Structural break

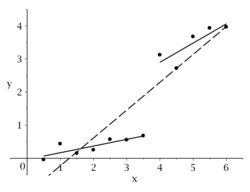

In econometrics and statistics, a structural break is an unexpected change over time in the parameters of regression models, which can lead to huge forecasting errors and unreliability of the model in general.[1][2][3] This issue was popularised by David Hendry, who argued that lack of stability of coefficients frequently caused forecast failure, and therefore we must routinely test for structural stability. Structural stability − i.e., the time-invariance of regression coefficients − is a central issue in all applications of linear regression models.[4]

Structural break tests

A single break in mean with a known breakpoint

For linear regression models, the Chow test is often used to test for a single break in mean at a known time period K for K ∈ [1,T].[5][6] This test assesses whether the coefficients in a regression model are the same for periods [1,2, ...,K] and [K + 1, ...,T].[6]

Other forms of structural breaks

Other challenges occur where there are:

- Case 1: a known number of breaks in mean with unknown break points;

- Case 2: an unknown number of breaks in mean with unknown break points;

- Case 3: breaks in variance.

The Chow test is not applicable in these situations, since it only applies to models with a known breakpoint and where the error variance remains constant before and after the break.[7][5][6] Bayesian methods exist to address these difficult cases via Markov chain Monte Carlo inference.[8][9]

In general, the CUSUM (cumulative sum) and CUSUM-sq (CUSUM squared) tests can be used to test the constancy of the coefficients in a model. The bounds test can also be used.[6][10] For cases 1 and 2, the sup-Wald (i.e., the supremum of a set of Wald statistics), sup-LM (i.e., the supremum of a set of Lagrange multiplier statistics), and sup-LR (i.e., the supremum of a set of likelihood ratio statistics) tests developed by Andrews (1993, 2003) may be used to test for parameter instability when the number and location of structural breaks are unknown.[11][12] These tests were shown to be superior to the CUSUM test in terms of statistical power,[11] and are the most commonly used tests for the detection of structural change involving an unknown number of breaks in mean with unknown break points.[4] The sup-Wald, sup-LM, and sup-LR tests are asymptotic in general (i.e., the asymptotic critical values for these tests are applicable for sample size n as n → ∞),[11] and involve the assumption of homoskedasticity across break points for finite samples;[4] however, an exact test with the sup-Wald statistic may be obtained for a linear regression model with a fixed number of regressors and independent and identically distributed (IID) normal errors.[11] A method developed by Bai and Perron (2003) also allows for the detection of multiple structural breaks from data.[13]

The MZ test developed by Maasoumi, Zaman, and Ahmed (2010) allows for the simultaneous detection of one or more breaks in both mean and variance at a known break point.[4][14] The sup-MZ test developed by Ahmed, Haider, and Zaman (2016) is a generalization of the MZ test which allows for the detection of breaks in mean and variance at an unknown break point.[4]

Structural breaks in cointegration models

For a cointegration model, the Gregory–Hansen test (1996) can be used for one unknown structural break,[15] the Hatemi–J test (2006) can be used for two unknown breaks[16] and the Maki (2012) test allows for multiple structural breaks.

Statistical packages

There are many statistical packages that can be used to find structural breaks, including R,[17] GAUSS, and Stata, among others. For example, a list of R packages for time series data is summarized at the changepoint detection section of the Time Series Analysis Task View,[18] including both classical and Bayesian methods.[19][20]

See also

References

- ↑ Antoch, Jaromír; Hanousek, Jan; Horváth, Lajos; Hušková, Marie; Wang, Shixuan (25 April 2018). "Structural breaks in panel data: Large number of panels and short length time series". Econometric Reviews 38 (7): 828–855. doi:10.1080/07474938.2018.1454378. http://centaur.reading.ac.uk/79661/1/final-pdf-Antoch-et-al.pdf. "Structural changes and model stability in panel data are of general concern in empirical economics and finance research. Model parameters are assumed to be stable over time if there is no reason to believe otherwise. It is well-known that various economic and political events can cause structural breaks in financial data. ... In both the statistics and econometrics literature we can find very many of papers related to the detection of changes and structural breaks.".

- ↑ Kruiniger, Hugo (December 2008). "Not So Fixed Effects: Correlated Structural Breaks in Panel Data". IZA Institute of Labor Economics. pp. 1–33. http://conference.iza.org/conference_files/pada2009/kruiniger_h5168.pdf.

- ↑ Hansen, Bruce E (November 2001). "The New Econometrics of Structural Change: Dating Breaks in U.S. Labor Productivity". Journal of Economic Perspectives 15 (4): 117–128. doi:10.1257/jep.15.4.117.

- ↑ 4.0 4.1 4.2 4.3 4.4 Ahmed, Mumtaz; Haider, Gulfam; Zaman, Asad (October 2016). "Detecting structural change with heteroskedasticity". Communications in Statistics – Theory and Methods 46 (21): 10446–10455. doi:10.1080/03610926.2016.1235200. "The hypothesis of structural stability that the regression coefficients do not change over time is central to all applications of linear regression models.".

- ↑ 5.0 5.1 Hansen, Bruce E (November 2001). "The New Econometrics of Structural Change: Dating Breaks in U.S. Labor Productivity". Journal of Economic Perspectives 15 (4): 117–128. doi:10.1257/jep.15.4.117.

- ↑ 6.0 6.1 6.2 6.3 Greene, William (2012). "Section 6.4: Modeling and testing for a structural break". Econometric Analysis (7th ed.). Pearson Education. pp. 208–211. ISBN 9780273753568. "An important assumption made in using the Chow test is that the disturbance variance is the same in both (or all) regressions. ...

6.4.4 TESTS OF STRUCTURAL BREAK WITH UNEQUAL VARIANCES ...

In a small or moderately sized sample, the Wald test has the unfortunate property that the probability of a type I error is persistently larger than the critical level we use to carry it out. (That is, we shall too frequently reject the null hypothesis that the parameters are the same in the subsamples.) We should be using a larger critical value. Ohtani and Kobayashi (1986) have devised a “bounds” test that gives a partial remedy for the problem.15" - ↑ Gujarati, Damodar (2007). Basic Econometrics. New Delhi: Tata McGraw-Hill. pp. 278–284. ISBN 978-0-07-066005-2.

- ↑ Erdman, Chandra; Emerson, John W. (2007). "bcp: An R Package for Performing a Bayesian Analysis of Change Point Problems". Journal of Statistical Software 23 (3): 1-1. doi:10.18637/jss.v023.i03.

- ↑ Li, Yang; Zhao, Kaiguang; Hu, Tongxi; Zhang, Xuesong. "BEAST: A Bayesian Ensemble Algorithm for Change-Point Detection and Time Series Decomposition". https://github.com/zhaokg/Rbeast.

- ↑ Pesaran, M. H.; Shin, Y.; Smith, R. J. (2001). "Bounds testing approaches to the analysis of level relationships". Journal of Applied Econometrics 16 (3): 289–326. doi:10.1002/jae.616.

- ↑ 11.0 11.1 11.2 11.3 Andrews, Donald (July 1993). "Tests for Parameter Instability and Structural Change with Unknown Change Point". Econometrica 61 (4): 821–856. doi:10.2307/2951764. https://www.ssc.wisc.edu/~bhansen/718/Andrews1993.pdf.

- ↑ Andrews, Donald (January 2003). "Tests for Parameter Instability and Structural Change with Unknown Change Point: A Corrigendum". Econometrica 71 (1): 395–397. doi:10.1111/1468-0262.00405. https://pdfs.semanticscholar.org/780a/6188c4ef4c388e902c0872338fc24ef12b0b.pdf.

- ↑ Bai, Jushan; Perron, Pierre (January 2003). "Computation and analysis of multiple structural change models". Journal of Applied Econometrics 18 (1): 1–22. doi:10.1002/jae.659.

- ↑ Maasoumi, Esfandiar; Zaman, Asad; Ahmed, Mumtaz (November 2010). "Tests for structural change, aggregation, and homogeneity". Economic Modelling 27 (6): 1382–1391. doi:10.1016/j.econmod.2010.07.009.

- ↑ Gregory, Allan; Hansen, Bruce (1996). "Tests for Cointegration in Models with Regime and Trend Shifts". Oxford Bulletin of Economics and Statistics 58 (3): 555–560. doi:10.1111/j.1468-0084.1996.mp58003008.x.

- ↑ Hacker, R. Scott; Hatemi-J, Abdulnasser (2006). "Tests for Causality between Integrated Variables Using Asymptotic and Bootstrap Distributions: Theory and Application". Applied Economics 38 (15): 1489–1500. doi:10.1080/00036840500405763.

- ↑ Kleiber, Christian; Zeileis, Achim (2008). Applied Econometrics with R. New York: Springer. pp. 169–176. ISBN 978-0-387-77316-2. https://books.google.com/books?id=86rWI7WzFScC&pg=PA169.

- ↑ Hyndman, Rob; Killick, Rebecca. "CRAN Task View: Time Series Analysis. Version 2023-09-26.". https://cran.r-project.org/web/views/TimeSeries.html.

- ↑ Achim, Zeileis; Leisch, Friedrich; Hornik, Kurt; Kleiber, Christian. "strucchange: Testing, monitoring, and dating structural changes". https://cran.r-project.org/web/packages/strucchange/index.html.

- ↑ Li, Yang; Zhao, Kaiguang; Hu, Tongxi; Zhang, Xuesong. "BEAST: A Bayesian Ensemble Algorithm for Change-Point Detection and Time Series Decomposition". https://github.com/zhaokg/Rbeast.

|