desktops. One calls a feed-handler the server that acquires data from the integrator and transmits them to the local distribution system.

Reuters, with its TRIARCH 2000, Teknekron, with its TIB, Telerate with TTRS, Micrognosis with MIPS, soon shared this growing market. This infrastructure is a prerequisite to the further installation, on each desktop, of the software that acquires, displays and graphically analyses these data.

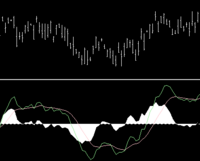

This type of software usually enables the trader to assemble the relevant information into composite pages, comprising a news panel, in text format, sliding in real time from bottom to top, a quotes panel, for instance spot rates against the US dollar, every quote update or « tick » showing up in reverse video during one or two seconds, a graphical analysis panel, with moving averages, MACD, candlesticks or other technical indicators, another panel that displays competitive quotes from different brokers, etc...

Two software package families were belonging to this new generation of tools, one dedicated to Windows-NT platforms, the other to Unix and VMS platforms.

However, Bloomberg and other, mostly domestic, providers, shunned this movement, preferring to stick to a service bureau model, where every desktop-based monitor just displays data that are stored and processed on the vendor's premises. The approach of these providers was to enrich their database and functionalities enough so that the issue of opening up their datafeed to any spreadsheet or third-party system gets pointless.

This decade also witnessed the irruption of television inside trading rooms. Press conferences held by central bank presidents are henceforth eagerly awaited events, where tone and gestures are decrypted. The trader has one eye on a TV set, the other on a computer screen, to watch how markets react to declarations, while having, very often, one customer over the phone. Reuters,[12] Bloomberg, CNN, CNBC each propose their news channel specially dedicated to financial markets.

Internet and bandwidth

The development of the internet triggered the fall of the cost of information, including financial information. It hit a serious blow to integrators who, like Reuters, had invested a lot the years before to deliver data en masse and in real time to the markets, but henceforth recorded a wave of terminations of their data subscriptions as well as flagging sales of their data distribution and display software licences.

Moreover, the cable operators' investors lead to a huge growth of information capacity transport worldwide. Institutions with several trading rooms in the world took advantage of this bandwidth to link their foreign sites to their headquarters in a hub and spoke model. The emergence of technologies like Citrix supported this evolution, since they enable remote users to connect to a virtual desktop from where they then access headquarters applications with a level of comfort similar to that of a local user. While an investment bank previously had to roll out a software in every trading room, it can now limit such an investment to a single site. The implementation cost of an overseas site gets reduced, mostly, to the telecoms budget.

And since the IT architecture gets simplified and centralised, it can also be outsourced. Indeed, from the last few years, the main technology providers[who?] active on the trading rooms market have been developing hosting services.

Software equipment

From the late 1980s, worksheets have been rapidly proliferating on traders' desktops while the head of the trading room still had to rely on consolidated positions that lacked both real time and accuracy. The diversity of valuation algorithms, the fragility of worksheets incurring the risk of loss of critical data, the mediocre response times delivered by PCs when running heavy calculations, the lack of visibility of the traders' goings-on, have all raised the need for shared information technology, or enterprise applications as the industry later called it.

But institutions have other requirements that depend on their business, whether it is trading or investment.

Risk-management

Within the investment bank, the trading division is keen to implement synergies between desks, such as:

- hedging the currency risk born from foreign exchange swaps or forward positions;

- funding by the money market desk of positions left open at end of day;

- hedging bond positions by interest-rate futures or options contracts.

Such processes require mutualisation of data.

Hence a number of package software come to the market, between 1990 and 1993 : Infinity, Summit, Kondor+, Finance Kit,[13] Front Arena, Murex and Sophis Risque, are quickly marketed under the umbrella of risk-management, a term more flattering though somewhat less accurate than that of position-keeping.[14]

Though Infinity died, in 1996, with the dream of the toolkit that was expected to model any innovation a financial engineer could have designed, the other systems are still well and alive in trading rooms. Born during the same period, they share many technical features, such as a three-tier architecture, whose back-end runs on a Unix platform, a relational database on either Sybase or Oracle, and a graphical user interface written in English, since their clients are anywhere in the world. Deal capture of transactions by traders, position-keeping, measure of market risks (interest-rates and foreign exchange), calculation of Profit & Loss (P&L), per desk or trader, control of limits set per counterparty, are the main functionalities delivered by these systems.

These functions will be later entrenched by national regulations, that tend to insist on adequate IT: in France, they are defined in 1997 in an instruction from the “Commission Bancaire” relative to internal control.[15]

Electronic trading

Telephone, used on over-the-counter (OTC) markets, is prone to misunderstandings. Should the two parties fail to clearly understand each other on the trade terms, it may be too late to amend the transaction once the received confirmation reveals an anomaly.

The first markets to discover electronic trading are the foreign-exchange markets. Reuters creates its Reuter Monitor Dealing Service in 1981. Contreparties meet each other by the means of the screen and agree on a transaction in videotex mode, where data are loosely structured.

Several products pop up in the world of electronic trading including Bloomberg Terminal, BrokerTec, TradeWeb and Reuters 3000 Xtra for securities and foreign exchange. While the Italian-born Telematico (MTS) finds its place, in the European trading rooms for trading of sovereign-debt.

More recently other specialised products have come to the market, such as Swapswire, to deal interest-rate swaps, or SecFinex and EquiLend, to place securities loans or borrowings (the borrower pays the subscription fee to the service).

However, these systems also generally lack liquidity. Contrarily to an oft-repeated prediction, electronic trading did not kill traditional inter-dealer brokerage. Besides, traders prefer to mix both modes: screen for price discovery, and voice to arrange large transactions.[16]

Order management and routing

For organised markets products, processes are different: customer orders must be collected and centralised; some part of them can be diverted for internal matching, through so-called alternative trading systems (ATS); orders with a large size, or on equities with poor liquidity or listed on a foreign bourse, and orders from corporate customers, whose sales contact is located in the trading room, are preferably routed either towards brokers, or to multilateral trading facilities (MTF); the rest goes directly to the local stock exchange, where the institution is electronically connected to.

Orders are subsequently executed, partially of fully, then allocated to the respective customer accounts. The increasing number of listed products and trading venues have made it necessary to manage this order book with an adequate software.

Stock exchanges and futures markets propose their own front-end system to capture and transmit orders, or possibly a programming interface, to allow member institutions to connect their order management system they developed in-house. But software publishers soon sell packages that take in charge the different communication protocols to these markets; The UK-based Fidessa has a strong presence among LSE members; Sungard Global Trading and the Swedish Orc Software are its biggest competitors.

Program trading

In program trading, orders are generated by a software program instead of being placed by a trader taking a decision. More recently, it is rather called algorithmic trading. It applies only to organised markets, where transactions do not depend on a negotiation with a given counterparty.

A typical usage of program trading is to generate buy or sell orders on a given stock as soon as its price reaches a given threshold, upwards or downwards. A wave of stop sell orders has been largely incriminated, during the 1987 financial crises, as the main cause of acceleration of the fall in prices. However, program trading has not stopped developing, since then, particularly with the boom of ETFs, mutual funds mimicking a stock-exchange index, and with the growth of structured asset management; an ETF replicating the FTSE 100 index, for instance, sends multiples of 100 buy orders, or of as many sell orders, every day, depending on whether the fund records a net incoming or outgoing subscription flow. Such a combination of orders is also called a basket. Moreover, whenever the weight of any constituent stock in the index changes, for example following an equity capital increase, by the issuer, new basket orders should be generated so that the new portfolio distribution still reflects that of the index. If a program can generate more rapidly than a single trader a huge quantity of orders, it also requires monitoring by a financial engineer, who adapts its program both to the evolution of the market and, now, to requirements of the banking regulator checking that it entails no market manipulation. Some trading rooms may now have as many financial engineers as traders.

The spread of program trading variants, many of which apply similar techniques, leads their designers to seek a competitive advantage by investing in hardware that adds computing capacity or by adapting their software code to multi-threading, so as to ensure their orders reach the central order book before their competitors'. The success of an algorithm therefore measures up to a couple of milliseconds. This type of program trading, also called high-frequency trading, conflicts however with the fairness principle between investors, and some regulators consider forbidding it .[17]

Portfolio management

With order executions coming back, the mutual fund's manager as well the investment bank's trader must update their positions. However, the manager does not need to revalue his in real time: as opposed to the trader whose time horizon is the day, the portfolio manager has a medium to long-term perspective. Still, the manager needs to check that whatever he sells is available on his custodial account; he also needs a benchmarking functionality, whereby he may track his portfolio performance with that of his benchmark; should it diverge by too much, he would need a mechanism to rebalance it by generating automatically a number of buys and sells so that the portfolio distribution gets back to the benchmark's.

Relations with the back-office

In most countries, the banking regulation requires a principle of independence between front-office and back-office: a deal made by the trading room must be validated by the back-office to be subsequently confirmed to the counterparty, to be settled, and accounted for. Both services must report to divisions that are independent from each at the highest possible level in the hierarchy.[18][19]

In Germany, the regulation goes further, a "four eyes' principle" requiring that every negotiation carried by any trader should be seen by another trader before being submitted to the back-office.

In Continental Europe, institutions have been stressing, since the early 1990s, on Straight Through Processing (STP), that is, automation of trade transmission to the back-office. Their aim is to raise productivity of back-office staff, by replacing trade re-capture by a validation process. Publishers of risk-management or asset-management software meet this expectation either by adding back-office functionalities within their system, hitherto dedicated to the front-office, or by developing their connectivity, to ease integration of trades into a proper back-office-oriented package.

Anglo-Saxon institutions, with fewer constraints in hiring additional staff in back-offices, have a less pressing need to automate and develop such interfaces only a few years later.

On securities markets, institutional reforms, aiming at reducing the settlement lag from a typical 3 business days, to one day or even zero day, can be a strong driver to automate data processes.

As long as front-office and back-offices run separately, traders most reluctant to capture their deals by themselves in the front-office system, which they naturally find more cumbersome than a spreadsheet, are tempted to discard themselves towards an assistant or a middle-office clerk. An STP policy is then an indirect means to compel traders to capture on their own. Moreover, IT-based trade-capture, in the shortest time from actual negotiation, is growingly seen, over the years, as a "best practice" or even a rule.

Banking regulation tends to deprive traders from the power to revalue their positions with prices of their choosing. However, the back-office staff is not necessarily best prepared to criticize the prices proposed by traders for complex or hardly liquid instruments and that no independent source, such as Bloomberg, publicize.

Anatomy of the biggest failures

Whether as an actor or as a simple witness, the trading room is the place that experiences any failure serious enough to put the company's existence at stake.

In the case of Northern Rock, Bear Stearns or Lehman Brothers, all three wiped out by the subprime crisis, in 2008, if the trading room finally could not find counterparts on the money market to refinance itself, and therefore had to face a liquidity crisis, each of those defaults is due to the company's business model, not to a dysfunction of its trading room.

On the contrary, in the examples shown below, if the failure has always been precipitated by market adverse conditions, it also has an operational cause :

| Month Year | Company | Fictitious trades | Hidden positions | Overshot positions | Insider trading | Market manipulation | Miscalculated risk | Erroneous valuation | Lack of trader control | Inadequate entitlement | Capture error | Conse- quences on the company |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Apr. 1987 | Merrill Lynch[21] | b | b | b | ||||||||

| Feb. 1990 | Drexel Burnham Lambert[22] | b | b | b | fine and bankruptcy | |||||||

| Sep. 1991 | Salomon Brothers[23] | b | fine | |||||||||

| Feb. 1995 | Barings[24] | b | b | b | bankruptcy | |||||||

| Apr. 1995 | Kidder Peabody[25] | b | b | |||||||||

| Jul. 1995 | Daiwa[25] | b | b | b | partial business closure | |||||||

| Jun. 1996 | Sumitomo | b | b | b | b | fines[26] + civil lawsuit | ||||||

| Jan. 1998 | UBS[27] | b | b | |||||||||

| Sep. 1998 | LTCM[28] | b | recapitalisation | |||||||||

| Dec. 2005 | Mizuho Securities[29][30] | b | ||||||||||

| Sep. 2006 | Amaranth Advisors[31] | b | ||||||||||

| Jan. 2008 | Société Générale[32] | b | b | b | b | fine[33] | ||||||

| Feb. 2008 | Credit Suisse[34] | b | ||||||||||

| May. 2008 | Morgan Stanley[35] | b | b | b | fine | |||||||

| Oct. 2008 | CITIC Pacific[36] | b | b |

These operational causes, in the above columns, are due to organisational or IT flaws :

- A fictitious trade gets possible whenever the system allows to post a trade to either a fictitious counterparty, or to a real counterparty, but for which the system sends neither a confirmation to that counterparty nor an automated message to the back-office, for settlement and accounting;

- Hidden position, which are fraudulent, and excess over authorized positions, which is not, are also made possible by the absence of a mechanism of limits control with transmission of a warning to the Risk Department, or by the absence of reaction by the recipient of such a warning;

- Some insider trading cases can be explained by the proximity, inside the trading room, of desks with conflicting interests, such as the one that arranges equity issues with that invests on behalf of customers.

- Price manipulation is also possible if no control is made on the share of an instrument that is held in relation to the total outstanding on the market, whether this outstanding is the total number of stocks of a given corporate issuer, or is the open position of a listed derivative instrument;

- Risk can be miscalculated, because it depends on parameters whose quality cannot be assessed, or because excessive confidence is put in the mathematical model that is used;

- An erroneous valuation may stem from a fraudulent handling of reference prices, or because the lack of fresh quotations on an instrument, and the failure to consider an alternative, model-based, valuation, have led to the use of obsolete prices;

- The lack of trader's control can be assessed by the weakness of the reporting required from him, or by the lack of expertise or critique by the recipients of this reporting;

- A user entitlement may prove inadequate, either because it is granted by the hierarchy in contradiction with the industry's best practices, or because, though not granted, it is still enforced either because the system cannot manage it or because, by neglect, it has not been properly set up in that system;

- Finally, a capture error may arise in a system with weak plausibility controls, such as that on a trade size, or with no « four eyes principle » mechanism, whereby a manifest anomaly would have been detected and stopped by a second person.

Destroyed rooms

- On May 5, 1996, during a Saturday to Sunday night, a fire, suspected to be criminal, ravaged the trading room of Crédit Lyonnais; trading businesses have been transferred in a couple of days to a backup, or disaster recovery, site, in outer Paris.

- On September 11, 2001, the attack against the World Trade Center destroyed the Cantor Fitzgerald's trading room and killed 658 persons, two-thirds of its workforce.[37] Yet business resumed about one week later.

Gambling

Trading rooms are also used in the sports gambling sector. The term is often used to refer to the liabilities and odds setting departments of bookmakers where liabilities are managed and odds are adjusted. Examples include internet bookmakers based in the Caribbean and also legal bookmaking operations in the United Kingdom such as William Hill, Ladbrokes and Coral which operate trading rooms to manage their risk. The growth of betting exchanges such as Betfair has also led to the emergence of "trading rooms" designed for professional gamblers. (reference: Racing Post newspaper 19/7/07) The first such establishment was opened in Edinburgh in 2003 but later folded. Professional gamblers typically pay a daily "seat" fee of around £30 per day for the use of IT facilities and sports satellite feeds used for betting purposes. Today there are eight such trading rooms across the UK, with two based in London – one in Highgate and one in Canary Wharf.

See also

- Regulation NMS

- Security

Notes and references

- ↑ "Barriers Falling Between Traders". Financial Times. February 1, 2010. https://www.ft.com/content/5cd8db6c-0f6a-11df-a450-00144feabdc0.

- ↑ "Canary Wharf Banks Get Access to Multiple Network Providers". Dealing With Technology. July 23, 2001. http://www.dealingwithtechnology.com/public/showPage.html?page=420108.

- ↑ "UBS Warburg Expansion Creates World's Largest Trading Floor". the bank's site. May 14, 2002. https://www.ubs.com/global/en/about_ubs/about_us/news/news-ndp/en-20020514-news_20020514b.html. Retrieved February 24, 2010.

- ↑ "La future salle des marchés Société Générale en construction à la Défense" (in fr). projets-architecte-urbanisme.fr. http://projets-architecte-urbanisme.fr/salle-marche-societe-generale-defense.

- ↑ "JPMorgan to Build Tower at World Trade Center Site". Bloomberg. June 14, 2007. https://www.bloomberg.com/apps/news?pid=20601087&refer=home&sid=a02O6UFd1kss.

- ↑ Alex Preda (August 2009). Framing finance: the boundaries of markets and modern capitalism. University of Chicago Press. ISBN 9780226679334. https://books.google.com/books?id=wJpleQWB6vgC&pg=PA131. Retrieved 5 January 2011.

- ↑ "Commercial presentation of Teleregister". Computerhistory.org. 1956. pp. 20–21. http://archive.computerhistory.org/resources/text/Teleregister/Teleregister.SpecialPurposeSystems.1956.102646324.pdf. Retrieved 4 April 2010.

- ↑ Read, Donald (1999-02-25) (in en). The Power of News: The History of Reuters. Oxford University Press. pp. 342–370. doi:10.1093/acprof:oso/9780198207689.001.0001. ISBN 978-0-19-820768-9. https://doi.org/10.1093/acprof:oso/9780198207689.001.0001.

- ↑ Lotus 1-2-3; used by a small percent of companies today

- ↑ Wingz; used by a small percent of companies today

- ↑ the feed of the main integrator, such as Reuters or Moneyline Telerate, typically complementing that of the local stock-exchange datafeed, like TOPCAC, in France, from Société de Bourse Française (in French) (SBF)

- ↑ Reuters Financial Television (RFTV) was launched in 1996 but closed in 2002 for lack of profitability

- ↑ Renamed Wall Street Suite after its publisher, the Finnish Trema, has been taken over, in 2006, by the US firm Wall Street Systems

- ↑ Indeed, the increasingly dominant view was that risks had to be consolidated bank-wide, therefore outside the dealing room, and take correlation effects across all asset types into account; JPMorgan's RiskManager and Algorithmics's RiskWatch are the main software publishers building packages matching this conception

- ↑ "Règlement CRBF 97-02, Titles IV and V on measurement and monitoring of risks" (in fr). Banque de France's site. http://www.banque-france.fr/cclrf/fr/pdf/CRBF97_02_arr_05_05_09.pdf.

- ↑ "Being fully wired is not enough for the world's biggest money brokers". The Economist. January 9, 2003. http://www.economist.com/businessfinance/displaystory.cfm?story_id=E1_TVNQGJT. Retrieved February 28, 2010.

- ↑ "SEC moves to curb high-frequency trading". Financial Times. January 13, 2010. https://www.ft.com/content/981a42dc-008e-11df-b50b-00144feabdc0. Retrieved February 27, 2010.

- ↑ "Circulaire IML 93-101 : Règles relatives à l'organisation et au contrôle interne de l'activité de marché des établissements de crédit" (in fr). Commission de Surveillance du Secteur Financier (CSSF - Luxembourg). http://www.cssf.lu/uploads/media/iml93_101.pdf.

- ↑ In France, article 7.1 of CRBF 97-02 regulation

- ↑ See also List of trading losses

- ↑ Sterngold, James (March 11, 1987). "Anatomy of a staggering loss". New York Times. https://www.nytimes.com/1987/05/11/business/anatomy-of-a-staggering-loss.html?sec=&spon=&pagewanted=all. Retrieved May 25, 2010.

- ↑ "The Death of Drexel". The Economist. February 17, 1990. http://www.economist.com/businessfinance/displayStory.cfm?story_id=14442572&source=hptextfeature.

- ↑ The Real Salomon Scandal. New York Magazine. September 2, 1991. https://books.google.com/books?id=b-kCAAAAMBAJ&pg=PA16.

- ↑ "Case Study - Barings". Ambit ERisk. 2010. Archived from the original on 2007-10-17. https://web.archive.org/web/20071017041450/http://www.erisk.com/Learning/CaseStudies/Barings.asp.

- ↑ 25.0 25.1 "An Unusual Path To Big-Time Trading". New York Times. September 27, 1995. https://www.nytimes.com/1995/09/27/business/an-unusual-path-to-big-time-trading.html.

- ↑ "fine by CFTC". CFTC. May 11, 1998. http://www.cftc.gov/opa/enf98/opa4144-98.htm. Retrieved February 22, 2010.

- ↑ "Blind Faith". The Economist. January 29, 1998. http://www.economist.com/businessfinance/displaystory.cfm?story_id=E1_TTTJVG.

- ↑ "Case Study - Long Term Capital Management". Archived from the original on 2011-07-18. https://web.archive.org/web/20110718024059/http://www.erisk.com/Learning/CaseStudies/Long-TermCapitalManagemen.asp.

- ↑ Lewis, Leo (December 9, 2005). "Fat fingered typing costs a trader's bosses £128m". London: Times Online. http://www.timesonline.co.uk/tol/news/world/asia/article755598.ece. Retrieved May 25, 2010.

- ↑ See also Tokyo Stock Exchange – IT Issues

- ↑ Hillary Till (October 2, 2006). "The Amaranth Case : early lessons from the debacle". EDHEC Risk & Asset Management Research Centre. http://www.edhec-risk.com/site_edhecrisk/public/features/RISKArticle.2006-10-02.0711.

- ↑ See also 2008 Société Générale trading loss

- ↑ "Décisions juridictionnelles publiées par la Commission bancaire au cours du mois de juillet 2008 - Bulletin Officiel N° 5, page 16" (in fr). http://www.acp.banque-france.fr/fileadmin/user_upload/acp/publications/Bulletin%20officiel%20du%20CECEI%20et%20CB/Bulletin-officiel-du-cecei-et-de-la-commission-bancaire-juillet-2008.pdf.

- ↑ "More Holes Than Thou". The Economist. February 21, 2008. http://www.economist.com/businessfinance/displaystory.cfm?story_id=E1_TDSPQQDQ.

- ↑ "Final Notice to Matthew Sebastian Piper". FSA. http://www.fsa.gov.uk/pubs/final/matthew_piper.pdf.

- ↑ "CITIC Pacific warns potential $2 billion forex losses". Reuters. October 20, 2008. https://www.reuters.com/article/idUSTRE49J5NI20081020.

- ↑ "Never has a firm lost so many staff". The Economist. September 20, 2001. http://www.economist.com/businessfinance/displaystory.cfm?story_id=E1_SRJTDP.

External links

- "Wall Street & Technology". http://www.wallstreetandtech.com.

- "Dealing with Technology". http://www.dealingwithtechnology.com.

- "The Power of Program Trades". Investopedia. http://www.investopedia.com/articles/trading/07/program_trading.asp.

- Daniel Beunza, David Stark. "Ecologies of Value in a Wall Street Trading Room". Columbia University. Archived from the original on 2011-07-06. https://web.archive.org/web/20110706220428/http://www.recercat.cat/bitstream/2072/880/1/735.pdf.

- Howard Kahn, Cary L. Cooper (1993). Stress in the dealing room - High performers under pressure. Business & Economics. p. 276. ISBN 9780415073752. https://books.google.com/books?id=Z9UNAAAAQAAJ.

- Andrew Delaney (2004). "The end of the age of the big vendors?". A-Team Insight. http://mondovisione.com/index.cfm?section=articles&action=detail&id=47671.

|