Beta prime distribution

|

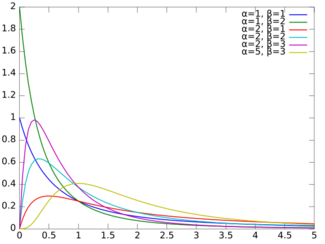

Probability density function  | |||

|

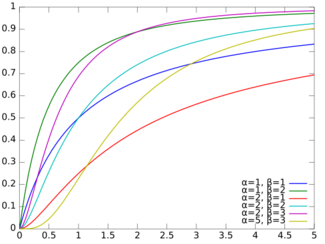

Cumulative distribution function  | |||

| Parameters |

shape (real) shape (real) | ||

|---|---|---|---|

| Support | |||

| CDF | where is the incomplete beta function | ||

| Mean | |||

| Mode | |||

| Variance | |||

| Skewness | |||

| MGF | Does not exist | ||

| CF | |||

In probability theory and statistics, the beta prime distribution (also known as inverted beta distribution or beta distribution of the second kind[1]) is an absolutely continuous probability distribution. If has a beta distribution, then the odds has a beta prime distribution.

Definitions

Beta prime distribution is defined for with two parameters α and β, having the probability density function:

where B is the Beta function.

The cumulative distribution function is

where I is the regularized incomplete beta function.

The expected value, variance, and other details of the distribution are given in the sidebox; for , the excess kurtosis is

While the related beta distribution is the conjugate prior distribution of the parameter of a Bernoulli distribution expressed as a probability, the beta prime distribution is the conjugate prior distribution of the parameter of a Bernoulli distribution expressed in odds. The distribution is a Pearson type VI distribution.[1]

The mode of a variate X distributed as is . Its mean is if (if the mean is infinite, in other words it has no well defined mean) and its variance is if .

For , the k-th moment is given by

For with this simplifies to

The cdf can also be written as

where is the Gauss's hypergeometric function 2F1 .

Alternative parameterization

The beta prime distribution may also be reparameterized in terms of its mean μ > 0 and precision ν > 0 parameters ([2] p. 36).

Consider the parameterization μ = α/(β-1) and ν = β- 2, i.e., α = μ( 1 + ν) and β = 2 + ν. Under this parameterization E[Y] = μ and Var[Y] = μ(1 + μ)/ν.

Generalization

Two more parameters can be added to form the generalized beta prime distribution :

having the probability density function:

with mean

and mode

Note that if p = q = 1 then the generalized beta prime distribution reduces to the standard beta prime distribution.

This generalization can be obtained via the following invertible transformation. If and for , then .

Compound gamma distribution

The compound gamma distribution[3] is the generalization of the beta prime when the scale parameter, q is added, but where p = 1. It is so named because it is formed by compounding two gamma distributions:

where is the gamma pdf with shape and inverse scale .

The mode, mean and variance of the compound gamma can be obtained by multiplying the mode and mean in the above infobox by q and the variance by q2.

Another way to express the compounding is if and , then . (This gives one way to generate random variates with compound gamma, or beta prime distributions. Another is via the ratio of independent gamma variates, as shown below.)

Properties

- If then .

- If , and , then .

- If then .

- If and two iid variables, then with and , as the beta prime distribution is infinitely divisible.

- More generally, let iid variables following the same beta prime distribution, i.e. , then the sum with and .

Related distributions

- If has an F-distribution, then , or equivalently, .

- If then .

- If then .

- For gamma distribution parametrization I:

- If are independent, then . Note are all scale parameters for their respective distributions.

- For gamma distribution parametrization II:

- If are independent, then . The are rate parameters, while is a scale parameter.

- If and , then . The are rate parameters for the gamma distributions, but is the scale parameter for the beta prime.

- the Dagum distribution

- the Singh–Maddala distribution.

- the log logistic distribution.

- The beta prime distribution is a special case of the type 6 Pearson distribution.

- If X has a Pareto distribution with minimum and shape parameter , then .

- If X has a Lomax distribution, also known as a Pareto Type II distribution, with shape parameter and scale parameter , then .

- If X has a standard Pareto Type IV distribution with shape parameter and inequality parameter , then , or equivalently, .

- The inverted Dirichlet distribution is a generalization of the beta prime distribution.

- If , then has a generalized logistic distribution. More generally, if , then has a scaled and shifted generalized logistic distribution.

Notes

- ↑ 1.0 1.1 Johnson et al (1995), p 248

- ↑ Bourguignon, M.; Santos-Neto, M.; de Castro, M. (2021). "A new regression model for positive random variables with skewed and long tail". Metron 79: 33–55. doi:10.1007/s40300-021-00203-y.

- ↑ Dubey, Satya D. (December 1970). "Compound gamma, beta and F distributions". Metrika 16: 27–31. doi:10.1007/BF02613934.

References

- Johnson, N.L., Kotz, S., Balakrishnan, N. (1995). Continuous Univariate Distributions, Volume 2 (2nd Edition), Wiley. ISBN 0-471-58494-0

- Bourguignon, M.; Santos-Neto, M.; de Castro, M. (2021), "A new regression model for positive random variables with skewed and long tail", Metron 79: 33–55, doi:10.1007/s40300-021-00203-y

|