Generalized Pareto distribution

|

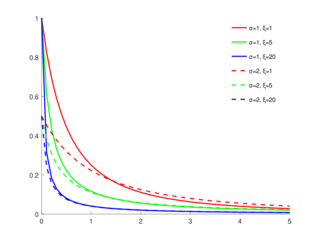

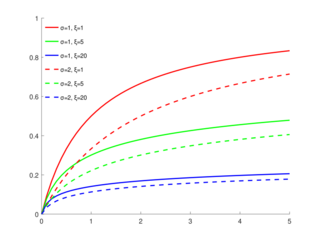

Probability density function  GPD distribution functions for and different values of and | |||

|

Cumulative distribution function  | |||

| Parameters | shape (real) | ||

|---|---|---|---|

| Support |

| ||

|

| |||

| CDF | |||

| Mean | |||

| Median | |||

| Mode | |||

| Variance | |||

| Skewness | |||

| Kurtosis | |||

| Entropy | |||

| MGF | |||

| CF | |||

In statistics, the generalized Pareto distribution (GPD) is a family of continuous probability distributions. It is often used to model the tails of another distribution. It is specified by three parameters: location , scale , and shape .[2][3] Sometimes it is specified by only scale and shape[4] and sometimes only by its shape parameter. Some references give the shape parameter as .[5]

With shape and location , the GPD is equivalent to the Pareto distribution with scale and shape .

Definition

The cumulative distribution function of (, , and ) is

where the support of is when , and when .

The probability density function (pdf) of is

again, for when , and when .

The standard cumulative distribution function (cdf) of the GPD is defined using [6]

where the support is for and for . The corresponding probability density function (pdf) is

Special cases

- If , the GPD is the exponential distribution.

- If , the GPD is the Pareto distribution with shape .

- If , the GPD is the power function distribution with shape .

- If , the GPD is the continuous uniform distribution .[7]

- If , then [1]. (exGPD stands for the exponentiated generalized Pareto distribution.)

- GPD is similar to the Burr distribution.

Prediction

- It is often of interest to predict probabilities of out-of-sample data under the assumption that both the training data and the out-of-sample data follow a GPD.

- Predictions of probabilities generated by substituting maximum likelihood estimates of the GPD parameters into the cumulative distribution function ignore parameter uncertainty. As a result, the probabilities are not well calibrated, do not reflect the frequencies of out-of-sample events, and, in particular, underestimate the probabilities of out-of-sample tail events.[8]

- Predictions generated using the objective Bayesian approach of calibrating prior prediction have been shown to greatly reduce this underestimation, although not completely eliminate it.[8] Calibrating prior prediction is implemented in the R software package fitdistcp.[2]

Generating generalized Pareto random variables

Generating GPD random variables

If U is uniformly distributed on (0, 1], then

and

Both formulas are obtained by inversion of the cdf.

The Pareto package in R and the gprnd command in the Matlab Statistics Toolbox can be used to generate generalized Pareto random numbers.

GPD as an Exponential-Gamma Mixture

A GPD random variable can also be expressed as an exponential random variable, with a Gamma distributed rate parameter.

and then

Notice however, that since the parameters for the Gamma distribution must be greater than zero, we obtain the additional restrictions that must be positive.

In addition to this mixture (or compound) expression, the generalized Pareto distribution can also be expressed as a simple ratio. Concretely, for and we have This is a consequence of the mixture after setting and taking into account that the rate parameters of the exponential and gamma distribution are simply inverse multiplicative constants.

Exponentiated generalized Pareto distribution

The exponentiated generalized Pareto distribution (exGPD)

If , then is distributed according to the exponentiated generalized Pareto distribution, denoted by .

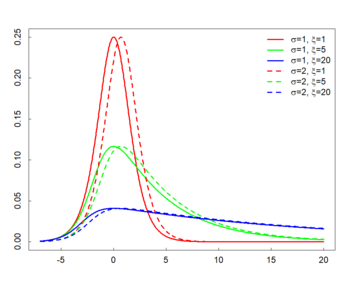

The probability density function(pdf) of is

where the support is for , and for .

For all , the becomes the location parameter. See the right panel for the pdf when the shape is positive.

The exGPD has finite moments of all orders for all and .

The moment-generating function of is where and denote the beta function and gamma function, respectively.

The expected value of depends on the scale and shape parameters, while the participates through the digamma function: Note that for a fixed value for the , the plays as the location parameter under the exponentiated generalized Pareto distribution.

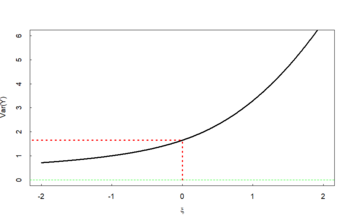

The variance of depends on the shape parameter only through the polygamma function of order 1 (also called the trigamma function): See the right panel for the variance as a function of . Note that .

Note that the roles of the scale parameter and the shape parameter under are separably interpretable, which may lead to a robust efficient estimation for the than using the [3]. The roles of the two parameters are associated each other under (at least up to the second central moment); see the formula of variance wherein both parameters are participated.

The Hill's estimator

Assume that are observations (need not be i.i.d.) from an unknown heavy-tailed distribution such that its tail distribution is regularly varying with the tail-index (hence, the corresponding shape parameter is ). To be specific, the tail distribution is described as It is of a particular interest in the extreme value theory to estimate the shape parameter , especially when is positive (so called the heavy-tailed distribution).

Let be their conditional excess distribution function. Pickands–Balkema–de Haan theorem (Pickands, 1975; Balkema and de Haan, 1974) states that for a large class of underlying distribution functions , and large , is well approximated by the generalized Pareto distribution (GPD), which motivated Peak Over Threshold (POT) methods to estimate : the GPD plays the key role in POT approach.

A renowned estimator using the POT methodology is the Hill's estimator. Technical formulation of the Hill's estimator is as follows. For , write for the -th largest value of . Then, with this notation, the Hill's estimator (see page 190 of Reference 5 by Embrechts et al [4]) based on the upper order statistics is defined as In practice, the Hill estimator is used as follows. First, calculate the estimator at each integer , and then plot the ordered pairs . Then, select from the set of Hill estimators which are roughly constant with respect to : these stable values are regarded as reasonable estimates for the shape parameter . If are i.i.d., then the Hill's estimator is a consistent estimator for the shape parameter [5].

Note that the Hill estimator makes a use of the log-transformation for the observations . (The Pickand's estimator also employed the log-transformation, but in a slightly different way [6].)

See also

- Burr distribution

- Pareto distribution

- Generalized extreme value distribution

- Exponentiated generalized Pareto distribution

- Pickands–Balkema–de Haan theorem

References

- ↑ 1.0 1.1 Norton, Matthew; Khokhlov, Valentyn; Uryasev, Stan (2019). "Calculating CVaR and bPOE for common probability distributions with application to portfolio optimization and density estimation". Annals of Operations Research (Springer) 299 (1–2): 1281–1315. doi:10.1007/s10479-019-03373-1. http://uryasev.ams.stonybrook.edu/wp-content/uploads/2019/10/Norton2019_CVaR_bPOE.pdf. Retrieved 2023-02-27.

- ↑ Coles, Stuart (2001-12-12). An Introduction to Statistical Modeling of Extreme Values. Springer. p. 75. ISBN 9781852334598. https://books.google.com/books?id=2nugUEaKqFEC.

- ↑ Dargahi-Noubary, G. R. (1989). "On tail estimation: An improved method". Mathematical Geology 21 (8): 829–842. doi:10.1007/BF00894450. Bibcode: 1989MatGe..21..829D.

- ↑ Hosking, J. R. M.; Wallis, J. R. (1987). "Parameter and Quantile Estimation for the Generalized Pareto Distribution". Technometrics 29 (3): 339–349. doi:10.2307/1269343.

- ↑ Davison, A. C. (1984-09-30). "Modelling Excesses over High Thresholds, with an Application". in de Oliveira, J. Tiago. Statistical Extremes and Applications. Kluwer. p. 462. ISBN 9789027718044. https://books.google.com/books?id=6M03_6rm8-oC&pg=PA462.

- ↑ Embrechts, Paul; Klüppelberg, Claudia; Mikosch, Thomas (1997-01-01). Modelling extremal events for insurance and finance. Springer. p. 162. ISBN 9783540609315. https://books.google.com/books?id=BXOI2pICfJUC.

- ↑ Castillo, Enrique, and Ali S. Hadi. "Fitting the generalized Pareto distribution to data." Journal of the American Statistical Association 92.440 (1997): 1609-1620.

- ↑ 8.0 8.1 Jewson, Stephen; Sweeting, Trevor; Jewson, Lynne (2025-02-20). "Reducing reliability bias in assessments of extreme weather risk using calibrating priors" (in English). Advances in Statistical Climatology, Meteorology and Oceanography 11 (1): 1–22. doi:10.5194/ascmo-11-1-2025. ISSN 2364-3579. Bibcode: 2025ASCMO..11....1J. https://ascmo.copernicus.org/articles/11/1/2025/.

Further reading

- Pickands, James (1975). "Statistical inference using extreme order statistics". Annals of Statistics 3 s: 119–131. doi:10.1214/aos/1176343003. https://projecteuclid.org/journals/annals-of-statistics/volume-3/issue-1/Statistical-Inference-Using-Extreme-Order-Statistics/10.1214/aos/1176343003.pdf.

- Balkema, A.; De Haan, Laurens (1974). "Residual life time at great age". Annals of Probability 2 (5): 792–804. doi:10.1214/aop/1176996548.

- Lee, Seyoon; Kim, J.H.K. (2018). "Exponentiated generalized Pareto distribution:Properties and applications towards extreme value theory". Communications in Statistics - Theory and Methods 48 (8): 1–25. doi:10.1080/03610926.2018.1441418.

- N. L. Johnson; S. Kotz; N. Balakrishnan (1994). Continuous Univariate Distributions Volume 1, second edition. New York: Wiley. ISBN 978-0-471-58495-7. Chapter 20, Section 12: Generalized Pareto Distributions.

- Barry C. Arnold (2011). "Chapter 7: Pareto and Generalized Pareto Distributions". in Duangkamon Chotikapanich. Modeling Distributions and Lorenz Curves. New York: Springer. ISBN 9780387727967. https://books.google.com/books?id=fUJZZLj1kbwC&pg=PA119.

- Arnold, B. C.; Laguna, L. (1977). On generalized Pareto distributions with applications to income data. Ames, Iowa: Iowa State University, Department of Economics.

External links

|