Social:Winner's curse

The winner's curse is a phenomenon that may occur in common value auctions, where all bidders have the same (ex post) value for an item but receive different private (ex ante) signals about this value and wherein the winner is the bidder with the most optimistic evaluation of the asset and therefore will tend to overestimate and overpay. Accordingly, the winner will be "cursed" in one of two ways: either the winning bid will exceed the value of the auctioned asset making the winner worse off in absolute terms, or the value of the asset will be less than the bidder anticipated, so the bidder may garner a net gain but will be worse off than anticipated.[1][2] However, an actual overpayment will generally occur only if the winner fails to account for the winner's curse when bidding (an outcome that, according to the revenue equivalence theorem, need never occur).[3]

The winner’s curse phenomenon was first addressed in 1971 by three Atlantic Richfield petroleum engineers, Capen, Clapp, and Campbell who published the seminal work "Competitive Bidding in High-Risk Situations" in the Journal of Petroleum Technology.[4] who claimed that oil companies suffered unexpectedly low returns “year after year” in early Outer Continental Shelf oil lease auctions. Outer Continental Shelf auctions are common value auctions, where value of the oil in the ground is essentially the same to all bidders.

Explanation

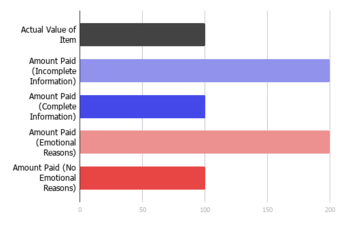

In a common value auction, the auctioned item is of roughly equal value to all bidders, but the bidders don't know the item's market value when they bid. Each player independently estimates the value of the item before bidding.

The winner of an auction is the bidder who submits the highest bid. Since the auctioned item is worth roughly the same to all bidders, they are distinguished only by their respective estimates of the market value. The winner, then, is the bidder making the highest estimate. If we assume that the average bid is accurate, then the highest bidder overestimates the item's value. Thus, the auction's winner is likely to overpay.

More formally, this result is obtained using conditional expectation. We are interested in a bidder's expected value from the auction (the expected value of the item, minus the expected price) conditioned on the assumption that the bidder wins the auction. It turns out that for a bidder's true estimate the expected value is negative, meaning that on average the winning bidder is overpaying.

Savvy bidders will avoid the winner's curse by bid shading, or placing a bid that is below their ex ante estimation of the value of the item for sale—but equal to their ex post belief about the value of the item, given that they win the auction. The key point is that winning the auction is bad news about the value of the item for the winner. It means that he or she was the most optimistic and, if bidders are correct in their estimations on average, that too much was paid. Therefore savvy bidders revise their ex ante estimations downwards to take account of this effect.

The severity of the winner's curse increases with the number of bidders. This is because the more bidders, the more likely it is that some of them have overestimated the auctioned item's value. In technical terms, the winner's expected estimate is the value of the nth order statistic, which increases as the number of bidders increases. In other words, more bidders = higher winner's curse.

There is often confusion that the winner's curse applies to the winners of all auctions. However, it is worth repeating here that for auctions with private value (i.e. when the item is desired independent of its value in the market), winner's curse does not arise. Similarly, there may be occasions when the average bid is too low relative to exterior market conditions e.g. a dealer recognizing an antique or other collectible as highly saleable elsewhere when other bidders do not have the necessary expertise.

Examples

Since most auctions involve at least some amount of common value, and some degree of uncertainty about that common value, the winner's curse is an important phenomenon.

In the 1950s, when the term winner's curse was first coined, there was no accurate method to estimate the potential value of an offshore oil field. So if, for example, an oil field had an actual intrinsic value of $10 million, oil companies might guess its value to be anywhere from $5 million to $20 million. The company who wrongly estimated at $20 million and placed a bid at that level would win the auction, and later find that it was not worth as much.

Other auctions where the winner's curse is significant:

- Spectrum auctions in which companies bid on licenses to use portions of the electromagnetic spectrum. Here, the uncertainty would come from, for example, estimating the value of the cell phone market in New York City .

- IPOs, in which bidders need to estimate what the market value of a company's stock will be.

- Pay per click advertising online, in which advertisers gain higher ranking if they bid higher amounts per click from a search engine user.

- Federal offshore oil leases The term winner's curse was originated in a paper published in the Journal of Petroleum Technology, volume 23, 1971, pages 641-653. The authors were Capen, Clapp & Campbell.

- Free agency in professional sports.

Related uses

The term winner's curse is also used in statistics to refer to the regression toward the mean phenomenon, particularly in genome-wide association studies and epidemiology. In studies involving many tests on one sample of the full population, the consequent stringent standards for significance make it likely that the first person to report a significant test (the winner) will also report an effect size much larger than is likely to be seen in subsequent replication studies.[5]

See also

- Buyer's remorse

- Proteus phenomenon

- War of attrition (game)

- Pyrrhic victory

References

- ↑ Thaler, Richard (1988), "Anomalies: The Winner's Curse", Journal of Economic Perspectives (ResearchGate) 2: 191–202, doi:10.1257/jep.2.1.191, https://www.researchgate.net/publication/4719439, retrieved 2018-10-19

- ↑ Hayes, Adam, ed., Winner's Curse, Investopedia, https://www.investopedia.com/terms/w/winnerscurse.asp

- ↑ McAfee, R. Preston; McMillan, John (1987), "Auctions and Bidding", Journal of Economic Literature (JSTOR) 25 (2): 699–738

- ↑ Capen; Clap; Campbell (June 1971). "Competitive Bidding in High-Risk Situations". Journal of Petroleum Technology (Society of Petroleum Engineers) 23 (6): 641 to 643. doi:10.2118/2993-PA. ISSN 0149-2136.

- ↑ Ioannidis, John P. A. (2008). "Why most discovered true associations are inflated". Epidemiology 19 (5): 640–648. doi:10.1097/EDE.0b013e31818131e7. PMID 18633328.

Further reading

- Charness, Gary; Levin, Dan (2009), "The Origin of the Winner's Curse: A Laboratory Study", American Economic Journal: Microeconomics (American Economic Association) 1: 207–236, doi:10.1257/mic.1.1.207, http://www.econ.ohio-state.edu/levin/wpapers/origin_012405.pdf

- Moser, Johannes (2017), Hypothetical Thinking and the Winner's Curse: An Experimental Investigation, ResearchGate, doi:10.2139/ssrn.2955871, https://www.researchgate.net/publication/316502634, retrieved 2018-10-19

- Publish and be wrong; Scientific journals, The Economist, 2008-10-11, p. 109(US)

- Kagel, John Henry (1989), "First-price common value auctions: bidder behavior and the 'winner's curse.'", Economic Inquiry 27 (2): 241, doi:10.1111/j.1465-7295.1989.tb00780.x, http://link.galegroup.com/apps/doc/A7606807/BIC?sid=BIC&xid=07266b96, retrieved 2018-10-19

- Smith, J.L. (1981), "Non-Aggressive Bidding Behavior and the 'Winner's Curse'", Economic Inquiry (Wiley Online Library) 19 (3): 380–388, doi:10.1111/j.1465-7295.1981.tb00323.x, https://dspace.mit.edu/bitstream/1721.1/32989/1/MIT-EL-80-013WP-06684288.pdf

- Xiao, R.; Boehnke, M. (2009), "Quantifying and correcting for the winner's curse in genetic association studies", Genet. Epidemiol. (Wiley Online Library) 33 (5): 453–462, doi:10.1002/gepi.20398, PMID 19140131

External links

- www.gametheory.net — applet demonstrating the winner's curse.

- www.techcentralstation.com — article explaining the winner's curse in the context of the Google IPO.

- The Winner's Curse in Baseball — article on how the winner's curse affects bidding for free agents.